Legal

Phase five margin queues spur calls for custody revamp

Custodians urged to update “antiquated technology” ahead of three-fold jump in phase six initial margin onboarding

Currenex class action faces hurdles, say legal experts

Case could raise questions around statutes of limitations and damages calculations

Show your workings: lenders push to demystify AI models

Machine learning could help with loan decisions – but only if banks can explain how it works. And that’s not easy

Isda’s ‘master’ master agreement courts controversy

Single master agreement to cover repo, securities lending and derivatives could bring efficiencies, but many remain sceptical

US federal legislation ‘eliminates’ need for synthetic Libor

‘Tough legacy’ proposal will be discussed at a House Financial Services subcommittee meeting on April 15

People moves: new CRO at LCH, changes at Natixis investment bank, and more

Latest job changes across the industry

To offset US sanctions risk, banks bake in China loan clauses

Global lenders seek to hedge against the threat of US sanctions on China – which seems unlikely to ease under Biden

Antitrust fears cloud Isda protocol – and fallback spreads

Wait for DoJ assurances could delay Libor transition plans and further unsettle rates trading

Machine learning in fraud analytics to combat financial crime – Getting it right

Risk and compliance professionals gathered for a Risk.net webinar in association with NICE Actimize to consider the challenges and opportunities of successfully harnessing artificial intelligence in the fight against financial criminals

Lawyers pick holes in Libor statutory fix

US ‘tough legacy’ contracts open to legal challenge even if proposed New York law is passed

Initial margin – A regulatory bottleneck

With the recent announcement of an extended preparation period for those smaller entities needing to post initial margin under the uncleared margin rules, the new timetable could cause a bottleneck for firms busy repapering derivatives contracts linked…

Op risk data: Brazil bank faces near-$1bn tax probe fine

Also: UBS hit for $77m for spread hikes; PPI costs top £50bn. Data by ORX News

BMR rift fuels zombie Libor uncertainty

False rate could limp on for months under EU’s benchmark regulation

Law firm of the year: Allen & Overy

Risk Awards 2020: Not just "stodgy lawyers", fintech incubator gives A&O a headstart on automation

Competitive differentiation – Reaping the benefits of XVA centralisation

A forum of industry leaders discusses the latest developments in XVA and the strategic, operational and technological challenges of derivatives valuation in today’s environment, including the key considerations for banks looking to move to a standardised…

Opening the buy-side liquidity pool

Vikash Rughani, business manager at triReduce and triBalance, outlines a new approach enabling buy- and sell-side participants to optimise the transition of legacy Libor over-the-counter swaps contracts to alternative reference rates

The digitisation of legal negotiations and data

In partnership with Risk.net, specialists from AcadiaSoft, Linklaters, and the International Swaps and Derivatives Association weighed in on the digitisation of derivatives documentation for a virtual roundtable discussion. Recent innovations, aimed at…

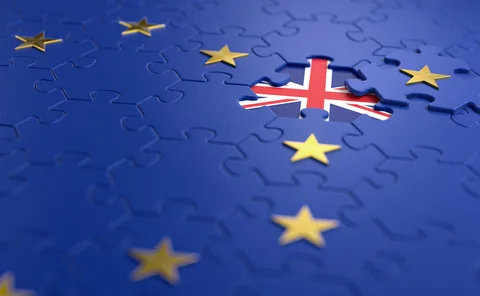

Politicians must heal a fractured UK society

Political journalist Robert Peston has grave concerns over the future of Britain, seeing profound risks with or without Brexit

Libor transition and implementation – Covering all bases

Sponsored Q&A

HKEX: Hong Kong should not fear China investment rule change

Confidence in city’s legal framework remains a key advantage as China loosens QFII rules, says risk chief

Proof-of-work blockchains and settlement finality: a functional interpretation

In this paper, the authors aim to provide an interpretation of the legal issue of settlement finality in the context of proof-of-work distributed ledger technology, such as the Bitcoin network.

Risk premia strategies – Lessons learned for the future

After a difficult 2018, investors are increasingly wary of risk premia, concerned that factors leading to underperformance might be a recurring problem. Imene Moussa, executive director at UBS, clarifies this issue