This article was paid for by a contributing third party.More Information.

50 billion: The new magic number for initial margin rules

Need to know

- A change to the margin mandate for uncleared derivatives reduces the number of affected firms from 1,100 to 200, according to triOptima

- Market participants are moving to futures and compression services to reduce the notional value of derivatives portfolios

Navigate Uncleared Margin Rules with CME Group. Find a Solution for your UMR Challenges. Learn more

A number of financial firms required to post initial margin on uncleared derivatives received some welcome news in July. The next phase of the initial margin rules – applying to firms that have derivatives portfolios with over $8 billion in notional outstanding – was modified so that the majority of these market participants would have another year before they had to comply.

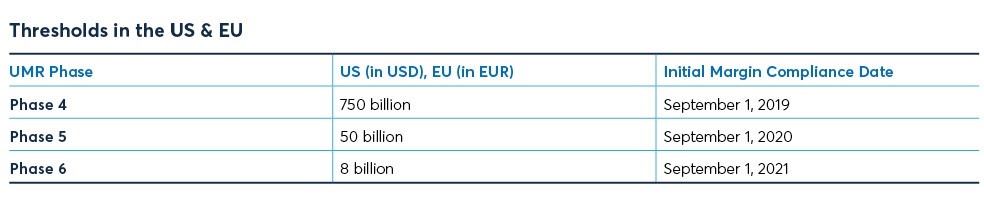

The regulation for uncleared margin rules (UMR) was set in motion at the 2009 G20 meeting following the global financial crisis. It requires firms using over-the-counter derivatives to post margin on those transactions. Phases 1 to 4 have covered firms with $750 billion+ in notional value.

Industry estimates from a September 2018 letter estimated that over 1,100 newly in-scope counterparties would become subject to initial margin rules by the time Phase 5 came to fruition in September 2020.

The New Magic Number

The Basel Committee on Banking Supervision (BCBS)/IOSCO announcement on July 23 is expected to make Phase 5 of Initial Margin apply to far fewer firms, as it establishes the 50 billion Average Aggregate Notional Amount (AANA) as the new magic number for UMR compliance in 2020. It also laid out a revised measurement period for some jurisdictions such as the United States, where clients will now measure their AANA from March-May 2020 in line with the European Union, instead of the previous window of June-August 2019 for U.S. clients.

200 Affected Firms

An October 2018 analysis by economists at the Commodity Futures Trading Commssion (CFTC) estimates while Phases 1 to 4 capture just over 40 entities, Phase 5 (the old phase 5 of $8B) could bring 700 entities in scope. Based on their analysis of CFTC data, over 75 percent of entities coming into scope in Phase 5 have AANAs less than $50 billion, implying that the New Phase 5 would include at least 175 entities.

TriOptima’s triResolve is a portfolio reconciliation service that helps firms measure their AANA. Whilst the measurement period is not until 2020, preliminary analysis of trades currently submitted to triResolve shows approximately 200 clients would be subject to the new Phase 5.

A Change in Trading Behavior Coming?

To borrow some option terminology, having the threshold at 50 billion instead of 8 billion puts a larger number of clients closer to being “at the money” of the threshold level. This increases the value of notional reduction opportunities like switching volume to listed futures and cleared swaps, and utilizing multilateral compression.

Several market participants told CME Group they would have been captured in Phase 4 of UMR because they would be over $750 billion in AANA, but they were able to change the product mix of what they traded in order to reduce their notional and remain out of scope of Phase 4. The latest estimates show that because of these notional reduction efforts, Phase 4 will now only impact approximately 25 clients instead of the 50+ that were initially anticipated.

CME Group has witnessed this with clients who started using FX futures instead of forwards, Equity Total Return Index Futures instead of total return swaps, and clients who backloaded their entire portfolios of Chilean Peso and Colombian Peso interest rate swaps into CME Clearing in order to get their notional amounts below the Phase 4 AANA threshold.

Suffice it to say that since the advent of UMR, there has been a definite movement from clients out of bilateral markets and into futures and cleared swaps.

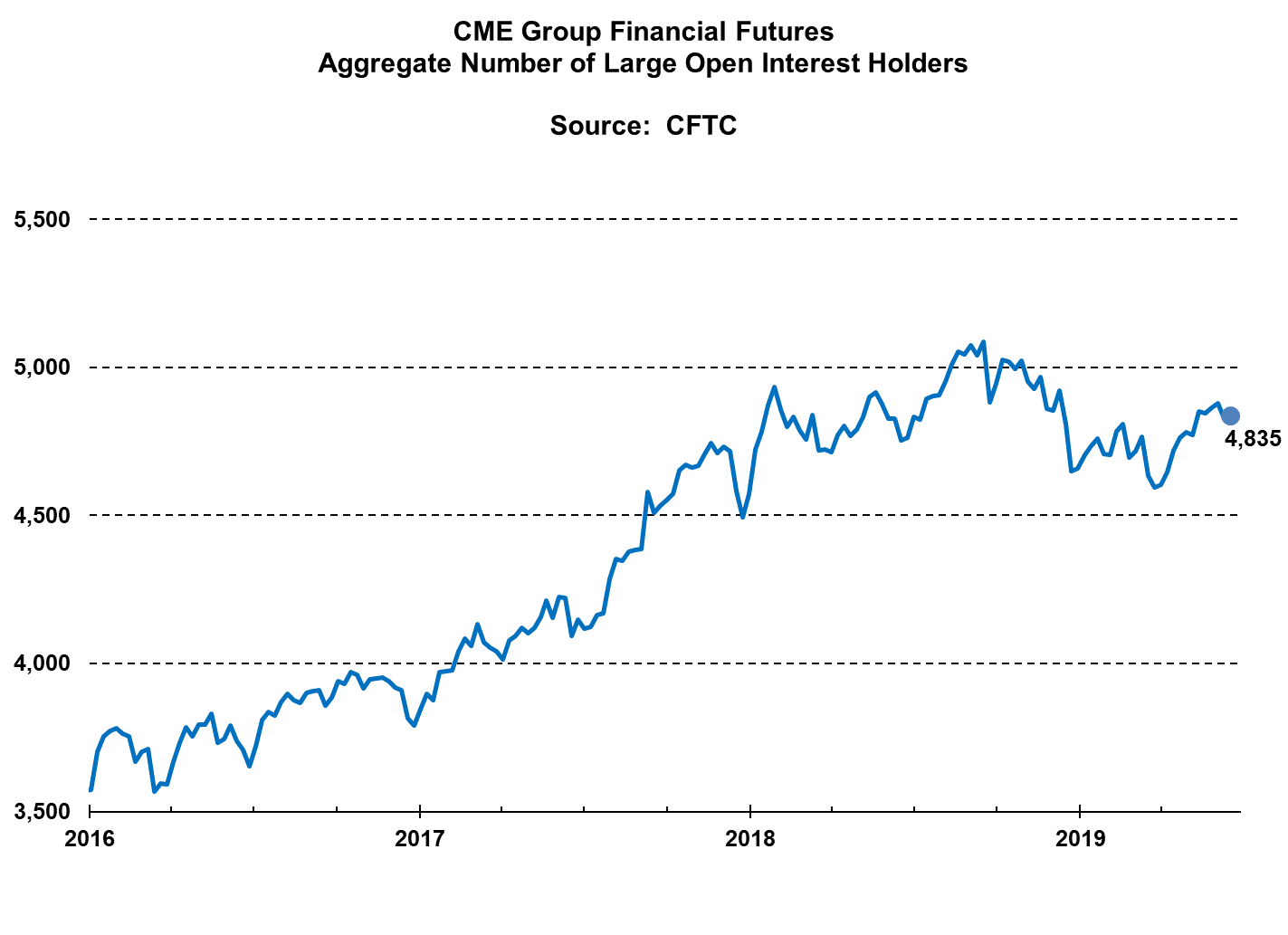

Looking at the Large Open Interest Holders for CME Group financial products, there has been tremendous growth in holders of CME Group futures with over 1,300 new large open interest holders across equities, interest rates and foreign exchange futures since the start of 2016.

Multilateral Compression

Not all exposures in a portfolio can be expressed via a listed future or a cleared derivative, so most firms will still have a portfolio of uncleared derivatives and the notional of those trades are what counts towards the threshold calculation, along with FX forwards.

With the goal of reducing the gross notional of a derivative portfolio, multilateral compression takes place via cycles where a group of different participants submits the trades they’d like to compress, along with their parameters and tolerances of how much they will allow their portfolio to change.

During these cycles, compression services looks across the submitted portfolios from all participants who want to compress, and it then reduces as much notional and as many line items as possible for all participants involved. TriOptima’s triReduce, the first such compression service, has eliminated $1.5 quadrillion of notional since launching 16 years ago.

Readiness for Phase 5

The trend of clients using futures, voluntary swap clearing and compression to reduce notional are likely to continue, as the start of the AANA calculation period approaches in March 2020.

Even though the size of Phase 5 is now down to approximately 200 clients, there are still a large number of clients that have to comply – particularly when considering they’ll be leveraging the same external resources across infrastructure providers, legal departments and custodians.

The message from the industry echoes what was said ahead of the clearing mandate back in 2013, which is that preparation always takes longer than expected and to get started early.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net