Equities

UK snuffs out hopes of end to midpoint trading ban

Financial Conduct Authority resists calls to diverge from EU’s tick size regime

Equity derivatives house of the year: Citi

Risk Awards 2021: US bank vaults into the top-tier, with some help from Garry Kasparov

Flow market-maker of the year: Citadel Securities

Risk Awards 2021: Palm Beach bubble allowed the firm to maintain crucial roles during March panic

End ‘senseless’ ban on midpoint trading, asset managers urge

Investors decry European rule that forces them to trade some equities in whole tick sizes

French regulator questions need for share trading equivalence

Esma’s reinterpretation ahead of Brexit reduces need for equivalence system, says AMF official

Trading heads call for reform of double volume caps

Asset managers endorse UK move on caps and back changes to EU’s unloved share trading restrictions

The lonely Londoners: doubts plague UK quest for equivalence

Planned MoU won’t automatically bring equivalence, leaving firms in limbo for unknown duration

Bonds fall from favour as shock absorbers for equity losses

Ultra-low rates force investors to rethink role of fixed income as diversifier

Trend followers fall under speeding equity markets

Riding trends in equity markets is proving to be a risky pastime for quant investors

Machine learning will create new sales-bots – UBS’s Nuti

Technologists working to automate indications of interest from trading desks

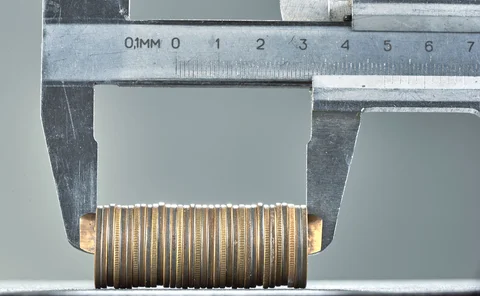

SA-CCR tweak could slash equity risk charge – research

Better calibration would cut equity options exposures in half, research finds

Underwriting activity of US G-Sibs topped $3 trillion in Q3

JP Morgan increased debt transactions by 41% year-on-year alone

Nasdaq retail rush powers intraday momentum trade

Options and ETFs give tech index new momentum, while S&P 500 sees higher levels of mean reversion

Canada pension fund Hoopp goes cool on bonds

$70bn investor rethinks LDI strategy to take into account paltry yield from fixed income

EU’s dividend ban overshadows reform effort

Banks may be reluctant to run down buffers even if regulators soften the MDA threshold for payouts

Asia moves: JP Morgan names Asia ECM head, Deutsche adds to ESG team, and more

Latest job news across the industry

Zooming in on equity factor crowding

A measure for crowding in trades is derived from supply and demand imbalances

One man’s trash is another man’s Treasury

With yields at record lows, investors are asking how much protection bonds will offer in a future crisis

Nordic noir: Swedish state pension fund’s outlook is austere

Sweden’s AP1 aims to ditch illiquid assets and target realistic returns with equities

UK and EU regulators diverging on double volume caps

Rule that limits anonymous equities trading to be reviewed in UK, but EC has bigger fish to fry

New HKEX warrant buyers surf vol in unfamiliar waters

While stock volatility is boosting inline warrant turnover, it’s driving bets more suited to wholesale products

Regional US banks outpace giants on loan growth

Banks $3-10 billion grew 19% over Q2

Eurozone funds favoured US equities in Q2

Investment funds also bought up eurozone bank stocks

EU insurers’ fund holdings battered by Covid in Q1

Total asset portfolios declined 6% through Covid shock