Equities

BofA becomes first US bank to adopt SA-CCR

Move cut leverage exposure by $66bn, but other banks wary of trade-offs

Vol decay and correlation flips: CFM’s take on the Covid crisis

Market bounce-back blindsided quant investment firm – and others

Equity hedges bolstered Axa through Covid crisis

Economic hedges contributed €425 million to H1 income

Eurozone insurers dived back into bonds in Q2

Net purchases of debt securities amounted to €15.1 billion over Q2

SocGen’s VAR jumped 54% in Q2

Credit VAR more than doubled to €43 million

Asia collar financing surges on back of Covid-19 volatility

Options-based structures gain ground on margin loans – and dealers say it may be a structural shift

Bargain-hunting equity hedgers turn to FX

Currency options are cheap relative to stock index puts, but correlations are uncertain

Funding adjustments in equity linear products

How tax asymmetries and Tobin tax affect the pricing of total return swaps

Studies test investors’ risk aversion after crash

Researchers use March tumult to investigate psychology of risk-taking

Quant firm deploys new metric for Covid sensitivity

Los Angeles Capital debuts new factor for measuring stocks’ sensitivity to the pandemic

Safe havens no longer safe, quants fear

Equity-debt correlation breakdown and negative bond yields make investors nervous

Calculating fair valuations for securities – The underlying complexities of trading fixed income

While some things have changed significantly over the past two decades across the capital markets, others have ostensibly remained the same. Take, for example, the challenge facing capital markets firms when calculating fair valuations for the securities…

Quants warn on credit risk in stocks

Conventional models may be missing explosion in novel exposure

ABN winds down Ronin books after Vix losses

$200m loss suffered by bank’s clearing business is thought to be mystery second default

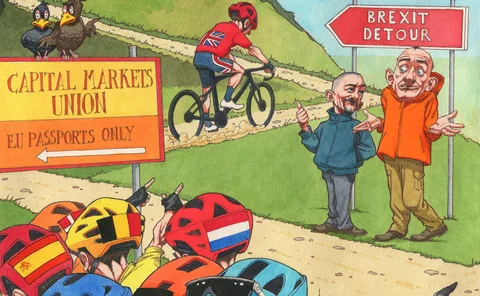

Equivalence failure threatens European share trading

UK and EU investors may be forced to trade dozens of shares on less liquid exchanges, analysis shows

Oil price shock triggers big margin calls

Banks and exchanges worked through weekend in anticipation of oil collapse

Equity, Treasury collateral builds up at US G-Sibs

Fair value of equity collateral rises 19% year-on-year

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

Systemic US banks’ trading portfolios swell 10% in 2019

US Treasuries held-for-trading soar 28% on Q4 2018

Rates trading revenues up 154% at top US banks

Net gains on interest rates-related exposures top $21 billion

Exploring new investment prospects in volatile markets

Custom and traditional proprietary indexes have been growing in popularity and actively transforming the investment landscape. Financial products linked to indexes are thriving, enabling more efficient access to the market, whether it is equity, bonds or…

Who killed FX volatility?

Beyond central bank policy, traders see a range of hidden structural factors at work

Equity gains bolster EU hedge funds’ portfolios

Funds were net sellers of equities, but market gains added +10% to balance sheet values

Hedging incentives for financial institutions

Using a simple model, this paper derives two results that provide guiding principles for hedging by, and capital regulation of, financial institutions.