Deep learning

Deep learning profit and loss

The P&L distribution of a complex derivatives portfolio is computed via deep learning

Machines can read, but do they understand?

A novel NLP application built on a Google transformer model can help predict ratings transitions

Deep learning for discrete-time hedging in incomplete markets

This paper presents several algorithms based on machine learning to solve hedging problems in incomplete markets.

Podcast: NYU’s Kolm on transaction costs and machine learning

TCA methodologies that ignore partial fills “might be off by 20% to 30%”

NLP and transformer models for credit risk

News feeds are factored into models to predict credit events

Wells touts new explainability technique for AI credit models

Novel interpretability method could spur greater use of ReLU neural networks for credit scoring

Show your workings: lenders push to demystify AI models

Machine learning could help with loan decisions – but only if banks can explain how it works. And that’s not easy

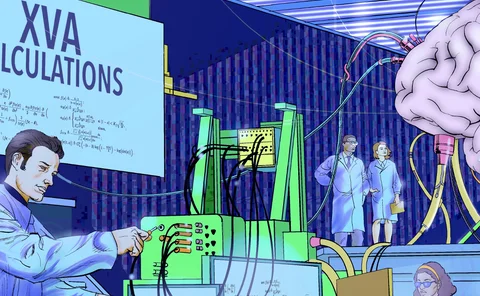

How XVA quants learned to trust the machine

Initial scepticism about using neural networks for derivatives pricing is giving way to enthusiasm

Deep XVAs and the promise of super-fast pricing

Intelligent robots can value complex derivatives in minutes rather than hours

Synthetic data enters its Cubist phase

Quants are using the theory of rough paths to distil the essence of financial datasets

Generating financial markets with signatures

Signatures can provide the synthetic data to train deep hedging strategies

Technology innovation of the year: Scotiabank

Risk Awards 2021: New risk engine can run nearly a billion XVA calculations per second

Solving final value problems with deep learning

Pricing vanilla and exotic options with a deep learning approach for PDEs

Setting boundaries for neural networks

Quants unveil new technique for controlling extrapolation by neural networks

Degree of influence: volatility shakes markets and quant finance

Volatility and machine learning were among the top research areas for quants this year

Machine learning hedge strategy with deep Gaussian process regression

An optimal hedging strategy for options in discrete time using a reinforcement learning technique

Detecting changes in asset co-movement using autoencoders

ARR aims to anticipate volatility patterns to provide signals for risk management and trading

Three adjustments in calibrating models with neural networks

New research addresses fundamental issues with ANN approximation of pricing models

Deep learning calibration of option pricing models: some pitfalls and solutions

Addressing model calibration and the issue of no-arbitrage in a deep learning approach

Podcast: Horvath and Lee on market generator models

Quants explain the application of the latest techniques

At Numerai, real-world figures need not apply

AI hedge fund CEO sees the light in black-box technology

The market generator

A generative neural network is proposed to create synthetic datasets that mantain the statistical properties of the original dataset

Interpretability of neural networks: a credit card default model example

Recently developed techniques aimed at answering interpretability issues in neural networks are tested and applied to a retail banking case

Ex-Credit Suisse quants embrace machine learning

Founders of XAI Asset Management grapple with unsupervised learning and the problems of explainability