Credit derivatives

A pricing model with dynamic credit rating transition matrixes

This paper incorporates a stochastic credit rating transition matrix into the Acharya–Das–Sundaram model and implements a simulation based pricing method

UK bank derivatives exposures fall by £321bn in Q2

At £1.12 trillion, FX exposures are at their lowest levels for seven years

UK banks interest rate swap exposures fall £711bn

Credit derivatives exposures bucked the downward trend, growing 16% quarter on quarter

CDS market prepares to join Libor transition

Ice and LCH will switch to new rates for margin interest; Isda to follow in standard model update

CDS trading remains stubbornly human

Buy-siders sceptical of benefits of algo execution for credit derivatives

ESG derivatives – From equity to fixed income, what next for this market?

The fast-evolving ESG derivatives market, how these products are helping investment strategies and expectations for market development.

Credit derivatives traded volume up 15% in 2020

Week ending March 1 was the most active in dollar-denominated swaps

Credit derivatives house of the year: Credit Suisse

Risk Awards 2021: Hedging before the crisis allowed bank to offer ample liquidity when markets tanked

ETF options: the market’s latest credit hedge

Investors look to derivatives on fixed income exchange-traded funds to manage credit risk exposure

Majority of EU funds’ CDSs are ‘naked’ exposures

Of more than 4,000 CDS positions assessed by Esma researchers, 71% were uncovered

Asia moves: HSBC appoints Apac CIO, Crédit Agricole names regional transaction banking head, and more

Latest job news across the industry

Cleared CDS volumes surged in H1 – BIS

CDX cleared contracts outstanding leapt 35% in H1

Credit swap portfolios contracted at systemic US banks in Q2

Sold notionals fell 8% over the three months to end-June

Barclays led UK banks in growing CDS book through Covid shock

Dealer saw credit derivatives notionals balloon £58.1 billion over the first half

XVA traders have no time to rest on laurels

Markets have calmed, but they may not be out of the woods yet

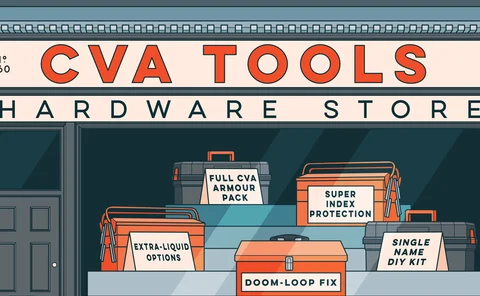

CVA desks arm themselves for the next crisis

March’s volatility forces dealers to fine-tune hedging strategies

ABN Amro crushes CVA charge with index hedges in H1

Risk-weighted assets for CVA drops 48% in six months to end-June

Stanford’s Duffie shakes up SOFR credit race with AXI index

Academics propose new credit index that ditches Libor tenors for a single funding spread

Common domain model needs infrastructure push, says Barclays

Bank wants market infrastructures to drive adoption of Isda CDM

Ice Europe’s CDS unit hit by almost 1,000 IM breaches in Q1

Peak breach was €100 million in size

Volatility scaling flops in credit alt risk premia

Strategies miss recovery from March plunge, prompting rethink on speed of mean reversion

Equity derivatives aided BlackRock funds in March

Flagship Strategic Income Opportunities fund posted $253 million in net derivatives gains at height of Covid crunch

Recent defaults lead to record credit derivatives payouts

CDS auctions have yielded historically low recovery rates this year, meaning swap sellers have had to pay more than normal

Sold CDS notionals climbed 16% at top US banks in Q1

Net fair value of credit protection positions vaults to $5.3 billion