Credit derivatives

Finding the investment management ‘one analytics view’

This paper outlines the benefits accruing to buy-side practitioners on the back of generating a single analytics view of their risk and performance metrics across funds, regions and asset classes.

Bank balancing: optimising margin and capital in a higher-rate environment

This Risk.net paper, which features leading practitioner insights, assesses the challenges banks are facing in the new higher rate environment and the strategies and tools they are using to optimise margin and capital on their derivatives portfolios.

UK tiptoes away from Europe on bank CDS transparency

Only a small number of instruments are affected, but some worry it will distort competition

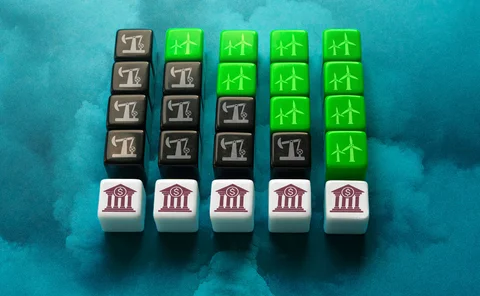

How to account for banks’ contribution to CO2 emissions

Price adjustments will depend on individual counterparties’ carbon footprints

US funds add to single-name CDS positions

Counterparty Radar: Corporate positions exceed SSA contracts for first time on record in Q2

The importance of data-driven decision-making in Apac

Embracing data-driven decision-making enabled by digital technologies is crucial for the success of lending institutions in Apac

US banks ditch IR futures as appetite for swaps booms

Notional for futures craters 19% in Q2, hitting lowest in at least seven years

Apac banks put trust in pre‑trade

Amid tougher trading conditions, Apac banks are making greater use of pre‑trade analytics to inform their strategies and reduce risk. But how successful are these tools?

Vue gives private credit another reason to shun CDSs

Lenders prefer to hold risk themselves and recent issues suggest incompatibility with private markets

Talking Heads 2023: A turf war in credit markets

Banks are looking to reclaim territory they previously ceded to market-makers and private funds

Navigating IFRS 9: strategies for effective implementation and moving beyond

There has been a constant change within the landscape of financial reporting, and IFRS 9 has been proven to be a critical component.

RBC’s credit derivatives book grows fourfold on market-making push

Notionals of credit protection sold and purchased have ballooned 236% and 382% respectively since October 2022

Using emerging technologies to improve the risk management function

This white paper discusses why capital markets firms need access to the most innovative technologies, real-time analytics, and timely and accurate data for better and faster decision-making in the risk function.

Adapting to economic uncertainty: internal audit’s journey

In this report, internal auditors in different sectors have shared their experiences and strategies, providing valuable insights for others facing similar challenges

Citi is building a central risk book for credit

Talking Heads 2023: Putting CDSs, ETFs and bonds into the same pot will result in better pricing, says credit head Bhatia

Why credit default committees are a turnoff for the buy side

With high costs and little to gain from participating, investment firms seem content to leave the legal work to the banks

The changing face of credit portfolio management at banks

Faced with huge increases in capital charges in the coming months, banks will turn to credit portfolio management to support business decisions on origination, capital allocation and risk transfer

Credit Suisse CDS blip spotlights obligations list overhaul

Isda began work on updating reference instruments before banking crisis erupted

For the capital markets, every risk playbook needs to implement these six themes

This white paper outlines six risk management themes that we think should be a part of any risk playbook and which can serve financial institutions well in preparation for the uncertain future that lies ahead.

Relief (and some regret) as EU scales back swaps transparency

Leaked document outlines plans to narrow scope of dysfunctional OTC disclosure regime

EU’s late CDS transparency push triggers trader fears

Leaked proposal to shoehorn public disclosure of CDS into Mifir placates Esma, but alarms traders

Same instrument, different market

Dealer Rankings 2023: For buy-side firms, the list of banks you can trade with depends on who you are

CDS auction-rigging lawsuit set to proceed

US judge clears way for case in which pension funds allege dealers manipulated CDS settlements

DC to consider second request to trigger Credit Suisse CDS

Last-ditch effort hinges on whether the bank was, or said it was, unable to pay its debts