Conduct risk

In roiling markets, fraud rises. Banks want to understand why

Disruption from Ukraine and Covid puts managers on alert for misconduct, as risk controls are stretched to the max

Op risk outlook 2022: the legal perspective

Christoph Kurth, partner of the global financial institutions leadership team at Baker McKenzie, discusses the key themes emerging from Risk.net’s Top 10 op risks 2022 survey and how financial firms can better manage and mitigate the impact of…

Top 10 operational risks for 2022

The biggest op risks for the year ahead, as chosen by senior industry practitioners

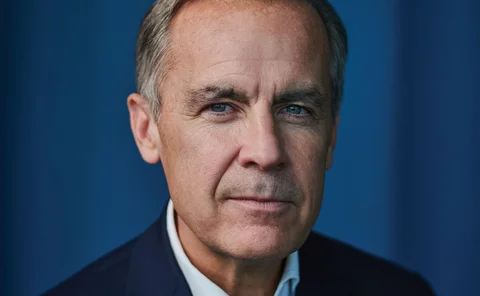

Lifetime achievement award: Mark Carney

Risk Awards 2022: The calm at the eye of the storm of post-crisis regulation and climate risk management

Op risk data: Morgan Stanley, Capital One’s data breach double trouble

Also: Citi shells out $45m for misleading stock trading info; coding clangers cost Credit Suisse $9m. Data by ORX News

Moving targets: the new rules of conduct risk

How are capital markets firms adapting their approaches to monitoring and managing conduct risk following the Covid‑19 pandemic? In a Risk.net webinar in association with NICE Actimize, the panel discusses changing regulatory requirements, the essentials…

Establishing an effective conduct risk framework

The stakes have never been higher when it comes to conduct risk. Regulators now look to hold senior managers personally liable for the misconduct of their employee populations and, with teams more globally dispersed, managing conduct and culture is more…

‘It’s the economy’: forecasting an op risk climate change spike

History of op risk suggests economic impacts of climate change could exacerbate losses, writes op risk head

Singapore banks step up their game against internal fraud

Firms respond to MAS warnings about dangers of remote working spurred by Covid

GFXC sees no changes to code on pre-hedging

Committee rejects calls to set more strict boundaries to controversial practice

Top 10 op risks 2021: conduct risk

Remote working vastly complicates the job of conduct risk supervisors

Top 10 operational risks for 2021

The biggest op risks for the year ahead, as chosen by senior industry practitioners

Deutsche Bank lines up new head of op risk

Appointment follows departure of Bakhshi to CRO role at LSEG

Must do better – Apac slow to curb control risk

Asia Risk 25: Even as the level of regulatory scrutiny peaks, meaningful change eludes the region’s banks

HSBC exec: measure culture through smarter surveillance

Machine learning could help gauge positive sentiment from surveillance logs, says Elhedery

NY Fed’s Stiroh: ‘cultural capital’ at risk in pandemic

Risk USA: remote working could “erode” the culture of financial firms, says senior regulator

Asic to weigh in on Libor transition conduct risk

Australia’s markets regulator will publish guidance on firms' conduct obligations in move to RFRs

Stuart Lewis, Deutsche’s survivor, confronts Covid-19

CRO talks loan reserves, VAR breaches, and the lessons of a lurid past

Covid capital, SA-CCR and problems with post-Libor protocol

The week on Risk.net, July 4-10, 2020

Lawmakers have to sort ‘tough legacy’ Libor products – survey

Challenges agreeing contract amendments and lack of term rates for the risk-free alternatives are also barriers to transition

An emergent taxonomy for operational risk: capturing the wisdom of crowds

In this paper, the author takes a data-driven approach and combines the individual active taxonomies of sixty large financial institutions (fifty-eight for construction and two for validation) to create a coherent new reference taxonomy: the ORX…

SOFR and credit spread – Not as simple as it seems

Chris Dias, principal and global Libor solution co-lead at KPMG, explores how the market will adjust as liquidity grows and why firms must resist the temptation to default to existing processes for determining credit spread and rethink the traditional…

Conduct risks stalk banks in Libor transition

As replacement rate concerns become more pressing, firms fear Libor lawsuits and regulatory wrath

Operational risk – Unleashing the power of AI to mitigate financial crime and manage conduct risk

Big data, data mining, machine learning and artificial intelligence have revolutionised how industry manages and mitigates risk. In light of the Covid-19 pandemic, what impact has this had on financial crime, what risks does remote working pose and how…