CCP

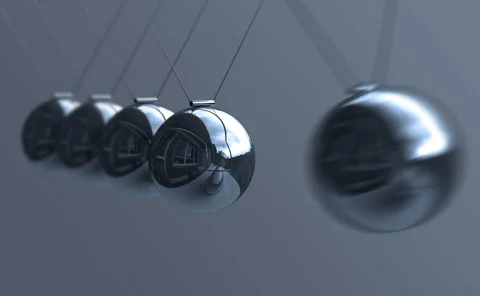

WHAT IS THIS? A central counterparty (CCP) manages default risk by collecting initial and variation margin from both parties to a trade. Spill-over losses are absorbed via a default fund to which all members contribute – introducing a degree of mutualised risk – and by the CCP’s own capital. The concept is an old one that was extended to over-the-counter derivatives in the aftermath of the financial crisis.

OCC members' default fund payments drop 39% in 2018

Calculation switch shaves billions off mandatory contributions

Will the Nasdaq default spur CVA for CCPs?

Quant proposes model to calculate bank credit risk exposure to CCP

Central counterparty CVA

Matthias Arnsdorf proposes a method to calculate the counterparty risk related to CCP membership

Brexit fear drives futures trades out of London

Transitions via FIA protocol have escalated since January as no-deal concerns mount

Eurex member faced jumbo VM call in Q4 2018

Third-largest actual same-day payment obligation is the biggest since 2016

Patchy response to Isda’s back office of the future

Some banks are quiet, while clearing houses seem split on uptake of Isda data standardisation project

EU swap users still hope for single-sided reporting, one day

Lawmakers fail to deliver Emir reprieve but tease at potential future changes

CFTC nominee opposes EU oversight of US clearing houses

In EU-US turf war, Heath Tarbert says US CCPs should be ‘exclusively supervised’ by US regulators

Study floats idea of breaking up CCP services

Proposal includes explicit public backstop for key functions and private provision of other services

Banks split over sending traders to default auctions

After Nasdaq auction failed, some see need for traders in process; others can’t afford to lose them

CFTC official: CCPs should war-game default auctions

Risk appetite should be factor in selecting auction participants – Wasserman

Time running out for Brexit data compliance, Bailey warns

FCA head also highlights shortfall on Mifid trading venue equivalence

Who pays? Who gains? Central counterparty resource provision in the post-Pittsburgh world

In this paper, the authors develop a conceptual framework to examine whether the regulatory changes since the Pittsburgh Summit could be a catalyst for reconsidering the structure of clearing houses.

Ring-fencing law swells Lloyds’ swap book

Recognition of intra-group trades boosts leverage exposure measure and CCP charges

Cleared swaps grow 10 times faster than bilateral at HSBC

Total derivatives notionals up 25% year-on-year

Regulators to scrutinise CCP default auctions

CPMI-Iosco preps discussion paper as banks warn further guidance needed after Nasdaq default

A rush on Libor fallbacks to head off holdouts

Concerns that valuation changes will scare some off adoption may be accelerating Isda timeline

LCH plans 2020 switch to SOFR discounting

Users opt for one-step switch to new US dollar regime, as long as CCP cooks up compensation scheme

Margin or membership? Regulators react to Nasdaq default

Six supervisors – from Bafin to the MAS – downplay idea of mandatory increase in futures MPOR

SOFR, so bad: liquidity lags transition ambitions

Thin current trading may lead to poor fallback choices, and dim SOFR’s appeal ahead of Libor’s death

Eurex Clearing names new CRO

CCP’s risk analytics head will replace Laux in July

FICC takes firm grip of US repo market

Central counterparty wrangled more money market repo cash than banks did by end-2018

DTCC, Ice Clear Europe lead top CCPs in boosting liquidity buffers

CCPs added $20.8 billion to their liquidity buffers in the third quarter of 2018

Ice Clear Europe posts $1.2bn margin breach in Q3

In total, 55 margin breaches reported at end-September 2018