Back office

Risk Markets Technology Awards 2019: Vendors enter the pick-and-mix era

Modular tech and micro-services – plus new risk and regulatory needs – are creating openings for insurgents and incumbents

Obstacles and opportunities in adopting cloud computing

Sponsored Q&A

Hackathon finds pre-trade gold in Isda’s post-trade project

Dealers’ derivatives trade processing costs could be cut by at least $3 billion per year

Banks cry foul over LCH compression policy changes

Allocation of compression slots favours TriOptima over competitors, critics say

Planned sale prompts hard look at post-trade firms

Plans to sell MarkitServ fuel warnings about middleware vendors’ future

From prophets to ‘parasites’

How post-trade vendors went from problem-solvers to ‘rent-seekers’

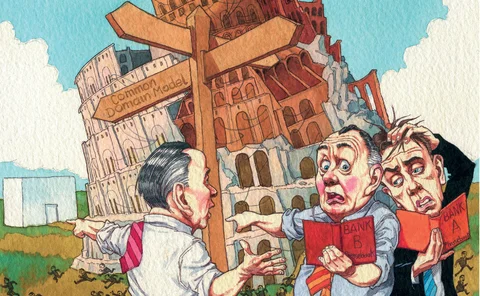

The battle for the back office

Post-trade incumbents at risk as Isda and others search for standards

Isda’s O’Malia: back-office costs are ‘killing’ swap dealers

Banks set to begin testing Isda’s common domain model for trade lifecycle processes

Welcome to the new Isda – more ambitious than the old one

Swaps body announces aim to expand its role from legal contracts to data and process at annual gathering

Innovation of the year: Energy Settlement Network by Aquilon Energy Services

Energy Risk Awards 2017: Aquilon's cloud-based settlement platform redefines automation

US public pensions failing on operational risk

Outdated systems and lax controls expose pension plans to 'operational failure'

Energy trading technology moves gradually into the cloud

Energy firms and software vendors making greater use of cloud computing

Technology House of the Year: TriOptima

Emir and Dodd-Frank are seeing energy companies flock to TriOptima

Out of office: banks debate merits of shared processing

Sliding profits are prompting banks to take a new look at an old idea – an industry run back-office utility

Ice Brent changes prove a hard pill to swallow

Ice says a plan to shift the expiry dates of futures and options on Brent crude oil is an important fix that will tighten the link between the physical and futures markets. However, carrying out the necessary changes could be painful for market…

Brent options trading disrupted by Ice expiry date shift

Proposals to ensure convergence between futures and physical Brent cause firms to avoid trading long-dated options

Northern Trust to shadow BNY Mellon at Bridgewater

Northern Trust appointed to replicate middle- and back-office functions of existing administrator BNY Mellon at $140bn hedge fund

Energy Risk's 2012 Software Survey and Rankings

Taking a targeted approach

Dealers face up to OTC clearing's tech revolution

All systems go

Dealers face up to OTC clearing's tech revolution

Clearing the way for IT

Regulators could focus on ETFs after UBS losses

Regulators could take some time to change the rules surrounding the exchange-traded products involved in the UBS rogue-trading losses, but banks might see an impact soon in capital terms

Curing the culture of fraud

Internal affairs