This article was paid for by a contributing third party.More Information.

Global investing under water? – Climate change could leave equities exposed

As impending global changes brought about by climate change loom, one issue in particular threatens to cause massive losses to institutional investors – rising sea levels. David Lunsford and Boris Prahl, of MSCI, explore where, despite the efforts of initiatives such as the Paris Agreement on climate change, institutional investors must protect their portfolios from physical climate risk, and why, when it comes to facing up to climate risk, inaction could prove catastrophic

Threats to the environment from climate change are many and wide in scope. However, the most potentially devasting and arguably most permanent of these is the threat of rising sea levels. Notwithstanding the Paris Agreement on climate change – in which it was agreed to reduce the temperature rise of greenhouse gas emissions to 1.5° Celsius and which may achieve this goal – the global mean sea level may still rise 29–59 centimetres by the end of the century, and may continue to rise into the next.

To estimate and attribute damage costs to company facilities, MSCI ESG Research used probabilistic modelling and geographic information systems technology to project future flood damages under climate change. MSCI ESG Research’s physical climate risk analysis comprises approximately 221,000 geo-referenced assets from around 7,200 publicly listed companies. For each of these facilities, MSCI assessed the threat of coastal flooding and the associated financial risks related to asset damage and business interruption. This analysis allows the model to determine cost profiles for each company, and feeds into the calculation of the MSCI ESG Research Climate Value-at-Risk (VaR) metric.

Even a modest increase in the global mean sea level of 11cm could result in additional losses of $1.4 trillion per year – 0.25% of global GDP – according to a recent study. For investors, the question is how coastal flooding may impact global equity portfolios.

How severe is the problem?

Based on estimates by MSCI Environmental, Social and Governance (ESG) Research, approximately 7% of all facilities covered by MSCI All Country World Index – now known as MSCI ACWI – constituents are under threat from coastal flooding.1 In addition, nearly 62% of all index constituents had at least one facility in a flood-prone area – highlighting the importance of accounting for these risks and integrating that information into the investment decision-making process. Rising sea levels would likely make these risks more acute.

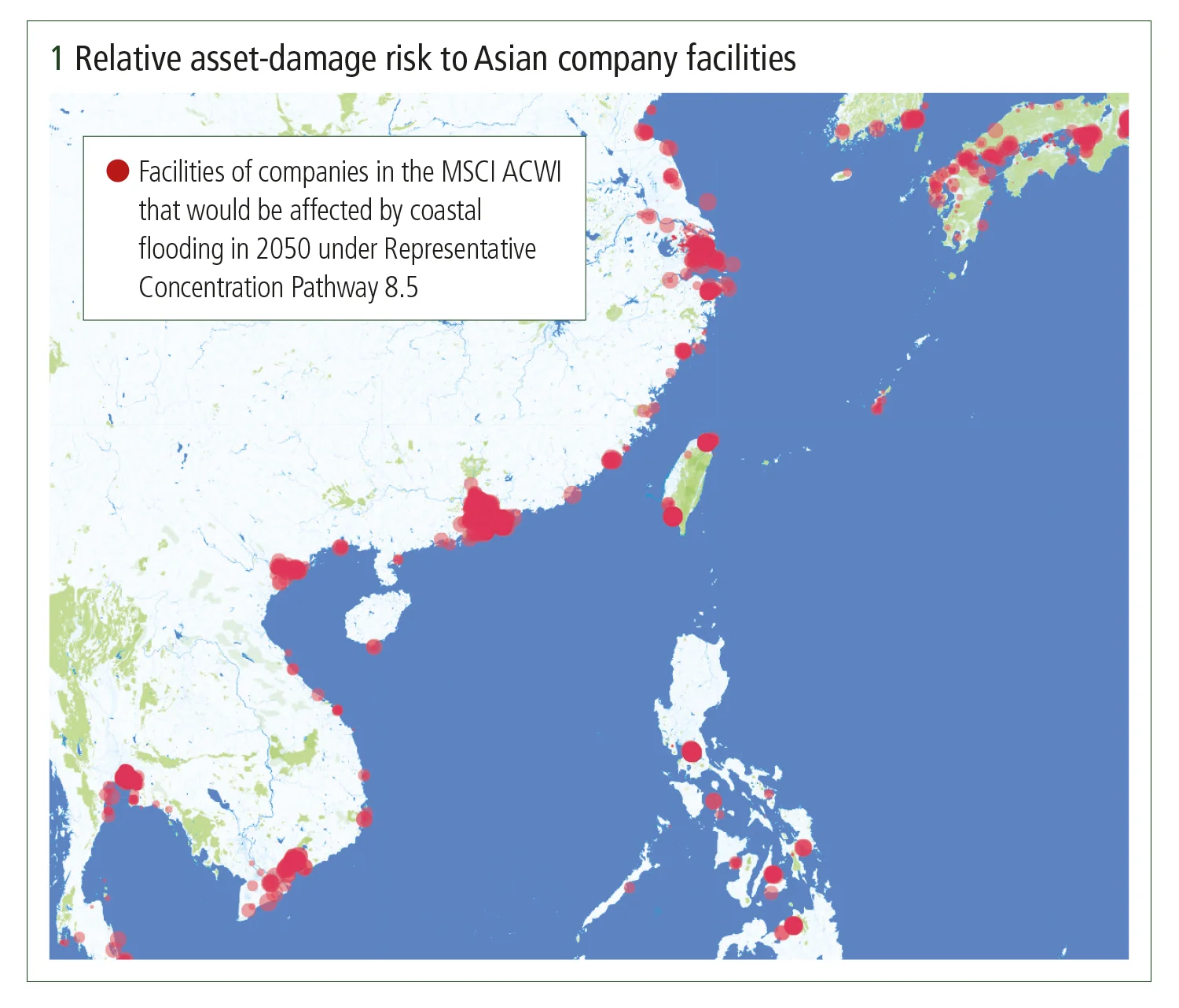

At a regional level, Asia had the highest exposure to coastal flooding risk by far, both in terms of the number of facilities and the level of potential damage at company sites. MSCI ESG Research’s analysis identified 6,257 facilities at risk in Asia, with $2.25 trillion of revenue at risk between now and 2050.2 The European Union had the second-highest number of facilities at risk from coastal flooding – 2,270 – while the US had the second-highest amount of revenue at risk, at $541 billion. Without significant investment in coastal protection and adaptation, more than half of the global assets at risk could become untenable by 2050, according to MSCI’s model (see figure 1).3

The MSCI Principles of Sustainable Investing

MSCI recently published The MSCI principles of sustainable investing, a framework designed to illustrate specific, actionable steps that investors can and should undertake to improve practices for environmental, social and governance (ESG) integration across the investment value chain. The framework includes three core pillars to full ESG integration:

1. Investment strategy – Asset owners should integrate ESG considerations into their processes for establishing, monitoring and revising their overall investment strategy and asset allocation.

2. Portfolio management – Portfolio managers should incorporate ESG considerations throughout the entire portfolio management process, including security selection, portfolio construction, risk management, performance attribution and client reporting.

3. Investment research – Research analysts assessing companies and issuing investment recommendations to portfolio managers should integrate ESG considerations – including ESG company ratings – into their fundamental company analysis.

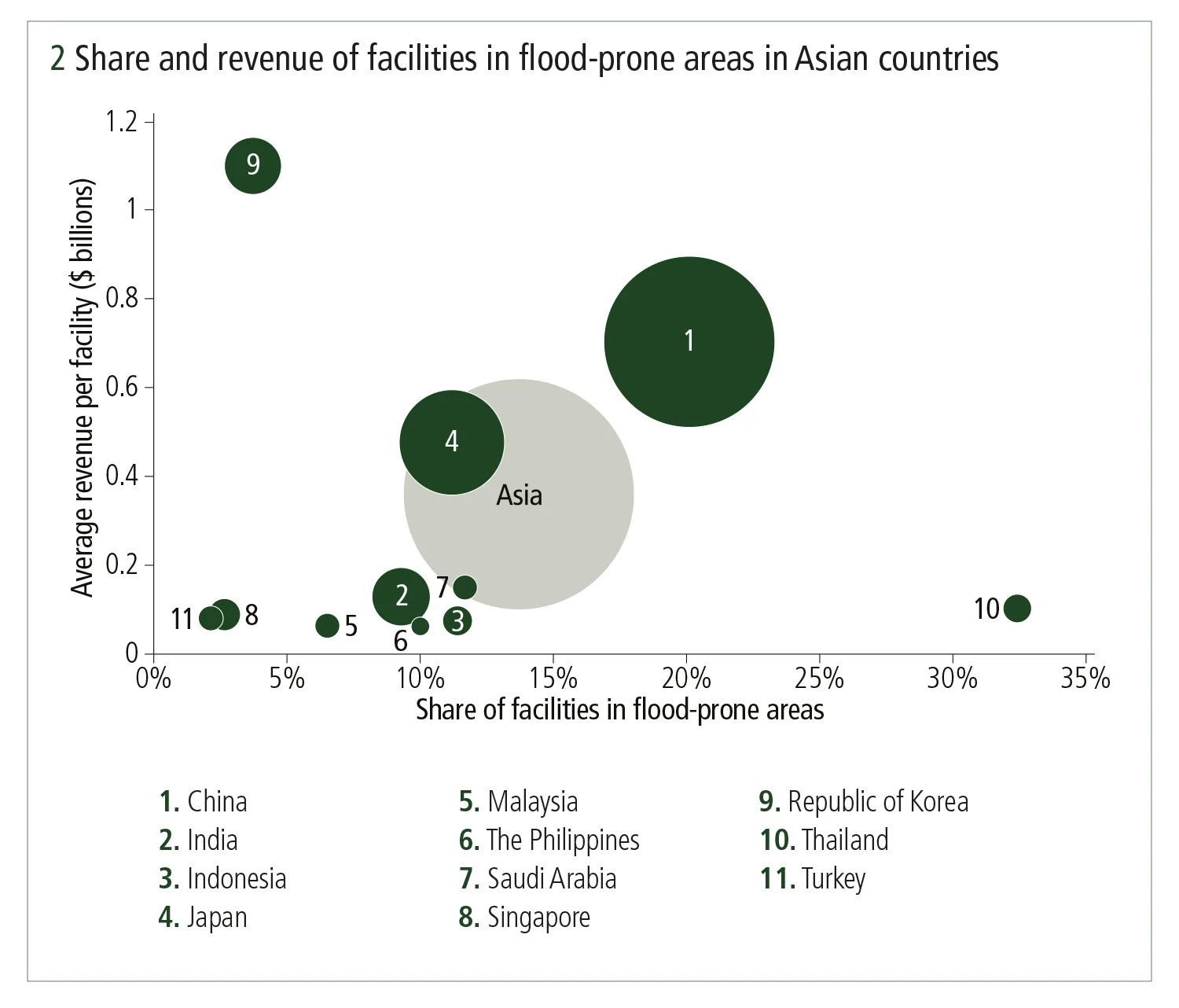

MSCI ESG Research estimated that nearly 14% of Asian facilities are located in flood-prone areas – nearly double the global average. On closer examination, the Asian risk exposure varies strongly by country.

For instance, Thailand – with 32% exposed facilities – is strongly affected because of its extensive low-lying areas and widespread land subsidence. In contrast, the relatively low number of affected facilities in South Korea – less than 4% – is outweighed by the high revenue per facility, being estimated at over $1 billion, on average. Countries with a large share of high-value facilities being exposed may constitute a severe risk in global investment portfolios (see figure 2).

Navigating all aspects of climate-related risk

For investors looking to identify, understand and manage their long-term financial risks and opportunities, the MSCI ESG Research Climate VaR metric has four main applications:

- Policy transition scenarios – The policy scenarios aggregate future policy costs based on an end-of-the-century time horizon. By overlaying climate policy outlooks and future emissions reduction price estimates onto company data, MSCI ESG Research’s model provides insights into how current and forthcoming climate policies will affect companies.

- Innovation transition scenarios – The low-carbon technology scenario is based on company-specific patent data, providing insight into the strategic investments companies are making to help the transition to a low-carbon economy.

- Portfolio warming potential – The warming potential methodology computes the contribution of a company’s activities towards climate change, delivering an exact future temperature value a company’s activities are currently aligned with.

- Physical risks and opportunities – The physical scenarios evaluate the impact and financial risk relating to several extreme weather hazards, such as extreme heat and cold as well as flood risk.

No assurance of insurance

Should global action on climate change fail and extreme scenarios of sea-level rise as predicted by the Intergovernmental Panel on Climate Change be realised, companies in the most exposed locations may experience increased difficulty in insuring assets. And, without investment in flood protection measures, some companies could lose their existing coverage. To identify companies that are potentially more resilient to flood risk, investors may scrutinise which have more comprehensive insurance coverage, as well as those that have in place other risk mitigation measures such as improved construction, upgraded floodwater drainage and retention capacity.

Institutional investors may want to review their options on how they work to protect their portfolios from physical climate risks such as exposure to coastal flooding. For example, they may engage with companies on physical climate risk, reduce exposure within a sector and/or a portfolio or create climate-smart benchmarks.

The authors

David Lunsford, Executive director and head of climate policy and strategy, MSCI

At MSCI’s Climate Risk Center, David Lunsford designed the transition risk and opportunity assessment methodologies, as well as other aspects of the climate modelling approach. He has worked with governments and corporations on managing climate risk for more than 13 years. He previously co‑founded Carbon Delta, an environmental financial technology and data analytics firm, which was acquired by MSCI in 2019. Lunsford has a master’s degree in sustainability and international organisations from the University of Geneva.

Boris Prahl, Vice‑president, MSCI ESG Research

Boris Prahl is a senior climate researcher and climate risk product manager with the MSCI Climate Risk Center in Zurich. Prahl leads the MSCI Climate Value-at-Risk model design and development for physical climate risks. Previously, he worked on impact assessment for climate hazards as a postdoctoral researcher at the Potsdam Institute for Climate Impact Research. Prahl holds a PhD in meteorology from the Free University of Berlin, and a master’s degree in physics from Imperial College London.

Notes

1. The Climate VaR model covers 2,344 out of 2,955 MSCI ACWI constituents (as of December 31, 2019). Of the companies covered by the model, 144,014 locations can be evaluated. Coastal flooding risk can be found at 10,242 of these locations, meaning 7% of the company locations in the ACWI would be exposed to coastal flooding risk under the Representative Concentration Pathway 8.5 business-as-usual scenario, unless further action is taken.

2. Revenue at risk is defined as the share of current company revenue attributable to facilities affected by specific extreme weather events or gradual climate shifts. To allocate revenue, global breakdown by country and map country revenue is used to asset locations.

3. Assets deemed untenable will experience, on average, more than 5% of asset damage per year.

MSCI ESG Research Products and Services are provided by MSCI ESG Research LLC, and are designed to provide in-depth research, ratings and analysis of ESG-related business practices to companies worldwide. ESG ratings, data and analysis from MSCI ESG Research LLC are also used in the construction of the MSCI ESG Indexes. MSCI ESG Research LLC is a registered investment adviser under the Investment Advisers Act of 1940 and a subsidiary of MSCI Inc.

Climate risk – Special report 2020

Read more

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net