Risk magazine - Jan 2019

This month: a new, collaborative mood is taking hold of the credit modelling industry; a threat to the Ion throne; more Brexit brouhaha; the year in review; and much more

Articles in this issue

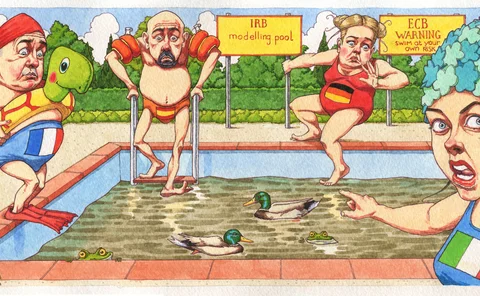

Credit risk quants are hitting the tech gap

An appetite to cut the costs of IRB is constrained by tougher regulatory scrutiny

Natixis’s €260m hit blamed on big books and Kospi3 product

Rivals say French dealer grew business too quickly – with leveraged version of Korean index one source of pain

NatWest kick-starts Brexit swaps transfer

Bank follows Barclays and UBS with plans to continue serving EU clients as ‘no-deal’ looms

Repo rate hits 7.25% on year-end volatility

US Treasury issuance on December 31 said to have fuelled last-minute dash for cash

Euro term rate likely to be OIS-based, says RFR group chair

Committed quotes “the most viable methodology”, but some insist rate creates new risks

Fallback decision will lift yen OIS, says Japan RFR group chair

Move should kick-start dormant Tonar OIS market – key requirement to building a term rate

Isda seeks consensus on CDS clean-up

Credit definitions amendments expected in Q1 to stamp out manipulated triggers

Risk premia strategies do not reward downside

Study says alt premia approaches do not compensate for exposure to rough markets; hints at data mining

People moves: SocGen adds in prime services, Deutsche fills new rates hole, HSBC makes model move, and more

Latest job changes across the industry

Pooled resources offer way to keep credit models afloat

Supervisors drive banks to seek more corporate default data and cost-effective model improvements

A threat to the Ion throne?

Banks need connections to e-trading venues; they don’t want the other services that come with them

Brexit set to jack up banks’ capital costs

Split into UK and EU arms will reduce netting benefits and capital flexibility

Basel’s archaic op risk taxonomy gets a makeover

Industry moves to revise out-of-date categories that feature risks such as cheque fraud

Fed’s MBS exit surprises some with muted rates vol

Shrinking of huge portfolio led to predictions of vol jump that – so far – has not appeared

AIIB risk chief on steering China’s World Bank rival

Martin Kimmig on the Asian Infrastructure Investment Bank’s challenge of overcoming patchy credit data

Industry lukewarm on proposed ‘quick fixes’ to Priips rules

Many fear performance scenarios will remain misleading and expose providers to mis-selling claims

HSBC and the risk-advisory robot

Bank has amassed 10-petabyte pool of client data to spot hedging, financing and payments needs

Q&A: Japan RFR group head on term rates and Tonar liquidity

MUFG’s Matsuura discusses term benchmark options, cross-currency swaps and Tibor’s future

For US banks, billions in regulatory manna

The unwind should help mid-tier banks, but the G-Sib impact is a complex balancing act

How quants at Value Partners pick Macau’s casino winners

Hotel data on ‘high rollers’ helps group make casino investment calls, as quant influence grows

Shipping and energy firms revisit hedging on IMO 2020

Upcoming shipping rules set to impact fuel prices across the energy complex

A tale of two CCPs

Nasdaq and Ice breaches carry warnings for the market

Ice Clear Europe posts $1.2bn margin breach in Q3

In total, 55 margin breaches reported at end-September 2018

Nasdaq default came at time of mass margin breaches

CCP's clearing members incurred 49 margin breaches as of end-September

IFRS 9 hits standardised banks harder than IRB peers

Capital wallop over eight times greater for SA banks than IRB

Bond trading dominates EU bank market risk

Traded debt position risk accounts for 60% of market risk capital requirements

Two stress tests give conflicting verdicts on UK banks

Under the BoE’s severe stress scenario, the average drop to UK banks’ CET1 capital ratios was 740bp, compared with 570bp under the EBA’s adverse scenario

Solvency II special measures boost EU insurers’ capital ratios

Median insurer's SCR ratio would be 24 percentage points lower without LTG and transitional benefits

Op risk data: SocGen hit with $95m money laundering fine

Citi, JP Morgan settle Sibor rigging claims; Europe matches US on AML fines. Data by ORX News

Does credit risk need an expected shortfall-style revamp?

Quants propose tail risk-sensitive measure for counterparty credit risk

Counterparty trading limits revisited: from PFE to PFL

The potential future loss is proposed as a replacement for PFE

Citizens: tearing up the rule book

Super-regional’s CRO streamlines RBS-era lending rules to speed up credit approvals