Europe

EU’s dividend ban overshadows reform effort

Banks may be reluctant to run down buffers even if regulators soften the MDA threshold for payouts

EU funds lack liquidity management tools – Esma

Most Ucits can only rely on temporary borrowing or gating to weather crises

November 9: the day the Brexodus started?

The UK Treasury’s equivalence verdict is a positive gesture, but could backfire if not reciprocated

Mixed response to Esma’s clearing carve-out for optimisation

Long-awaited proposal must be replicated by US and UK to be effective, participants say

How low can you go: falling cost of FX fix sparks concern

Algorithms reducing fixing fees, but some dealers willing to go even lower – perhaps dangerously so

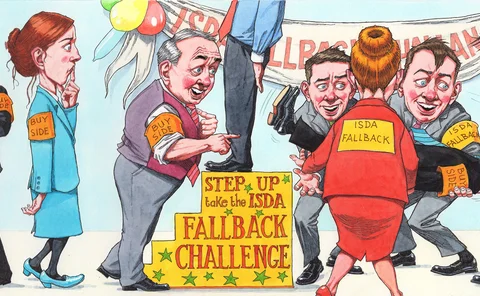

The buy side and Libor: it’s decision time

Investors weigh pros and cons of signing newly released Isda fallback protocol, as Libor demise looms

Loan-loss provisions take a smaller bite out of EU banks in Q3

Set-asides fell 57% quarter on quarter

SME risks take centre stage at European banks

Lenders could suffer if government support for small business starts to wane

EBA wants Basel to revisit prudential rules on software

Banking regulator set to soften capital impact of IT assets, but proposals are still out of line with US

French rivals BPCE, SocGen see market risks fall in Q3

Market RWAs drop 24% at SocGen quarter on quarter

At UniCredit, XVAs amped trading gains in Q3

Italian bank claimed a €110 million benefit to earnings from valuation adjustments

ING’s op risk charge jumped €228m in Q3

Op RWAs had been falling since Q3 2019

Funding pain prompts calls to rehome FVA

Dealers push to move derivatives funding costs out of P&L following March’s outsize losses

BNP Paribas’ RWAs shrank over €10bn in Q3

CET1 ratio climbed 20bp to 12.6%

One man’s trash is another man’s Treasury

With yields at record lows, investors are asking how much protection bonds will offer in a future crisis

Botched copy: Esma delivers cut and paste pastiche of Trace

Mifid transparency mishmash misses key aspects of US system it emulates, say dealers

Which EU banks hold the most SME exposures?

Danske Bank, Crédit Agricole, Group BPCE lead the field

Investors weigh merits of ESG hedging

Opinion divided over proposed tool for transferring risk of non-sustainable activities

Jerome Kemp on the skewed economics of clearing

Only Fed intervention prevented “a really big market disaster” during Covid, says derivatives veteran

Regulators should set ‘guidelines’ for CCP margins – Kemp

Citi’s former clearing head says CCPs are still competing on margin

Nordic noir: Swedish state pension fund’s outlook is austere

Sweden’s AP1 aims to ditch illiquid assets and target realistic returns with equities

One-third of EU banks used TLTROs to hit supervisory targets

Twenty-three per cent said future TLTROs would improve their ability to fulfil regulatory or supervisory requirements

Deutsche’s cash buffer ballooned in Q3

The bank had borrowed €34 billion through the ECB’s TLTRO III as of September

At Santander, Covid relief for €75bn of loans expired through Q3

Sixteen per cent of loans coming out of payment holidays have experienced a fall in creditworthiness