Europe

Trading VAR leapt higher across EU banks in Q2

Average VAR across seven systemic lenders increased 61% quarter-on-quarter

Axa’s solvency ratio continues fall in Q2

French insurer’s core ratio has dropped 18 percentage points year-to-date

Systemic eurozone bank provisions hit €11bn in Q2

ING sees loan-loss charge double in Q2

FX swaps platform aims to cut out the banks – but not entirely

Peer-to-peer newcomer FX HedgePool targets asset managers’ month-end hedging activity

CRR ‘quick fix’ pushes UniCredit’s RWAs lower

Italian bank nets €2.4 billion of RWA relief from regulatory changes

Shift out of models nets ING €8bn of sovereign RWA relief

Of standardised approach government debt exposures, 24% had a zero risk-weighting in Q2

People moves: Eurex picks Peters as CEO, Citi appoints Italy duo as MSS co-heads, ORX reshuffles board, and more

Latest job changes across the industry

Market risks push Allianz’s Solvency II ratio lower in Q2

Whipsawing markets help take three percentage points of the firm’s core solvency ratio

Commerzbank takes €111m of XVA losses in H1

Valuation adjustment benefits gained in Q2 did not offset huge Q1 losses

EU banks’ Q1 credit risk estimates show little Covid effect

Probability of defaults for retail exposures edged up only slightly quarter-on-quarter

SocGen mulls sale of structured product books after big losses

Rival Natixis also plans to place parts of its equity derivatives business in run-off mode

BPCE’s capital ratio falls as it waits on Covid loan relief

Delay to state guarantee benefits took 32bp off of CET1 ratio

Corporate, SME loans to take brunt of Covid shock, say EU banks

Though credit outlook has darkened, banks expect to increase lending overall

Eurex passes volatility test with flying colours

Eurex explores how Covid‑19 volatility across the industry has tested market participants’ resilience, and how the central counterparty itself has proved its credentials as a reliable and sustainable euro liquidity pool

IFRS 9 and the loan loss lottery

As reserves for bad loans balloon, banks grapple with measuring Covid-era credit risk

Natixis’s market RWAs grew 49% over Q2

Average VAR spiked to €18 million over Q2

SocGen’s VAR jumped 54% in Q2

Credit VAR more than doubled to €43 million

BNP tags €10bn of equity derivatives as hard-to-value

Over 12% of exposures classified as Level 3 at end-June

Cross-currency confusion stalks FCA announcements

Possibility of RFR fallbacks setting on different dates creating valuation issues, say banks

Covid hammered CEE banks’ capital ratios

One-quarter of EU banks have CET1 ratios below 13%

Slump in €STR swap volumes at LCH leaves market guessing

Market participants are counting on July 27 discounting switch to revive key euro benchmark

The evolution of pricing bonds and the data journey

Jason Waight, head of regulatory affairs, Europe at MarketAxess, considers why access to flexible data is key to using new trading protocols in fixed income

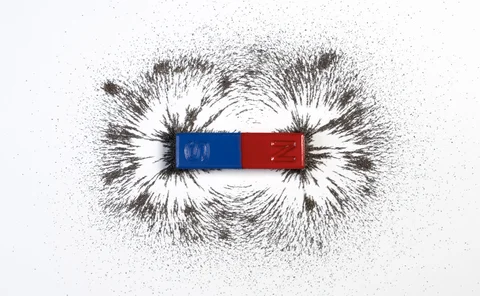

Why investors are stuck with flawed VAR models

Buy-side risk survey: VAR wasn’t much use in March, but it is ingrained in the industry

Coronavirus crisis sours €8bn of Santander’s loans

Loans moved into IFRS 9 stage two to reflect significant increase in credit risks