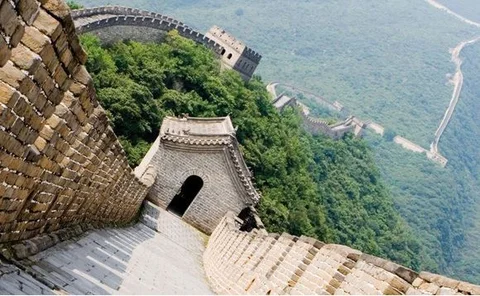

China

Investors look to profit from record low equity volatility

Hedge funds holding their nerve in game of volatility limbo

Lookback: UK pension funds slow the switch from equities

Pension fund equities pullout at slowest pace since financial crisis

Korea retail flows push China volatility to a record low

Volatility is trading at low levels on HSCEI despite China fears

Carbon bond launch a step forward for China market

Chinese firms move into the carbon market but obstacles remain

HK-Shanghai stock tie-up could hit currency volatility

Analysts say CNH volatility could rise under pilot stock scheme

Chinese exchange in freight derivatives first

Shanghai Shipping Freight Exchange planning to launch crude oil freight contact next

GF Futures set to expand beyond London by joining CME

First the LME, now the firm is looking at the US

RMB volatility slows corporate hedging activity

Demand for structured forwards down by 80% as corporates wait for currency to stabilise, dealers say

Lookback: FCA reviews RDR implementation

UK regulator checks 'independent' status of IFAs

FTSE to launch CPSS-Iosco compliant fixed-income China indexes

Regulatory and price considerations key for China indexes

China looks beyond commodity derivatives with equity options launch

New equity options on two exchanges

China still a 'dirty' netting jurisdiction for banks

Lack of certainty over close-out netting continues in China

Gold-plated

Sponsored statement: State Street Global Advisors

PetroChina recruits BAML natural gas trader

Former BAML natural gas trader Brad Banky joins PetroChina in Houston

PBoC behind RMB depreciation

China central bank acts to stimulate two-way trading

China RQFII ETF managers secure capital gains tax exemptions

China AMC and CSOP Asset Management no longer withholding 10% of fund appreciation for capital gains tax provisions

Emerging markets volatility lucrative for discerning investors

Lucrative volatility

ETFs based on China benchmarks take advantage of new liquidity rules

The launch of European and US ETFs based on offshore renminbi-denominated indexes signal a new development in investment in the currency

Westpac to tap into RMB product demand with new China drive

Bank receives approval to offer derivative products onshore

China rate liberalisation to spur onshore IRS market

Interested parties

Shareholder activism hedge funds stand out

Event driven and distressed were among the best performing hedge funds segments in 2013 with shareholder activism funds at the fore

India steers offshore investors away from P-notes towards direct market access

Sebi tries to exert greater control over foreign investment by tightening rules governing P-note issuance and streamlining foreign investor approval process

Aperios finds value in concentrated emerging market long/short strategy

Aperios Emerging Connectivity Master Fund: Aperios Partners Investment Management