People

Making an Asian footprint

asia: local coverage

A tale of two cultures… India or China?

china vs india

Taking the high road to absolute advocacy

While a lot of pension funds still dither over whether or not to invest in hedge funds, General Motors Asset Management's head of research, Edgar Sullivan, puts the case and reasons for GMAM's step into absolute return in 2001

De-leveraging credit risk

Leverage

A calculated gamble

After a promising start, Canadian carbon trading has slowed. The country has much work to do if it wants to get a domestic greenhouse-gas trading market running ahead of the 2008 Kyoto deadline. By Catherine Lacoursiere

The best of all worlds

Thanks to their varying scale, structure and diversity, European organisations often have very different solutions to risk management. But which system is the most effective? In an exclusive to Energy Risk, the European Energy Risk Forum offers a route…

Emissions education

As the European carbon market continues to grow, so too do some unique challenges: not least the gap between retail and wholesale players and the problem of counterparty credit risk. Oliver Holtaway reports

A good time to build

US utilities may need to spend more than $100 billion in the next 25 years on new power plants and transmission capacity. Richard McMahon looks at how utilities are assessing long-term risks and attracting potential investors

Declaration of Independence

credit research

Editor's letter

Comment

Battle lines drawn in ISS court case

ISS Global

Merrill swoops for JPM derivatives team

people news

Inflation-linked bonds Ready for take-off, or a load of hot air?

index-linked market

League table chicanery in Spain

Spain focus

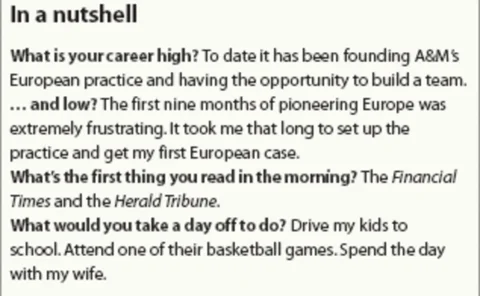

Antonio Alvarez III

Profile

Two new consultation papers from CEBS

REGULATORY UPDATE

Operational Risk 07/05

LOSSES & LAWSUITS

Changing hats

MEASUREMENT ADVANCES

Is Basel II a hurdle too far for US broker-dealers?

SEC CAPITAL REQUIREMENTS

Vorsprung durch AMA

GERMANY AMA