Opinion

Op risk data: 1MDB scandal still haunts Wall Street

Also: Woodford in hot water, Salesforce voice phishing hooks multiple firms. Data by ORX News

How much do investors really care about Fed independence?

The answer for some is more nuanced than you might think

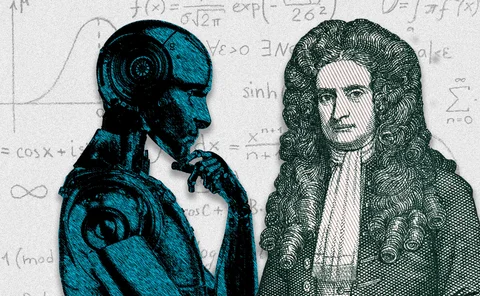

Why know-it-all LLMs make second-rate forecasters

A bevy of experiments suggests LLMs are ill-suited for time-series forecasting

Crypto’s predictable path from central books to OTC discretion

Demand for bilateral trading as seen in FX is fuelling crypto’s institutional take-up, finds BridgePort

Trump’s FX impact: a tale of two terms

Traders say Trump version 2.0 is already proving a much trickier task to manage than the original, and have had to adapt

Op risk data: Santander takes hefty historic hit over PPI mis-selling

Also: Brazil’s cyber screw-up, Barclays’ AML mishap, and MAS metes out more AML fines. Data by ORX News

The AI bot that left the garage

Senior operational risk exec explains how hidden third-party feature could lead to systemic risk

The Bank of England’s four pillars for a new CCP rule book

Executive director urges feedback on margin transparency, broader collateral and aiding innovation

Podcast: Muhle-Karbe on the maths behind broker selection

Imperial College’s mathematical finance head introduces new tool to measure slippage and trade quality

Turn of the skew: FX options dealers balance fragile market

Calls-versus-puts demand flips wildly in response to geopolitical events

Libor appeals leave future misconduct cases Hayes-y

UK authorities must develop a more effective framework for punishing bad bankers

Was a big US bank close to collapse in 2023?

PNC’s Bill Demchak says it was. And the data suggests he was talking about BofA

Op risk data: GVA and Nobitex in geopolitical risk strikes

Also: UBS chief a target of third-party data hack, internal bank frauds in Asia. Data by ORX News

From fringe to forecast: why bitcoin now moves like a currency

LMAX data finds crypto prices react to macro market events as quickly as EUR/USD

Lessons from chaos theory on Trump tariff bottlenecks

Forecasting the ripple effects of trade policies presents a special challenge

Sebi unravels Jane Street’s ‘sinister’ trades

US trading firm barred from Indian securities market after “disregarding” February warnings

US banks’ VAR shortfalls are wrapped in a black box

Public disclosures only allow crude approximations of loss size and timing

Podcast: Villani and Musaelian on a quantum boost for machine learning

Classical methods struggle with highly dimensional problems. Quantum cognition takes a different approach, as hedge fund duo explain

The VAR-centric models that never were

Often spotlighted, rarely dominant – VAR plays a surprisingly small role in most IMA stacks

Why AI-enhanced risk management is vital for open finance

In bank-fintech partnerships, AI can be both a source of operational risk and a solution to it

Op risk data: Rates bait and switch incurs Capital One punishment

Also: Crypto firms suffer cyber setbacks, Umpqua in Ponzi play, and QSuper premium palaver. Data by ORX News

A mix of Gaussian distributions can beat GenAI at its own game

Synthetic data is seen as the preserve of AI models. A new paper shows old methods still have legs

Bunds’ hedging role for euro swaps still in question

Dealers seek ultimate hedge for euro swaps amid EGB rush following Trump tariffs

Podcast: Fabrizio Anfuso on computing for Archegos-like event exposures

BoE quant discusses top-down counterparty risk framework using Gaussian distributions and copulae