News

UBS: QIS3 results in increased capital, is not "fair"

UBS, the Switzerland-based financial institution, says its overall capital will increase under the Basel Accord revisions, as currently outlined in the third quantitative impact study (QIS3). In addition, other institutions have had the same results, the…

New FSA chairman appointed

A new chairman of the UK's Financial Services Authority was announced yesterday by Chancellor Gordon Brown.

Hong Kong retail credit-linked bond is latest victim of 'atypical pneumonia'

SHK Fund Management, a unit of Hong Kong conglomerate Sun Hung Kai, has postponed the sale of a retail minibond linked to the credits in the Standard & Poor’s 100 Index, due to the deteriorating social and economic environment in Hong Kong caused by the…

ABN Amro creates new global head of rates research role

ABN Amro has appointed Graham McDevitt to the new role of global head of rates research in the bank’s financial markets business. McDevitt was previously head of credit strategy.

Canada eyes shift to mark-to-market accounting

The Canadian Accounting Standards Board has entered into a consultation period to assess proposed new accounting rules aimed at improving how financial instruments are reported in financial statements.

Thomson Financial releases new 'Vestek' risk model

Canadian information and technology provider Thomson Financial has released its 'Vestek Fundamental Risk Model', which is designed to identify the sources and size of portfolio risks.

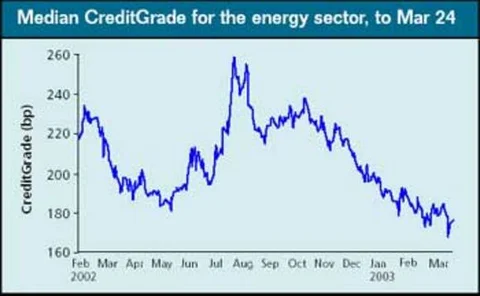

Credit watch

In this month’s analysis of energy firms’ credit quality via Riskmetrics’ CreditGrades tool, Williams and El Paso are among those with tighter spreads

BIS report highlights asset managers' role in inefficient markets

The structure of incentive schemes may limit the ability or willingness of institutional asset managers to act as a natural counterbalance to mispricing, according to the Committee on the Global Financial System (CGFS) – a G-10 central bank forum that…

IMF study shows Basel weaknesses in offshore centres

Many offshore centres have weaknesses in the on- and off-site supervision of their banking systems, as well as "less material weaknesses" in their credit supervision and market risk, according to a study by the International Monetary Fund (IMF).

Sector roundup

Sectors

Schering chooses Trema’s 'Finance Kit'

German pharmaceutical, Schering, has chosen Stockholm-based financial services vendor Trema’s flagship product Finance Kit for its treasury and asset management operations.

RiskMetrics acquires on-line technology from JP Morgan Chase Private Banking

New York-based risk technology vendor RiskMetrics has acquired Arrakis, the technology platform developed by JP Morgan’s Private Banking Group in 1999 to support the bank’s online site for clients, Morgan OnLine.

UBS Warburg hires structured products director in Hong Kong

UBS Warburg has hired Sheree Ma as a director in its structured products distribution group in Hong Kong. Ma was formerly a vice-president in JP Morgan Chase’s structuring and solutions group for Asia ex-Japan.

Eurex achieves another record-breaking month

Eurex, the international derivatives exchange, has reported record-breaking volumes for March 2003. More than 106 million contracts were traded last month, an increase of almost 20 million over the previous monthly high, set in October 2002. Year-on-year…

Korea opens retail market

New angles

Taiwan ABS market off to a quick start

New angles