News

Hong Kong banks ready SARS contingency plans

Banks are readying contingency plans for FX trading in Hong Kong, as a potentially fatal pneumonia virus grips the trading centre.

NumeriX enhanced to support more complex credit products

US analytics company NumeriX has enhanced its core analytics toolkit and engine to meet demand from a rapidly evolving credit derivatives market. The modifications will allow users to model, price and manage the risk of a broad range of sophisticated…

Japanese banks get a breather but airlines continue to dip

The cost of credit protection on Japanese banks were off their lows, as the regulator eased earlier concerns that it may nationalise ailing banks. Meanwhile, the cost of protection on airlines continued to skyrocket as the war in Iraq and the spreading…

Boberski to head rates strategy at Bear Stearns

US investment bank Bear Stearns has hired David Boberski as managing director and head of interest rate strategy, in a bid to consolidate research across interest rate product lines.

JP Morgan Chase launches Janice to track Japanese credit derivatives

JP Morgan Chase has launched a new index that will track Japanese credit default swaps. Called JPMorgan All Nippon Index of Credit, or Janice, the index is the average of the spreads on the 45 most liquid credit default swaps of Japanese companies and…

HSBC appoints new global markets heads in Hong Kong

Paul Hand and Anita Fung, HSBC’s head of sales and head of trading respectively in the bank’s treasury and capital markets team in Hong Kong, have been appointed co-heads of global markets, Asia-Pacific.

JP Morgan Chase and Morgan Stanley team to launch new credit indexes

JP Morgan Chase and Morgan Stanley plan to issue a raft of new 'Tracx' credit default swap indexes over the coming 12 months. The two have already launched their own versions of such products under the names Hydi and Jeci for JP Morgan Chase, and Tracers…

Reuters and IBM team up in Asia-Pacific

Reuters has teamed up with IBM Financial Services to offer risk management systems and consulting services to small and medium sized financial institutions in Asia-Pacific.

UBS: QIS3 results in increased capital, is not "fair"

UBS, the Switzerland-based financial institution, says its overall capital will increase under the Basel Accord revisions, as currently outlined in the third quantitative impact study (QIS3). In addition, other institutions have had the same results, the…

New FSA chairman appointed

A new chairman of the UK's Financial Services Authority was announced yesterday by Chancellor Gordon Brown.

Hong Kong retail credit-linked bond is latest victim of 'atypical pneumonia'

SHK Fund Management, a unit of Hong Kong conglomerate Sun Hung Kai, has postponed the sale of a retail minibond linked to the credits in the Standard & Poor’s 100 Index, due to the deteriorating social and economic environment in Hong Kong caused by the…

ABN Amro creates new global head of rates research role

ABN Amro has appointed Graham McDevitt to the new role of global head of rates research in the bank’s financial markets business. McDevitt was previously head of credit strategy.

Canada eyes shift to mark-to-market accounting

The Canadian Accounting Standards Board has entered into a consultation period to assess proposed new accounting rules aimed at improving how financial instruments are reported in financial statements.

Thomson Financial releases new 'Vestek' risk model

Canadian information and technology provider Thomson Financial has released its 'Vestek Fundamental Risk Model', which is designed to identify the sources and size of portfolio risks.

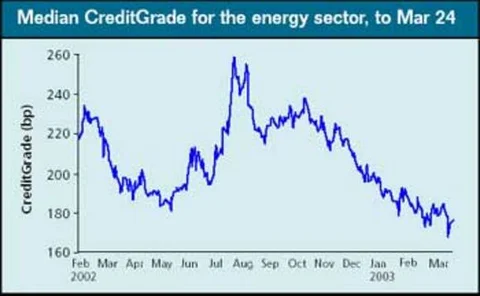

Credit watch

In this month’s analysis of energy firms’ credit quality via Riskmetrics’ CreditGrades tool, Williams and El Paso are among those with tighter spreads

BIS report highlights asset managers' role in inefficient markets

The structure of incentive schemes may limit the ability or willingness of institutional asset managers to act as a natural counterbalance to mispricing, according to the Committee on the Global Financial System (CGFS) – a G-10 central bank forum that…