Credit data: worrying trends in sovereign risk

All signs point to a more volatile environment for sovereign credit risk

Sovereign credit risk is a complex beast. It is often country-specific, but can also be driven by regional and global themes.

Currently, all three factors are in play.

Venezuela is in a state of near-total economic collapse. Argentina, which sold a 100-year bond in 2017 after emerging from default the previous year, is gearing up for a critical election in October. A split decision in Turkey’s recent local elections offered little reprieve for the country’s already fragile economy.

At a regional level, oil producers in the Middle East face a common problem. The conflict in Libya and tougher sanctions on Iran have pushed up oil prices, with Brent crude trading at $74 a barrel on April 25, up from around $50 at the start of the year, but the US shale boom is flooding the market with a glut of oil supply, and Saudi Arabia needs oil prices above $80 a barrel to balance its budget. The credit risk of the Organization of the Petroleum Exporting Countries sovereigns has risen 30% since December 2016 and will remain elevated unless oil prices can sustain higher levels.

Meanwhile, Chinese sovereign risk deteriorated 15% last year after the US slapped tariffs on imports.

The problems are not confined to emerging markets. Sovereign credit risk in developed countries improved steadily from early 2017 but has deteriorated over the past six months. Monetary tightening and slowing economic growth are having a negative effect, at least in the short term.

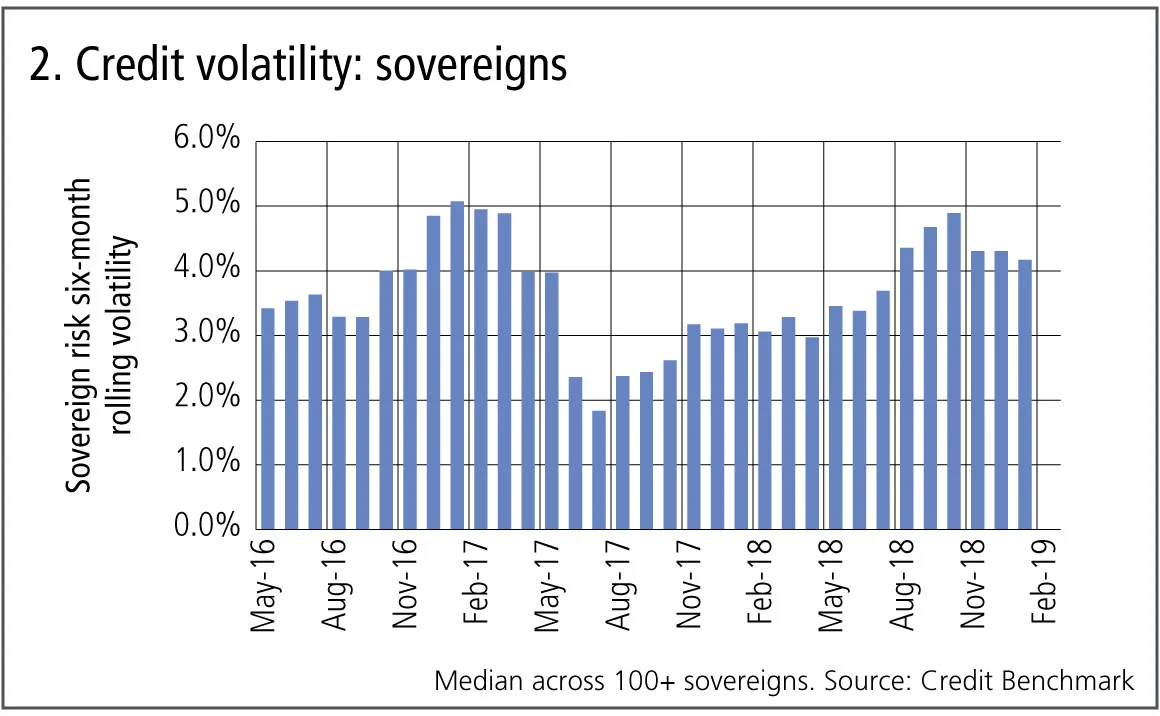

Looking ahead, changing geopolitical alliances, trade flows and supply chains will have a more profound and far-reaching effect. It all adds up to a more volatile environment for sovereign credit risk. From mid-2017 to late 2018, sovereign credit volatility more than doubled. And while it has come down recently, sovereign credit volatility remains worryingly high, at just above 4%.

Global credit industry trends

The latest bank-sourced credit data, based on 30+ financial institutions, shows upgrade and downgrade activity has decreased, with 39 companies moving more than one notch, compared with 62 companies the previous month. Figure 1 shows detailed industry migration trends for the most recent published data, based on data adjusted for changes in contributor mix.

Figure 1 shows:

- Globally, the number of corporate upgrades outweighs the number of downgrades.

- Upgrades outnumber downgrades in seven of the nine industries and there are no industries where downgrades dominate.

- Basic materials, oil and gas and utilities continue their multiple month trend of upgrades dominating.

- After three months of balance, consumer goods upgrades outnumber downgrades in a ratio of 7:2.

- Technology and health care return to upgrades outweighing downgrades after a month of balance.

- Consumer services are in balance after three months of downgrades outweighing upgrades.

- Telecommunications are in balance after four months of downgrades dominating.

- Industrials continue to be in balance for the second month.

Sovereign credit risk

Sovereign credit risk is a high-profile and sensitive topic. Changes in government funding rates affect the lives of millions of citizens and controversial rating decisions can damage investment portfolios. Recent economic developments have pushed sovereign risk back into the spotlight due to a combination of global, regional and country-specific factors.

Figure 2 shows the median rolling six-month volatility for 100+ sovereigns.

Figure 2 shows:

- Sovereign credit risk volatility peaked at the end of 2016.

- Volatility declined throughout the first six months of 2017.

- From mid-2017 to late 2018, sovereign credit volatility rose steadily and substantially.

- Credit volatility has been dropping in recent months but remains high.

Airlines

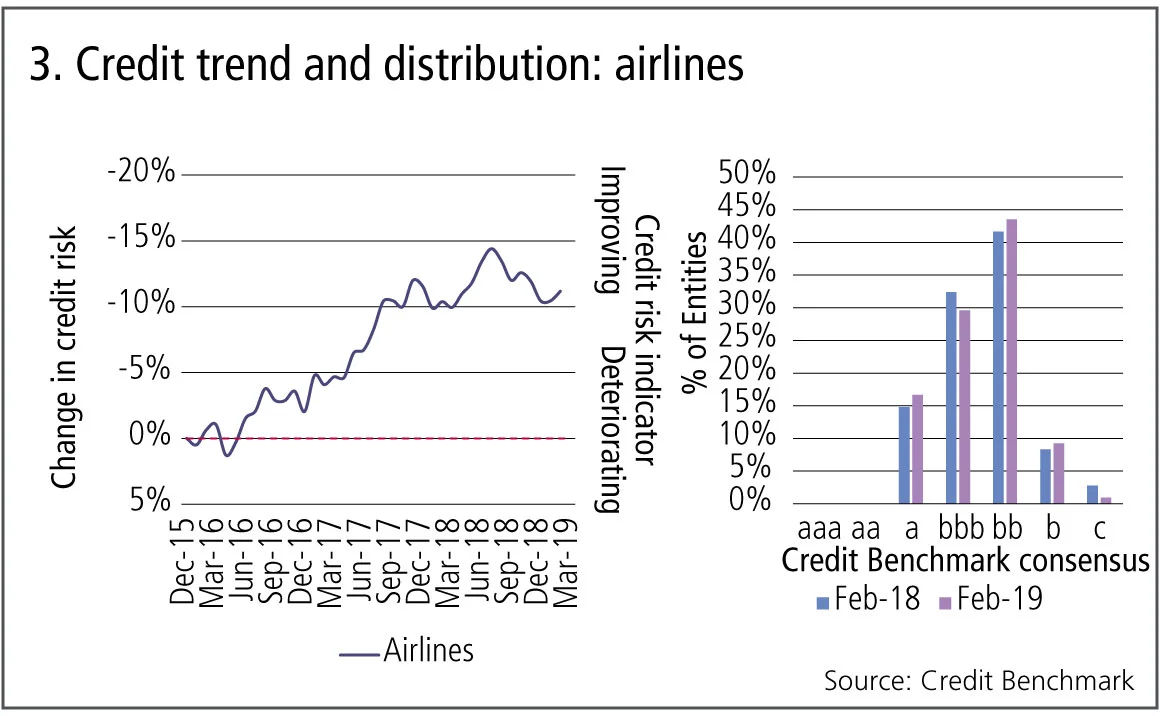

The airline industry has had some major setbacks in recent months, particularly with the unresolved problems of the Boeing 737 Max 8. Dozens of nations have grounded the plane, with immediate financial impacts for airlines and travel operators, as well as their supply chains.

Broader economic factors have hit airlines around the globe. In the UK, EasyJet warned of damage caused by Brexit uncertainty and falling consumer confidence; while the major Chinese airlines saw profits cut due to rising fuel prices and currency losses.

Figure 3 shows the credit trend and distribution of 104 airline companies around the world.

Figure 3 shows:

- Credit risk improved steadily by 15% from the beginning of 2016 to mid-2018.

- Credit quality dropped in the last quarter of 2018 by 5%.

- The majority of airlines have a Credit Benchmark consensus of bb.

- Over the past year, there has been a slight shift in distribution from bbb to a and bb categories.

Opec sovereigns

Opec has had a difficult few years. Fracking has made the US self-sufficient in oil, making it the world’s biggest oil producer. It could overtake Saudi Arabia to become the top oil exporter within five years.

Oil faces a two-way pull. The Libyan conflict has pushed prices up, but fracking has capped the long-term sustainable price. It has been difficult for Opec to maintain production cuts, with Qatar recently leaving the group. Venezuela – despite huge reserves – is in a state of near-total economic collapse. Saudi Arabia has shelved plans to float Saudi Aramco, but there was strong demand for its recent $10 billion bond.

Figure 4 shows the credit trend of 353 US large oil and gas companies and 12 Opec sovereigns.

Figure 4 shows:

- US large oil and gas credit risk saw a 25% increase throughout 2016 and early 2017.

- Since then, it has been on an improving trend, dropping by nearly 30%.

- US oil and gas credit risk surpassed its December 2015 credit level in September 2018.

- Opec sovereigns’ credit risk has steadily increased from December 2016 onwards, rising by nearly 30%.

Basic materials v utilities

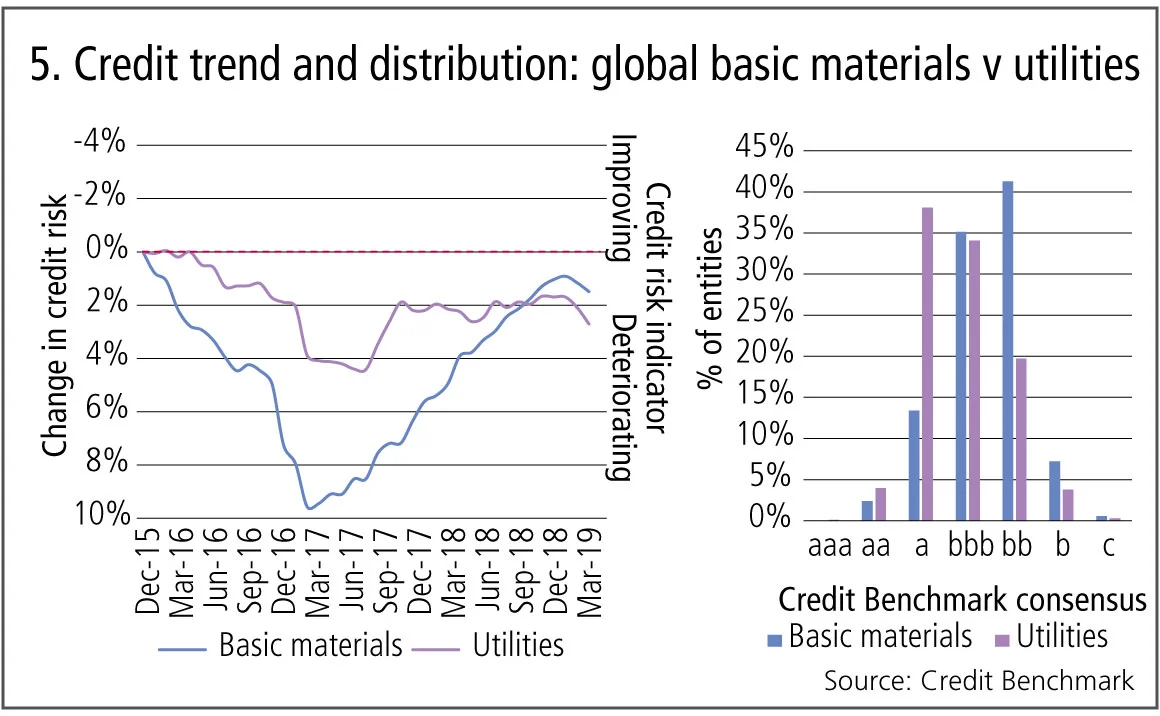

Basic materials and utilities have very different credit dynamics, with basic materials driven by global commodity prices while utilities are largely domestic and subject to local regulations. For this reason, the credit trends for these two industries would normally be expected to show independent or even divergent paths. Over the past few years, credit risk for utilities has indeed been less volatile; but the industries show similar turning points. The reason for this is unclear, but may reflect the impact of global infrastructure spending on the demand for basic materials. Figure 5 compares the credit trend and distribution for 1,580 basic materials and 850 utilities companies.

Figure 5 shows:

- Both basic materials and utilities saw an increase in credit risk until the first quarter of 2017. The decline of basic materials credit risk was much sharper with an increase of 10%, compared with 4% for utilities.

- Basic materials then saw an improvement in credit risk from March 17, followed by utilities a few months later.

- Utilities stabilised in 2018, while basic materials continued to improve.

- Recent trends show a decline in credit risk for both industries.

- Utilities are concentrated in the a/bbb categories, with more than three-quarters of entities classed as investment grade. Basic materials are evenly split between investment grade and high yield, with more than 40% having a Credit Benchmark consensus of bb.

About this data

Credit Benchmark provides the world’s most comprehensive market view of credit risk. By bringing together monthly credit risk inputs from 40-plus of the world’s leading financial institutions, Credit Benchmark provides credit trends across geographies and industries as well as a unique view of credit risk with consensus ratings on about 50,000 rated and unrated entities globally.

David Carruthers is head of research at Credit Benchmark.

コンテンツを印刷またはコピーできるのは、有料の購読契約を結んでいるユーザー、または法人購読契約の一員であるユーザーのみです。

これらのオプションやその他の購読特典を利用するには、info@risk.net にお問い合わせいただくか、こちらの購読オプションをご覧ください: http://subscriptions.risk.net/subscribe

現在、このコンテンツを印刷することはできません。詳しくはinfo@risk.netまでお問い合わせください。

現在、このコンテンツをコピーすることはできません。詳しくはinfo@risk.netまでお問い合わせください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(ポイント2.4)に記載されているように、印刷は1部のみです。

追加の権利を購入したい場合は、info@risk.netまで電子メールでご連絡ください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

このコンテンツは、当社の記事ツールを使用して共有することができます。当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(第2.4項)に概説されているように、認定ユーザーは、個人的な使用のために資料のコピーを1部のみ作成することができます。また、2.5項の制限にも従わなければなりません。

追加権利の購入をご希望の場合は、info@risk.netまで電子メールでご連絡ください。

詳細はこちら コメント

大げさな宣伝を超えて、トークン化は基盤構造を改善することができる

デジタル専門家によれば、ブロックチェーン技術は流動性の低い資産に対して、より効率的で低コストな運用手段を提供します。

GenAIガバナンスにおけるモデル検証の再考

米国のモデルリスク責任者が、銀行が既存の監督基準を再調整する方法について概説します。

マルキールのサル:運用者の能力を測る、より優れたベンチマーク

iM Global Partnersのリュック・デュモンティエ氏とジョアン・セルファティ氏は、ある有名な実験が、株式選定者のパフォーマンスを評価する別の方法を示唆していると述べています。

IMAの現状:大きな期待と現実の対峙

最新のトレーディングブック規制は内部モデル手法を改定しましたが、大半の銀行は適用除外を選択しています。二人のリスク専門家がその理由を探ります。

地政学的リスクがどのようにシステム的なストレステストへと変化したのか

資源をめぐる争いは、時折発生するリスクプレミアムを超えた形で市場を再構築しています。

オペリスクデータ:FIS、ワールドペイとのシナジー効果の失敗の代償を支払うことに

また:ORXニュースによるデータで、リバティ・ミューチュアル、年齢差別訴訟で過去最高額を支払う;ネイションワイド、不正防止対策の不備。

東京の豊富なデータが市場への影響について明らかにすること

新たな研究により、定量金融において最も直感に反する概念の一つが普遍的であることが確認されました。

資金調達コストの配分:集中型 vs 分散型

サチン・ラナデ氏は、特に担保付融資において、集中化は資本効率と自己資本利益率(ROE)の向上に寄与し得ると述べています。