Europe struggles to get a grip on derivatives transparency

Mifid reporting has fallen short of US swaps data, but national regulators are partly to blame

When Europe mandated full transparency for derivatives trades from the start of 2018, it was hardly an unprecedented move. The Dodd-Frank Act ushered in similar rules in the US as far back as 2012.

So how’s Europe doing by comparison?

The second Markets in Financial Instruments Directive (Mifid II) requires investment firms to report the price and quantity of some trades – known as post-trade transparency – to Approved Publication Arrangements (APAs). APAs are then supposed to publish those details for free to the public 15 minutes after they publish the data in real time for paying customers.

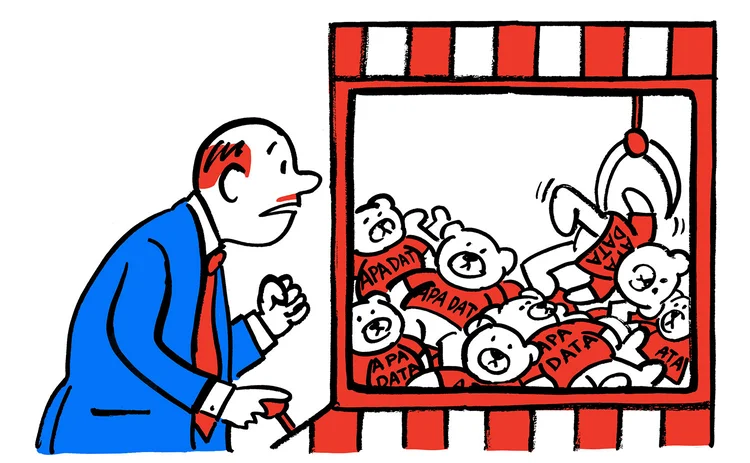

But controversy now surrounds whether APAs are fulfilling their end of the bargain. Market participants complain the APA data – which firms have paid to report, and have contributed to themselves – is not particularly accessible, and even less usable.

Meanwhile, the US process has generally met with approval. Under Dodd-Frank, swap dealers have to report over-the-counter derivatives to so-called swap data repositories (SDRs), which then disseminate the data to the public.

Data from SDRs contrasts starkly with that being reported through APAs. Not only is it all easily accessible for everyone to view for free, but users can tell what instruments they are actually looking at and search historic records, unlike with APAs.

The UK’s Financial Conduct Authority has even pointed to the way SDRs publish data as desirable for post-trade transparency requirements in Mifid II.

But the comparison might be unfair. Three firms operating APAs tell Risk.net they are finding it hard to make money out of the reporting business, which would explain shortcuts in how some are delivering the data.

There are a larger number of APAs in Europe than there are SDRs in the US. Four firms currently run SDRs in the US: Bloomberg, Chicago Mercantile Exchange, the Depository Trust & Clearing Corporation and Ice. According to the European Securities and Markets Authority, there are 14 registered APAs in Europe, and some sources suggest Esma may even have missed a few off its public list.

The minimum deferral allows APAs and trading venues to delay publishing any details of a trade for two working days after execution. The maximum deferral requires no details of trades to be published until the Tuesday of the week after execution

More APAs ultimately means more competition for clients and a smaller slice of business for each one. Consolidation could be on the horizon. Three sources say they have heard one APA operator is considering whether to exit the business by selling to a competitor.

That should allow the remaining APAs to increase their market share and revenues. However, there are still the various operating costs APAs must contend with that do not have an equivalent in the US, including the complex deferral regimes adopted by each member state in the European Union.

The publication of information on trades can be deferred if the trade is classed as illiquid by Esma or if it is larger than regulator-set size thresholds for that instrument.

The minimum deferral allows APAs and trading venues to delay publishing any details of a trade for two working days after execution. The maximum deferral requires no details of trades to be published until the Tuesday of the week after execution.

In that initial disclosure, the price and volume of a trade in an instrument – the quantity for bonds and the notional amount for derivatives – is aggregated with several other trades in the same instrument deferred from the same week. Local regulators can also allow APAs and trading venues not to disclose the aggregated volume of the trades. Then, four weeks after the aggregated exposure, each individual trade is fully disclosed to the public.

This is an approach the UK and France have taken for all non-equity instruments.

If that doesn’t sound confusing enough, other member states have put their own spin on it, which APAs are saying is a nightmare to process.

For example, Denmark does not allow any deferral at all for bonds that are not issued by the sovereign, which means the price and volume of individual trades has to be published in real time.

Portugal, on the other hand, uses the maximum deferral for all instruments – like the UK and France – but requires APAs and trading venues to disclose the aggregate price of at least five deferred trades in the same instrument the day after they were executed.

Sources at APAs say building the systems to try to recognise and apply each of these deferrals has been difficult and added to the costs. And applying them wrongly is also costly: a product manager at a firm that runs an APA says one of their competitors has lost clients following the start of Mifid II because it did not apply the deferrals that market participants were expecting.

With all these costs, it should not come as a surprise that APAs are placing barriers in the path of market participants who seek to use free data, in a bid to drive more business onto their paid-for real-time services. If regulators want APAs to behave more like SDRs, ironing out the inconsistencies in Europe’s reporting regime would be a good way to start.

Editing by Philip Alexander

コンテンツを印刷またはコピーできるのは、有料の購読契約を結んでいるユーザー、または法人購読契約の一員であるユーザーのみです。

これらのオプションやその他の購読特典を利用するには、info@risk.net にお問い合わせいただくか、こちらの購読オプションをご覧ください: http://subscriptions.risk.net/subscribe

現在、このコンテンツを印刷することはできません。詳しくはinfo@risk.netまでお問い合わせください。

現在、このコンテンツをコピーすることはできません。詳しくはinfo@risk.netまでお問い合わせください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(ポイント2.4)に記載されているように、印刷は1部のみです。

追加の権利を購入したい場合は、info@risk.netまで電子メールでご連絡ください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

このコンテンツは、当社の記事ツールを使用して共有することができます。当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(第2.4項)に概説されているように、認定ユーザーは、個人的な使用のために資料のコピーを1部のみ作成することができます。また、2.5項の制限にも従わなければなりません。

追加権利の購入をご希望の場合は、info@risk.netまで電子メールでご連絡ください。

詳細はこちら 我々の見解

ファニーメイとフレディマックによる住宅ローン買い入れが金利上昇を招く可能性は低い

9兆ドル規模の市場において2,000億ドルのMBSを追加しても、従来のヘッジ戦略を復活させることはできません。

2025年の影響度合い:デリバティブ価格設定が主導的役割を担い、クオンツはAIの群れに追随しない

金利とボラティリティのモデリング、ならびに取引執行は、クオンツの優先事項の最上位に位置しております。

株式には、投資家が見落としている可能性のある「賭け要素」が存在する

投機的取引は、対象となる株式によって異なる形で、暗号資産と株式市場との間に連動関係を生み出します。

パッシブ投資とビッグテック:相性の悪い組み合わせ

トラッカーファンドがアクティブ運用会社を締め出し、ごく少数の株式に対して過熱した評価をもたらしています。

粘着性のあるインフレに対する懸念がくすぶり続けている

Risk.netの調査によると、投資家たちはインフレの終息を宣言する準備がまだ整っていないことが判明しましたが、それには十分な理由があります。

トランプ流の世界がトレンドにとって良い理由

トランプ氏の政策転換はリターンに打撃を与えました。しかし、彼を大統領の座に押し上げた勢力が、この投資戦略を再び活性化させる可能性があります。

Roll over, SRTs: Regulators fret over capital relief trades

Banks will have to balance the appeal of capital relief against the risk of a market shutdown

オムニバス(法案)の下に投げる:GARはEUの環境規制後退を乗り切れるのか?

停止措置でEU主要銀行の90%が報告を放棄で、グリーンファイナンス指標が宙ぶらりんな状態に