Swaps data: breaking down CCPs’ $750 billion funding bill

Amir Khwaja of Clarus FT considers how initial margin, variation margin and default fund contributions can quickly add up

Initial margin, variation margin and default resources are three key weapons used by central counterparties (CCPs) to protect against risk. Under the voluntary Committee on Payments and Market Infrastructures and the International Organization of Securities Commissions public quantitative disclosures, over 200 quantitative data fields covering margin, default resources, credit risk, collateral, liquidity risk and more are published each quarter.

The most recent available data is for the quarter ending September 30, 2017, and shows some interesting insights. For instance, across the three metrics, the total funding requirement for all CCPs could be as high as $750 billion. Variation margin calls could be as much as 2.5 times the average, while over half of initial margin is posted as government bonds.

Initial margin required

Initial margin required from participant members is a good measure of the size of risk managed by a CCP and, aggregating this information for a wide selection of major clearing houses, we get a grand total of $500 billion.

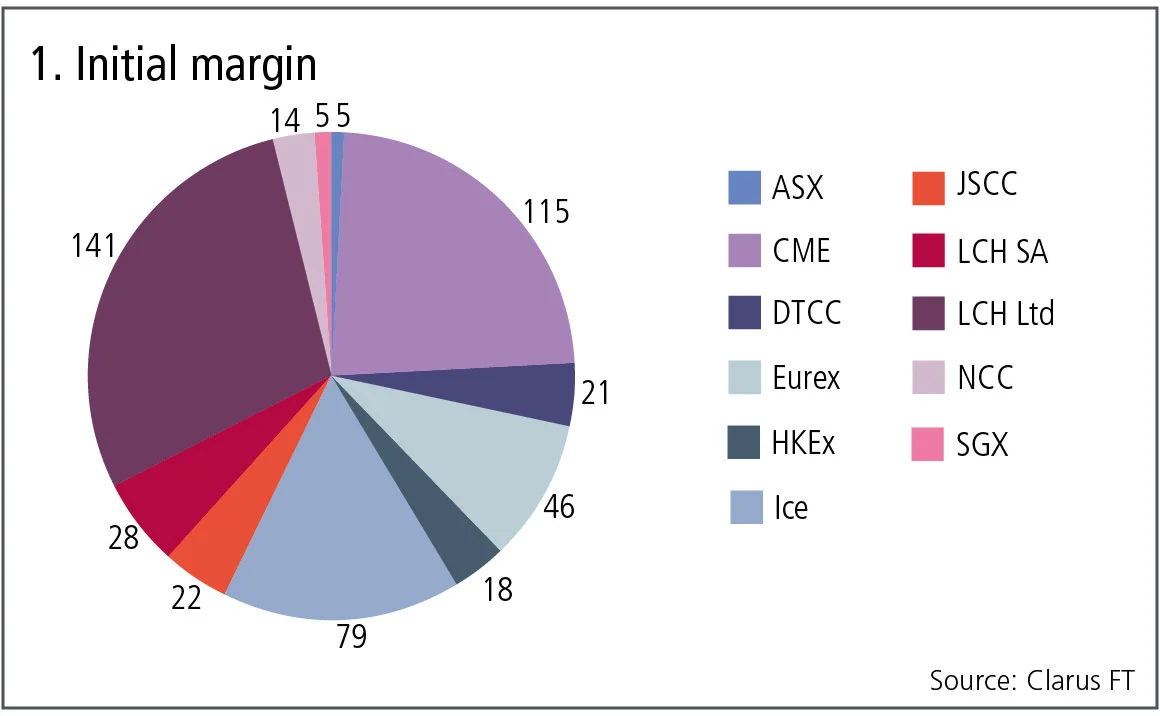

Figure 1 is the breakdown for a clearing house, with the constituent CCPs aggregated in billions of dollars.

Figure 1 shows:

- LCH Ltd with $141 billion of initial margin is the largest, of which SwapClear contributes $121 billion.

- CME is next with $115 billion.

- Ice has $79 billion, aggregating Ice Clear Credit, US futures and options, Ice Clear Europe Credit and its futures and options – no data is available for other Ice-owned CCPs.

- Eurex with $46 billion.

- LCH SA with $28 billion and the Japan Securities Clearing Corporation with $22 billion.

- The Depository Trust & Clearing Corporation with $21 billion, of which the government securities division contributes $11.7 billion.

Initial margin type

A grand total of $500 billion of initial margin is required, which is a large sum indeed. Remember, this is the amount that members are required to post at the CCP, so it is real money and not a notional number.

Let’s look at data on how these clearing houses hold initial margin funds.

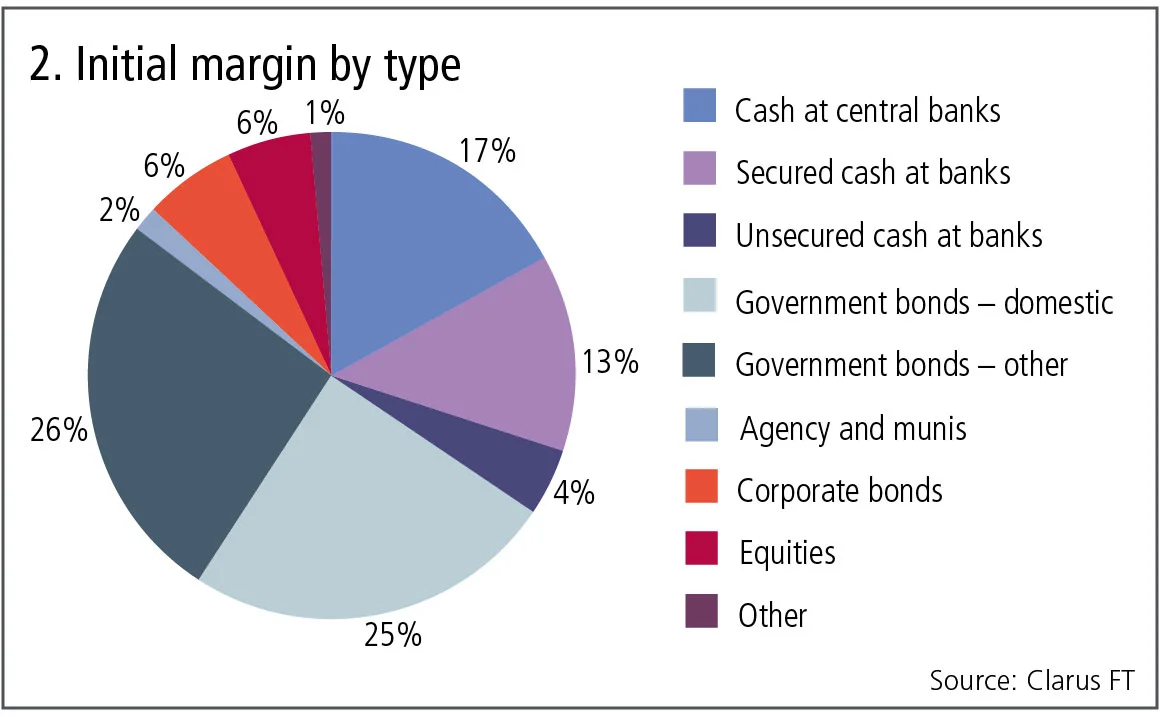

Figure 2 shows:

Government bonds are by far the largest at 51%, made up of almost equal amounts of domestic – meaning the sovereign of the CCP’s location – and other, meaning foreign country sovereigns.

- Cash at central banks is the next largest at 17%.

- Secured cash at commercial banks is 13% and includes reverse repo transactions.

- Corporate bonds and equities are 6% each.

- Unsecured cash at commercial banks is 4%.

Clearing houses will impose larger haircuts on riskier securities, and these figures use pre-haircut amounts, there is additional data on the post-haircut amounts of these types, but this does not materially alter the above percentages.

Total variation margin

CCPs also collect and post daily variation margin to participant members to reflect the daily profit and loss of their positions. Let’s look at the size of these flows.

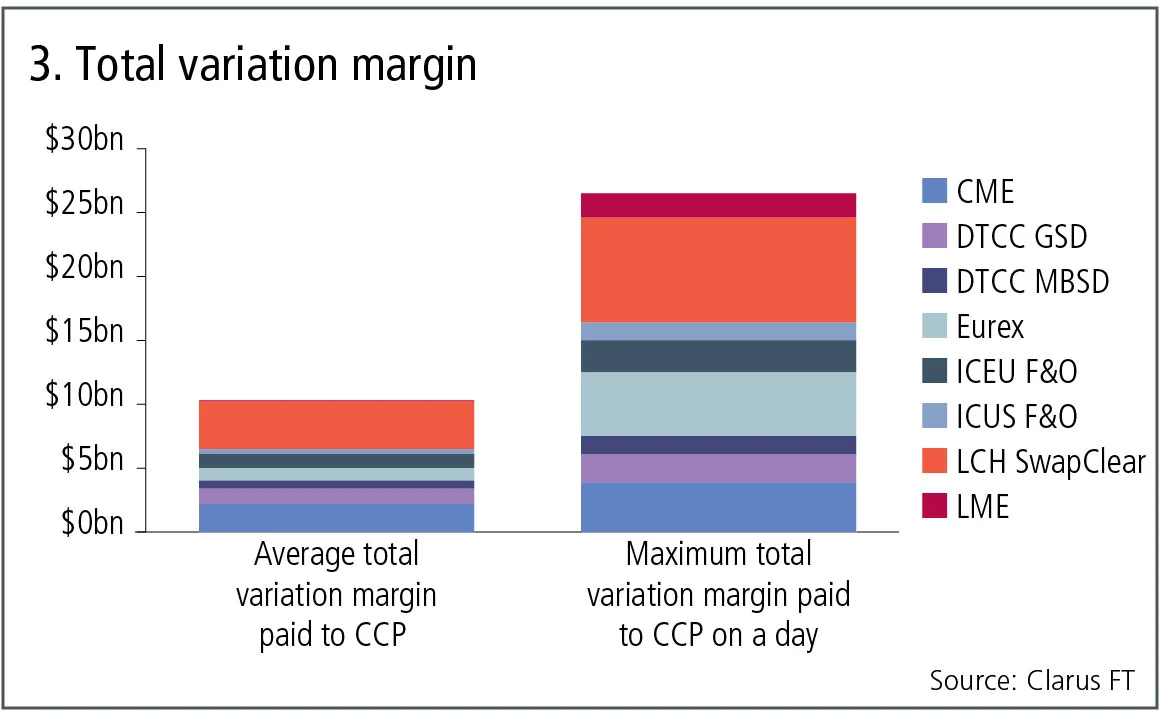

Figure 3 shows:

- Average total variation margin paid to a CCP and the maximum total variation margin paid to a CCP on a day in the quarter ending September 30, 2017, for selected CCPs with large variation flows.

- The grand total for these eight CCPs is $10 billion, meaning on average this amount is being collected by CCPs from members and the same amount posted to other members.

- LCH SwapClear at $3.7 billion and CME at $2.2 billion are the largest two contributors.

- The total of maximum total variation in a day in the quarter is $26 billion, so two and a half times as large as the average.

- LCH SwapClear at $8.2 billion and Eurex at $5 billion are the largest two contributors.

Default resources

Besides initial margin and variation margin, the other important measure of a CCP’s significance is the default fund or guarantee fund. These are the resources that will be called into action should a defaulting member’s variation margin, initial margin and pre-funded default fund contribution not be sufficient to close out their positions. As such it provides the backstop that gives a high level of confidence to the safety and risk management provided by a CCP.

Let’s look at these default resources for the same clearing houses that we aggregated initial margin by their constituent CCPs.

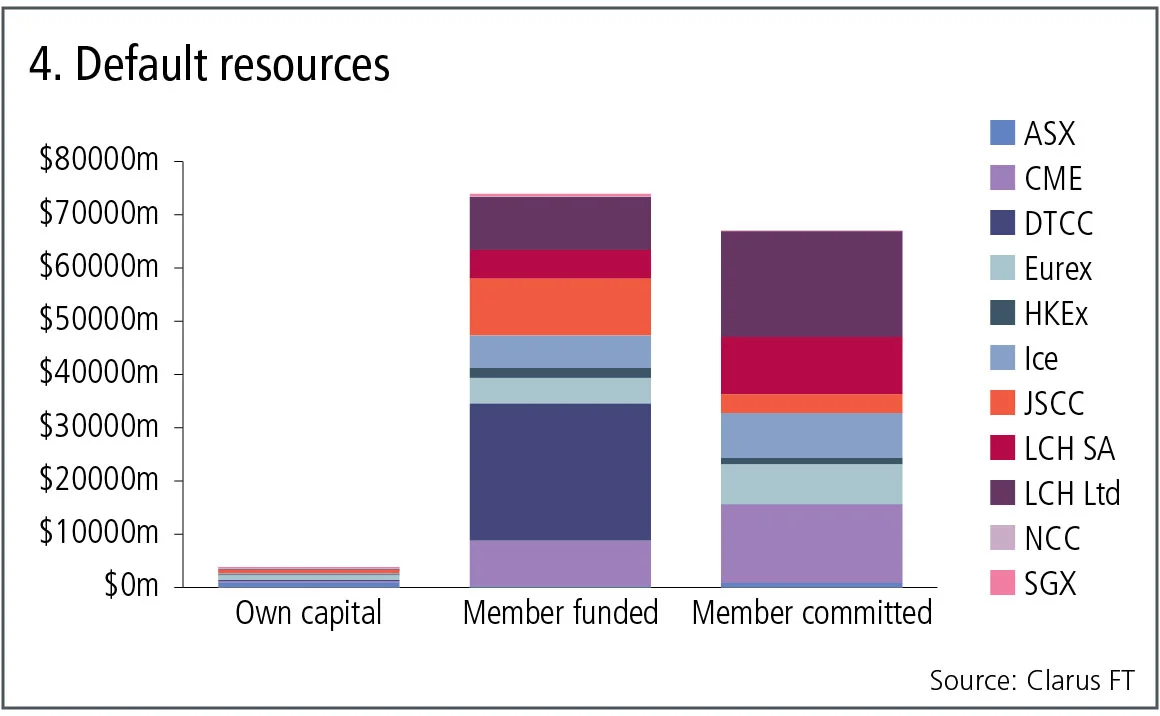

Figure 4 shows:

- Three columns: the clearing houses’ own capital; member-funded contributions, so already held by the CCP; and member-committed contributions that would be available in the event of a default, should they be needed.

- Clearing houses’ own capital of $3.8 billion is the smallest of these figures and there has been much comment over recent years on “skin in the game” and whether CCPs should be required to have more of their own capital. However, there has been no movement by the regulators who authorise, monitor and stress test CCP models and resources, which by implication means they are satisfied by the amount of this capital.

- Member-funded contributions are very significant at $74 billion – this is cash or securities provided by members to CCPs.

- DTCC has the largest amount of member-funded contributions at $26 billion, followed by LCH Ltd at $10 billion.

- Member-committed contributions are next at $67 billion.

- LCH Ltd has the largest share at $20 billion, followed by CME at $15 billion.

Initial margin, variation margin, default resources

In the preceding section we have looked at the three key numbers, initial margin, variation margin and default resources and shown that for selected major CCPs, these amount to:

- $500 billion of initial margin.

- $10–26 billion of variation margin.

- $78–145 billion of default resources.

- A grand total of $670 billion.

A big number, but one that is likely to be higher if more CCPs are included, for example B3 in Brazil or Shanghai Clearing in China, perhaps by $30 billion to $80 billion.

Irrespective of whether the number is $670 billion or $750 billion, the size of these numbers shows the systemic importance of CCPs as a major part of financial market infrastructure.

コンテンツを印刷またはコピーできるのは、有料の購読契約を結んでいるユーザー、または法人購読契約の一員であるユーザーのみです。

これらのオプションやその他の購読特典を利用するには、info@risk.net にお問い合わせいただくか、こちらの購読オプションをご覧ください: http://subscriptions.risk.net/subscribe

現在、このコンテンツを印刷することはできません。詳しくはinfo@risk.netまでお問い合わせください。

現在、このコンテンツをコピーすることはできません。詳しくはinfo@risk.netまでお問い合わせください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(ポイント2.4)に記載されているように、印刷は1部のみです。

追加の権利を購入したい場合は、info@risk.netまで電子メールでご連絡ください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

このコンテンツは、当社の記事ツールを使用して共有することができます。当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(第2.4項)に概説されているように、認定ユーザーは、個人的な使用のために資料のコピーを1部のみ作成することができます。また、2.5項の制限にも従わなければなりません。

追加権利の購入をご希望の場合は、info@risk.netまで電子メールでご連絡ください。

詳細はこちら コメント

大げさな宣伝を超えて、トークン化は基盤構造を改善することができる

デジタル専門家によれば、ブロックチェーン技術は流動性の低い資産に対して、より効率的で低コストな運用手段を提供します。

GenAIガバナンスにおけるモデル検証の再考

米国のモデルリスク責任者が、銀行が既存の監督基準を再調整する方法について概説します。

マルキールのサル:運用者の能力を測る、より優れたベンチマーク

iM Global Partnersのリュック・デュモンティエ氏とジョアン・セルファティ氏は、ある有名な実験が、株式選定者のパフォーマンスを評価する別の方法を示唆していると述べています。

IMAの現状:大きな期待と現実の対峙

最新のトレーディングブック規制は内部モデル手法を改定しましたが、大半の銀行は適用除外を選択しています。二人のリスク専門家がその理由を探ります。

地政学的リスクがどのようにシステム的なストレステストへと変化したのか

資源をめぐる争いは、時折発生するリスクプレミアムを超えた形で市場を再構築しています。

オペリスクデータ:FIS、ワールドペイとのシナジー効果の失敗の代償を支払うことに

また:ORXニュースによるデータで、リバティ・ミューチュアル、年齢差別訴訟で過去最高額を支払う;ネイションワイド、不正防止対策の不備。

東京の豊富なデータが市場への影響について明らかにすること

新たな研究により、定量金融において最も直感に反する概念の一つが普遍的であることが確認されました。

資金調達コストの配分:集中型 vs 分散型

サチン・ラナデ氏は、特に担保付融資において、集中化は資本効率と自己資本利益率(ROE)の向上に寄与し得ると述べています。