Feature

Outsourced model validation: is it viable?

Consortium promises cost savings in outsourcing model validation, but some say pooling doesn’t float

Review of 2019: shaken, not stirred

The market survived a cocktail of hits. But is a hangover on the way?

Quant funds look to AI to master correlations

Machine learning shows promise in grouping assets better, predicting regime shifts

In the US, it’s an even ‘tougher legacy’ for Libor

A legislative solution for cash products is in the works, but lawyers say it raises constitutional issues

Calls to hike climate policy raise risk for oil firms

Increased climate policy will put more oil and gas assets under threat of stranding

Germany scrambles to shut the door on Mifid open access

Finance ministry will face fine timing to reverse clearing rule during its EU presidency

Climate risk-weighting: the devil and the deep blue sea

Should capital charges be calibrated to climate risk? European banks test the waters

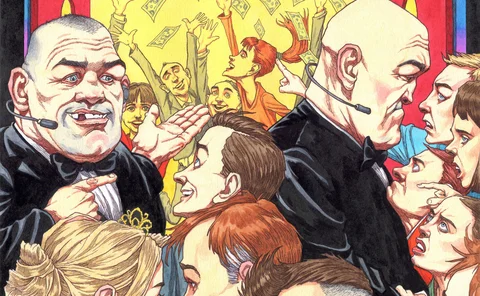

The human touch: SMCR extension reaches smaller firms

Extended to nearly 50,000 firms, UK regime aims to pinpoint responsibility, from money laundering to #MeToo

Why Europe’s markets might need Mifid III

Lawmakers leaning towards small-scale review, others call for fuller rewrite

Clearing house power-downs raise fears among members

Banks question CCP resilience to system outages, as debate swirls over non-default losses

Quants clone private equity: pale imitation or real deal?

Theory says replication can work, but investors are reluctant to give up private equity’s smoothed returns

Bad clocks block forex best-ex

To get a good deal in fast-moving forex markets, buy-side firms need to know the time. Some don’t

HKEX outage zapped key hedge; now banks push for rule change

Dealers seek shutdown of CBBC market if futures go dark

Robo-raters help banks vet vendors for cyber risk

Specialists tout service for monitoring third parties amid tougher rules on outsourcing risk

Cat risk: why forecasting climate change is a disaster

Forecasters are poles apart on climate-driven catastrophes; insurers fear worse ahead

UK financials pilot £4bn Sonia bond switch

Lloyds, Santander UK and Nationwide follow ABP with legacy bond transition

All clear? Structural shifts add to repo madness

Many things contributed to 10% repo, among them a FICC programme and a surge in overnight funding

Structural snags frustrate STS for synthetics

Curbs on excess spread and collateral stymie route to ‘high-quality’ signifier

Buy side builds bots to cut trade costs

With margins under pressure, investment firms are looking to accelerate automation push

Double trouble: don’t blur FRTB deadlines, warns ECB

Ignoring reporting model deadline could muddy capital approval cut-off

Cultural appropriation: private equity goes quant

Machines are helping venerable shops find under-the-radar performers and factors that drive them

When climate risk starts to bite

Energy firms under increased pressure to assess physical climate risk

Fund fears linger over guidelines set to avert fire sales

Final Esma framework allays some European asset managers’ concerns

Deal misfires expose risk of contingent hedging

Banks hike premiums on deal contingent swaps amid Brexit uncertainty