Energy Risk - Feb 2018

Articles in this issue

How energy players are reaching the limits of hedging

Commodities firms face lasting changes in 2018

China oil future approved, March start targeted, says source

International banks see healthy interest from overseas clients

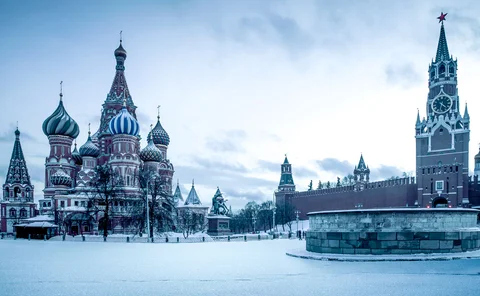

Transneft quits OTC market after settling $1bn swaps case

Russian market participants edgy after settlement leaves disclosure duties unclear

BAML hires new US head, Ice names model risk head, and more

Latest job changes across the industry

Forecasting crypto crashes with bubble analysis

Analysis finds bubble signals in bitcoin and ether, write trio of quant risk managers

Bitcoin futures pricing kindles manipulation fears

CME and CBOE insist pricing methodology is robust; critics say contracts are ripe for manipulation

Trade surveillance shouldn’t deter traders

Monitoring costs are forcing commodity players away from market participation, say consultants

Banks begin to model climate risk in loan portfolios

Environmental stress tests and scenario analysis reveal hidden risks

Credit data: the Trump effect on PDs

The war on coal is over, according to the US president – and the effect can be seen in banks' default estimates

Utilities turn to big data to improve pricing models

Smart meters and time-of-use rates could dampen power market volatility and improve hedging

Oil hedging rally slows amid backwardation

Producers pause to see if prompt price rally rolls along the curve

Intraday power storage and demand optionality

George Levy discusses the value of intraday power storage and demand optionality in UK power contracts