Monetary policy

Unthinkably favourable

Imagination in stress testing demands unorthodox thinking, as even seemingly favourable events can have negative consequences. In the case of the oil markets, this means stress testing for a fall, as well as a rise, in oil prices, argues David Rowe

Set for meltdown?

Cover story

Singapore stumbles

Exchanges

The missing link

With several countries now developing emissions trading schemes, UN-supervised project-based emissions credits could become the linking instrument that creates a global price signal for greenhouse gas abatement. But greater standardisation in the market…

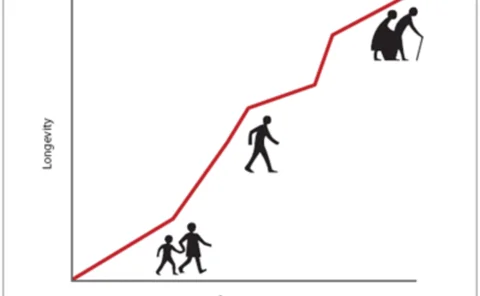

The road to diversity

Nordic risk - Inflation

Distributors have their say

German distributor survey

Korea lights the way

Cover story

A liability defined

Pension indexes

Designing a market

With Canada likely to embark on an emissions-trading scheme this year, Oliver Holtaway looks at the various forms it could take

Underlying concerns

Exchange-traded Funds

The Fiduciary feeling

Investment management

Creating the LDI infrastructure

UK pensions

A view on 2007

Viewpoint

Shifting sands

High oil prices and a lack of accessibility to reserves are reawakening oil majors' interest in Canada's oil sands. David Watkins looks at their potential and at the challenges involved in this capital-intensive mining operation

The LDI makeover

For all the hype surrounding liability-driven investing, few UK pension funds have actually taken the plunge and implemented the technique. The London Pension Fund Authority is one notable exception. Nick Sawyer reports

Credit model meltdown

Dealers are trading increasingly high volumes of bespoke tranches of synthetic credit risk with each other, yet there still appears to be little consensus on the application of credit models. Is there a danger the house of cards may come tumbling down?

Igniting the Italian market

Conference report

Picking up the pieces

Restructuring

The price of political risk

Korea credit

Upwardly mobile

Korea

Reaping the biofuel benefits

Commodities

Driven to distraction

Pension funds

A quiet revolution

Governments have traditionally kept their limited use of derivatives close to their chests. But some sovereigns are now broadening their mandates to encompass a wider array of risks and they are increasingly turning to the derivatives markets. By Navroz…