Hedge funds

Tax concerns remain top of the agenda

What are some of the key concerns and issues about the tax structure of a fund? What advice do you give on the tax structure of a fund or fund of hedge funds?

Family Office Leadership Summit

September 2009, London

Credit fund looks set for another good year

Founded in 2000 to take advantage of the opportunities in the European markets with the introduction of the euro, Liontrust Credit Fund has seen continued growth. Simon Thorp, head of fixed income at the company, remembers the fund managers saw great…

Emerging opportunities

US-based investment managers Prince Street Capital’s flagship long/short fund has never suffered annual negative returns, even in 2008.

Enterprising investment

TTP Ventures’ chief executive David Gee believes clean technology is set to be the highest growth economy in the UK over the next 10–20 years.

Building on property

Faircroft Properties chief executive James Burchell believes the current economic climate is the right time to invest in commercial property.

Making money from a macro-economic shift

The world is in the midst of “one of the great macro-economic shifts of the last 100 years”, according to DTAP Capital Advisors partner Hugh Warrender.

Systematic investment

Formed through a spin-off from JWM Capital Partners, Episteme Capital’s inaugural fund went live in July this year.

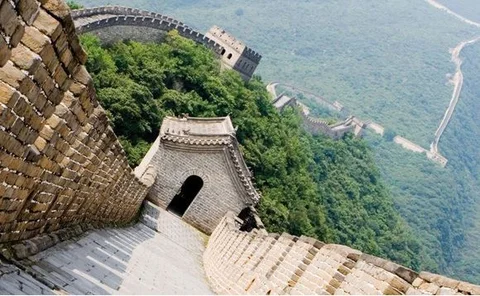

Chinese opportunities

Of all the world’s emerging markets, none has boomed so quickly as China. While the developed world struggles with the financial crisis, China is forecasting continued strong growth.

Warming up to Cuban investment

Alex Schmid thinks there is a rare, niche opportunity for investors in one of the few remaining territories standing outside the world’s financial markets.

Farmland offers opportunities

Population growth and climate change are driving a change in the way the world uses land. As a consequence there is a shortage of good-quality farm and forest land.

Watch for the bond bubble

The credit markets have avoided becoming the next bubble waiting to burst. Nevertheless, investors should be cautious of government bonds.

Investment grade bonds offer

Increased issuance of US investment grade bonds present increased opportunities, says Scott Service, senior global strategist at Loomis, Sayles & Co. There has already been a huge rally and he is confident “there is more rally to come”.

Future of diversification

Family offices are increasingly looking at tangible assets as a way to diversify their portfolios away from purely financial risk.

Emerging markets, emerging assets

Investors must be wary of a still-volatile economy and pick investments accordingly. However, emerging markets are a good bet and will continue to be so, concludes Cayzer Trust Company director Dominic Gibbs.

Commercial property set to rise

The economic forecast for the commercial property market is clearing, says Standard Life Investments’ investment director Andrew Jackson.

Simple strategies are the best

Investors were shocked in 2008 when they discovered diversifying a portfolio could not get rid of risk. Economists were less unsettled. They tend to look at a whole range of views, examining data and information domestically and globally in order to form…

Defining a family office

“Any ex-UBS banker these days starting up their own shop is calling themselves a family office,” says Reyl Private Office director Pierre Condamin-Gerbier, discussing the question of the optimum structure for a family office.

Future planning for succession

There are a number of different structures that can be used to manage a family’s wealth, but the most important requirement is adequate succession planning.

Inside story of family offices

Duncan Straughen, director of Wates Family Office, was recruited to work closely with family members to help create the infrastructure and support needed for an actively engaged owners group. The family was just completing a transfer of ownership between…

Outsourcing dilemma

Family offices come in a variety of shapes and sizes. Not all are called ‘family offices’ and not all are designed to meet every need of a family.

Entrepreneurial spirit drives success

EXCLUSIVE