Risk

Balance-sheet interest rate risk: a weighted Lp approach

In this paper, the authors introduce a new interest rate risk measure that is a product of two factors: one related to the distance between assets and liabilities in the Lp-space of financial instruments, and the other linked to the performance of the…

A three-state early warning system for the European Union

In this paper, the authors develop an early warning system for forecasting a financial crisis of the magnitude of the 2007–8 crisis for the European Union (the EU14).

Asia embraces intelligent automation

Asia’s adoption of new tools and processes has gained significant momentum, with increased automation now a primary focus for many financial firms. Paul Worthy, head of Japan at Tradeweb, explores how this change has come about, and how firms can use the…

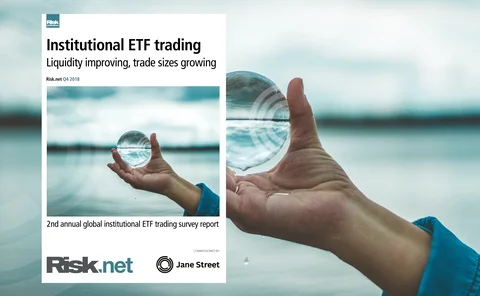

Institutional ETF trading: Liquidity improving, trade sizes growing

Sponsored survey report: Jane Street

Transitioning beyond Libor: Some key considerations

Liang Wu, vice-president of financial engineering and head of CrossAsset product management at Numerix, explores the transition to Libor alternative rates and the impact on curve construction practices

A general framework for constructing bank risk data sets

This paper proposes a general framework for constructing bank risk data sets, which provides an integrated process from data sources to comprehensive risk data sets.

Risk evolves in springtime of energy spin-offs

New risk management challenges as firms split legacy fossil-fuel operations from renewable-focused areas

RFR valuation challenges

A new system of interest rate benchmarks for all major currencies is emerging. These new benchmarks will replace interbank funding rates with risk-free rates (RFR). This article by LPA focuses on valuation challenges during the transitional period to new…

JP Morgan cuts op risk RWAs by $12.5 billion

Operational RWAs down to $387.6 billion from $400 billion in the second quarter

Covering the world: global evidence on covered calls

Typical covered call strategies may be decomposed, using a risk and performance attribution methodology, into three components: equity exposure, short volatility exposure and equity timing. This paper applies that attribution methodology to covered calls…

Managing adverse temperature conditions through hybrid financial instruments

This paper proposes temperature-based risk management using hybrid financial instruments built on weather derivatives.

Asia moves: SGCIB makes two promotions, Natixis hires three heads, and more

Latest job changes across industry

A call to arms – How machine intelligence can help banks beat financial crime

The revolution in artificial intelligence promises new leads in banks’ fight against dirty money. Alexander Campbell of Risk.net hosted a live online forum, in association with NICE Actimize, to investigate the applications of this emergent technology

Pensions and insurers give new impetus to Asia’s ETFs

Cost-conscious institutional investors are embracing exchange-traded funds (ETFs) to lower transaction fees and achieve higher returns. Hong Kong Exchanges and Clearing (HKEX) explores the theme of yield‑chasing among insurers in Asia’s expanding ETF…

Preparing for the initial margin phase-in

Requirements for the mandatory exchange of initial margin are expected to be time‑consuming and laborious to implement. David White, head of sales at triResolve, discusses the lessons learned from in‑scope firms, obstacles to achieving compliance and how…

Defining the next generation of GRC

Firms are now under pressure to significantly transform governance, risk and compliance processes. Traditional mechanisms of effective risk management and regulatory compliance are fast becoming outdated. New technologies such as machine learning and…

Disruptive change in US power markets: Identifying risks and embracing opportunities in the new world of digital

Power markets worldwide are experiencing disruptive changes on a bigger scale and with greater speed than many had anticipated. Now, more than ever, it is essential to understand opportunities and risks associated with these changes

Risk monitoring through better knowledge-based risk processes

The aim of this paper is to propose a model that describes the integration of knowledge-based risks (via the processes of knowledge-based risk identification, analysis, evaluation and education) and knowledge-based risk repositories to support risk…

New backtests for unconditional coverage of expected shortfall

In this paper, the authors present a new backtest for the unconditional coverage property of expected shortfall.