Private equity

Private equity is finding ways to attract smaller investors

Platforms and funds of funds make it easier to get money out, but opacity and liquidity risk remain

What drives the convertible bond market?

This whitepaper looks at the key drivers that influence the convertible bond market and how it provides unique opportunities for both investors and issuers.

Shifting cyber security from compliance to a risk focus

Cyber attacks have grown in frequency and sophistication, with 3,813 data breaches reported in the first half of 2019, which was an increase of 54% over the previous year.

Seven steps to performance-enhancing ERM

Achieving best practices in risk management takes time and involves progressing through various levels. The important thing is that the three lines of defence are aligned around the ultimate objectives and understand their individual roles.

Integrated risk management: the confidence to carpe diem

In a world that has changed almost overnight, businesses across the planet have had to adapt just as fast.

Modeling the exit cashflows of private equity fund investments

This paper analyzes the realized exit cashflows of individual portfolio companies in a joint modeling framework that describes both the exit timing and the exit performance.

The importance of enterprise resilience alongside rapid digital transformation

The Covid-19 pandemic has accelerated digital and organisational transformation for many companies but, as leaders across industries note, this has also made them more vulnerable to new risks.

The $1 trillion shortfall if private equity bets turn sour

Investors have to keep sending money to private equity firms even if returns crumble, says hedge fund executive

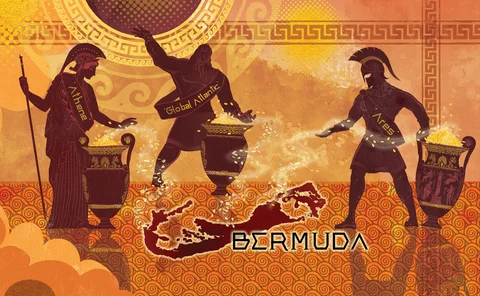

Apollo, KKR, Ares and the Bermudan CLO arbitrage

‘Capital efficiency’ may explain a 1,100% surge in life assets reinsured on the Atlantic island

Outrunning risk with cloud

Supercharged risks are running circles around banking risk models. Here’s how the cloud can keep you one step ahead

Building artificial intelligence in credit risk: a commercial lending perspective

This white paper provides a contemporary look at what AI and machine learning adoption could mean for commercial lending and credit risk assessments

SEC outdoes Europe on hedge fund, private equity disclosures

US to ban preferential treatment and introduce quarterly performance updates in rule shake-up

Outrunning risk with cloud

Supercharged risks are running circles around banking risk models. Here’s how the cloud can keep you one step ahead

Cryptocurrency regulation summary: 2022 edition

An analyst report summarising global regulatory guidelines surrounding the trading and issuing of crypto assets around the world

Rising inflation may spare smaller middle-market lenders

PennantPark bets that picking the right entrepreneur can protect private credit from rising prices

Sixth Street leads race to buy Allianz’s US annuity book

Credit investment firm spun out of TPG in 2020 snapping up insurance assets via its Tao fund

How Athora uses its ties to Apollo to boost returns

European life insurer boosts returns by sourcing loan assets directly from private equity firm

Deutsche sees equity RWAs jump 29% on new EU rules

CRR II requires banks to calculate exposure they would incur to honour guaranteed returns on investment products

Seeking SCB relief, Goldman cuts equity investments

Plans for less capital-intensive balance sheet could shave 140bp off capital requirements

Botched fallbacks leave CLOs facing early Libor switch

Nearly two-thirds of CRE securitisations issued since 2019 have already triggered fallback clauses

CalSTRS CIO: new derivatives needed to hedge ESG risks

Second-largest US pension fund has also reduced fixed income allocation to 12% as rates have fallen

Esma’s move on hedge fund leverage worries industry

Critics say proposed guidelines rely on patchy data and inconsistent calculations

Top European insurers bet on private equity

Allianz and Axa had a combined €29 billion at end-2019

Fund securitisation makes capital vanish – and watchdog growl

Probe into possible “abuses” of CFO structure could hit wider investments, experts say