Losses and lawsuits

Hwang trial exposes flaws in verbal information handling

Court shown discrepancies in audio and email records; Credit Suisse insider says “fair amount” of intel slipped through cracks

The ghost of Archegos returns to haunt Simm

UK regulator’s attack on Simm may have more to do with the failed family office than meets the eye

Emir data may have exposed Archegos, but not in real time

Entity-level reports were limited to supervisors, leaving counterparty banks in the dark

How banks got caught in Archegos’s web of lies

Risk managers quizzed and confronted the firm, but lawsuits claim they were “systematically misled”

US pension fund sues Credit Suisse over Archegos failures

Lawsuit alleges top execs breached fiduciary duties; Credit Suisse shareholders block board exoneration

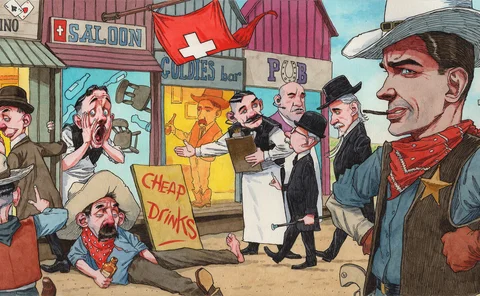

Credit Suisse and the Wild West of synthetic prime brokerage

Industry insiders describe a frontier business with few rules – and plenty of questionable practices

After Archegos, Credit Suisse clients tap rivals for clearing

Swiss bank is said to have lost clearing business amid uncertainty over its future

Would margin rules have checked Archegos? Perhaps not

Regulator-prescribed margin methodology permits six-times leverage on equity swaps

Op risk data: Sberbank suffers $108m supermarket clean-out

Also: Copper trader buys $36m of worthless bricks; big lenders hurt in $400m mortgage fraud. Data by ORX News

Op risk managers could be Covid long-haulers

New threats sprang from old sources in this year’s Top 10 op risks, belying a big drop in losses

Autocalamity: can hit product be reinvented?

Spreads on ‘worst-of’ bonds leap 50% as some dealers retreat and others pile on hedges

SocGen mulls sale of structured product books after big losses

Rival Natixis also plans to place parts of its equity derivatives business in run-off mode

Pressure grows on structured products as losses mount

Dividend-related losses at BNP Paribas may be higher than previously reported

How axed dividends left SocGen in a €200 million hole

Collapse in equity trading revenues prompts rethink of autocall hedging

Autocalls hit peak vega, where hedging costs mount

Eurostoxx and Nikkei losses flip structured product dealers into painful short vol territory

Korean regulator likely to probe issuers of rate-linked products

Mis-selling enquiry may extend to structuring banks as global rates plunge threatens retail notes

Natixis said to offload a third of Korean structured book

BAML and BNP Paribas named as buyers in $2.5 billion notional sale of equity-linked securities

European banks op risk losses dominated by business failures

Losses relating to accident and neglect account for 38% of op risk losses at eight big dealers

Mortgage and auto loan securitisations inflict op risk losses

Megan van Ooyen from SAS rounds up the top five operational risk losses for March 2017

Intesa Sanpaolo takes $235 million hit for AML failures

Megan van Ooyen from SAS rounds up the top five operational risk losses for December 2016

The missing piece in operational risk appetite

Setting an op risk appetite is illogical without reference to reward, argues Ariane Chapelle