Interest rate swaps

Swaps liquidity slumps as Treasury stress spreads

Big buy-side participants report “worst day” for market depth in 10 years, as spreads widen and prices gap

Bonds and swaps struggled in virus volatility

Low liquidity and wider spreads amplified by remote working, traders claim

Swaps data: cleared volumes drop for all markets – except FX

Smaller CCPs make market share gains in a quarter of double-digit declines for rates and credit

Fed funds swaptions offer SOFR alternative

Investors dry-run systems using familiar overnight rate, as markets wait for SOFR liquidity to build

Dealers cast doubt on swaptions compensation plans

Redress scheme for victims of post-Libor valuation change may fail due to “cherry-picking” fears

FCA: sign up to fallback protocol or face ‘serious questions’

UK regulator urges derivatives users to accept Isda swap fallbacks to ensure compliance with benchmark law

Synthetic Libor faces legal obstacles

EU benchmark rules may thwart ‘tough legacy’ fix, reviving calls for blanket legislation

Margin exchange threshold relief: get out of jail free?

‘Game-changing’ IM exchange threshold relief may not be the phase five free pass it first appears

Goldman, JPM kick off SOFR swaptions

US dealers spearhead non-linear trading but patchy liquidity weighs on vol market ambitions

Isda plans February rerun of Libor pre-death trigger poll

Lack of consensus would add pre-cessation option to post-cessation protocol for bilateral swaps

Custody battle: competing tensions put IM prep in jeopardy

Conflicting custody interests and delayed docs call IM phase five readiness into question

Libor replacement jumble may hike hedging costs

Use of term rates and credit adjustments will create new basis risks that could be costly to hedge

LCH targets hardwired pre-cessation triggers

Proposal aims to align transfer pricing for cleared and bilateral markets in the event of split on ‘zombie Libor’ triggers

Bank disruptors: Crédit Ag taps AI to lure swaptions business

Machine learning model predicts client demand with high accuracy, giving traders an edge in pricing

New pre-cessation poll likely as FCA quells zombie Libor fears

Minimal non-representative lifespan opens door for rerun of Isda trigger consultation

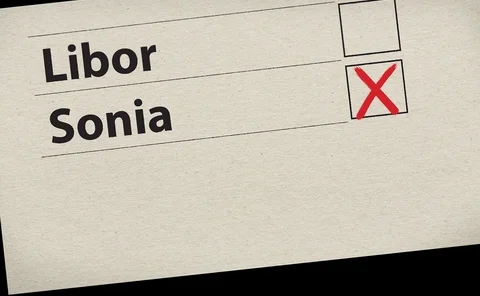

Judgement day looms for dealers in swap shift to Sonia

Regulator pushes Q1 deadline for users to adopt risk-free rate as norm for interdealer trades

Giant £174bn Sonia swaps trading day may be biggest ever

Mammoth swaps focus on upcoming announcements from the Bank of England’s Monetary Policy Committee

EU compounding confusion creates headaches for banks

With the fallback possibly illegal in some EU states, loan system updates may become more complicated

At CME, required IM up 18% in Q3

Surge follows busy August and September for the swaps clearing business

Eurex: from EQD clearing specialist to all-rounder

Initial margin for equity derivatives makes up 41% of total, down from 63% four years prior

Singapore’s banks eye LCH membership

London CCP’s move to clear for stranded SGX clients pays off, amid broader Apac membership push

Sonia users push for official in-arrears rate

US Fed proposal for compounded SOFR index leads to calls for endorsement of NatWest’s Sonia calculation

US firms must rerun non-cleared margin test in March

Proposed CFTC calculation delay offers in-scope firms chance to trade out of phase five compliance

Compounded rate out of favour, finds Japan survey

Users prefer forward-looking term rate to replace yen Libor, but dealers bemoan “lack of understanding”