Government bonds

Japanese banks load up on HQLA

Aggregate liquid assets increase ¥22.3 trillion year-on-year

Dodge & Cox turns to MBS as Treasury yields rise

Income Fund grows securitised allocations from 36.1% to 39.7%

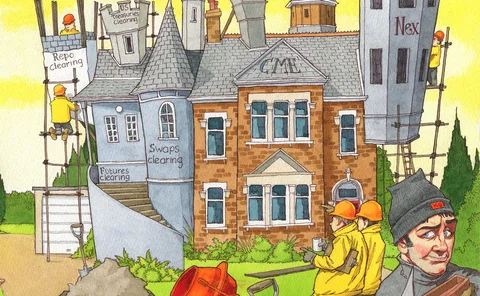

CME has chance to rule US rates after Nex deal

Market expects exchange to unite bond, repo, futures and swaps clearing – eroding grip of banks and DTCC

State Street bolsters liquidity buffers

HQLA share of investment portfolio grows from 61% to 70% in the first quarter

Pensions shackle UK to RPI linkers, say traders

Carney’s call to end use of flawed inflation index faces obstacles

Banking union: big bang or damp squib?

Eurozone needs package of interrelated measures to prevent project going backwards

Rates flow market-maker of the year: Citadel Securities

Risk Awards 2018: Firm takes on dealers once again by market-making in custom swaps and off-the-run Treasuries

DTCC set to cut US Treasury clearing fees

Revised fee structure could prompt more firms to participate in clearing

Fed’s Powell on Libor reform, repo and clearing

Risk30: Market doesn’t need to “clear all US dollars in US and all euros in eurozone” says next Fed chair

Curing the eurozone: how to fix the ESM

Bailout fund should guarantee all EU government debts but charge a protection fee, writes Marcello Minenna

LCH limits substitution to tackle quarterly collateral flight

CCP clamps down on bond-for-cash switches driven by reporting and quarter-end repo spikes

Scrap the gold plate: Mnuchin goes global on bank rules

Treasury converges to international standards, but leverage ratio exception may delay Basel deal

US Treasury’s leverage fix tipped to boost repo market

US Treasury plan to exempt US government bond exposures expected to help struggling market

Size-discovery protocols are not on the efficient frontier

Practice improves allocations but more can be done, says Darrell Duffie

BrokerTec dominance ‘unhealthy’, says Nasdaq’s Shay

More clearing needed to improve US Treasury competition

Non-banks eye EGBs as primary dealers retreat

Primary dealers warn of further exits as principal trading firms wait in the wings

New data reveals liquidity gaps in EU bond markets

Liquidity in German, Italian and UK bonds has suffered over past three years

Exchange innovation of the year: CME Group

Risk Awards 2017: Patience pays off with spectacular success of Ultra 10 Treasury futures

Derivatives house of the year: Citi

Risk Awards 2017: Simple vision has taken rates business a long way

Clamour grows for US Treasuries clearing mandate

HFT default could destabilise interdealer markets, participants fear

Interview: US Treasury CRO on credit risk, Tarp and cyber threats

Ken Phelan stresses importance of credit risk management in key Treasury role

Volatility fears obstruct China Treasury futures growth

Commercial banks barred despite support for their entry from securities regulator

DTCC’s Murray Pozmanter on repo clearing and HFT

Buy-side clearing a top priority following suspension of interbank GCF repo

Doomed loop: Europe gets creative on sovereign bond risks

Political and prudential risks in huge bond-holdings force experts to consider new ideas