Studies test investors’ risk aversion after crash

Researchers use March tumult to investigate psychology of risk-taking

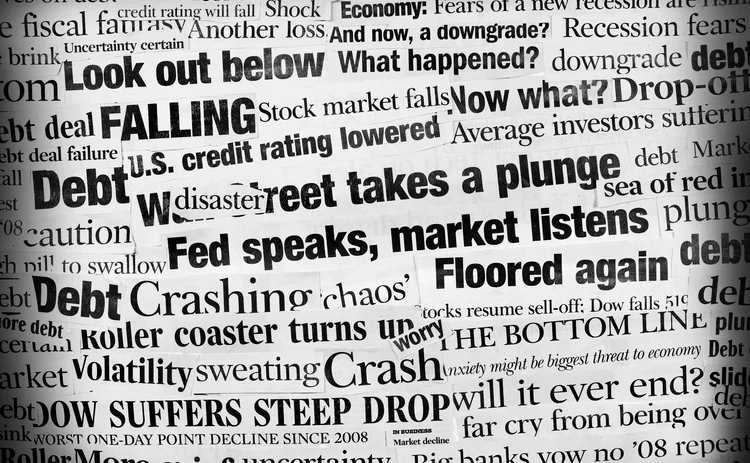

The coronavirus turmoil promised a rare chance to answer an elemental question in finance: does fear change how investors think after a market crash? Two recent studies that explore this debate reach opposing conclusions.

Received wisdom would say investors get skittish after crashes and bolder during booms. The idea is often used to explain why markets boom and bust at all – and has been

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Investing

Passive investing and Big Tech: an ill-fated match

Tracker funds are choking out active managers, leading to hyped valuations for a dangerously small number of equities

FSB chief defends global non-bank regulation drive

Schindler slams ‘misconception’ that regulators intend to impose standardised bank-like rules

Crisis-era CDO protection keeps on giving for Athene

Apollo-owned insurer still sees payments from sold CDS protection on a 2006 synthetic resecuritisation

Will lifer exodus kill Taiwan’s NDF market?

Traders split over whether insurers’ retreat from FX hedging is help or hindrance

Calamos brings popular US autocall ETF to Europe

Dublin filing points to Q1 launch for Calamos Autocallable Income Ucits ETF

How geopolitical risk turned into a systemic stress test

Conflict over resources is reshaping markets in a way that goes beyond occasional risk premia

How JPM AM swapped platforms for pipes

Asset manager wanted to cut FX venues – and their fees – out of dealer relationships. Now, it only trades direct

What the Tokyo data cornucopia reveals about market impact

New research confirms universality of one of the most non-intuitive concepts in quant finance