Diversification

The role of Indian equity exchange-traded funds in diversified portfolios: a risk-adjusted performance analysis

The authors evaluate how Indian equity ETFs perform relative to US and global benchmarks between 2008 and 2023.

Brevan Howard: life beyond macro

Talking Heads 2025: Wider range of strategies helped firm rebound from 2018 low – but brought re-correlation risks

How to solve the Fed’s $300bn FRTB problem

A sacrifice will have to be made to ensure new market risk rules meet demands for capital neutrality

Bank of England urged to rethink HHI concentration risk add-on

Experts think overhaul of credit risk measure should be part of PRA’s ongoing Pillar 2 review

The Covid-19 pandemic and the portfolio diversification effect of catastrophe bonds

The authors delve into catastrophe bonds within an international multiasset portfolio for periods before and during the Covid-19 pandemic, showing how at different times they act as a diversifier and a safe haven.

European Commission changes tune on proposed FRTB multiplier

Banks fear departure from original diversification factor undermines case for permanent relief

Delving into the European Commission’s proposed overhaul of FRTB

Raft of potential changes would benefit both IMA and SA banks – but only temporarily

Approximate risk parity with return adjustment and bounds for risk diversification

The authors approach diversifying risk contributions to improve returns by satisfying approximate risk parity and providing bounds on a risk spread (RS) metric that quantifies risk diversification and takes returns into account.

Can pod shops channel ‘organisational alpha’?

The tension between a firm and its managers can drag on returns. So far, there’s no perfect fix

Study finds just 10 banks plan to apply for FRTB models

Research provides extra insight on reasons for decline in internal models

Loss of diversification benefits ‘will drive higher FRTB charges’

Independent study backs industry’s claims of significant rise in market risk capital requirements

Foreign funds are bulls in China’s onshore commodity futures

Growing participation from overseas investors is boosting liquidity in what’s already a boom market

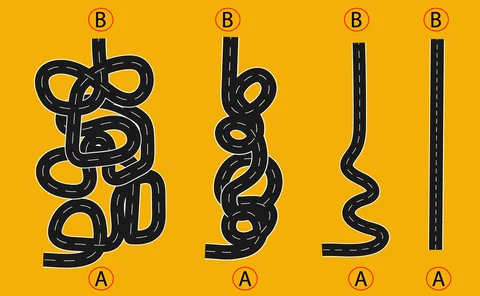

FX alternative risk premia as a key diversifier for equity bond portfolios

Siddharth Grover, head of QIS structuring at BBVA, discusses how the BBVA FX Risk Premia Indices can aid investors seeking diversification, and provides insight into potential trends moving forward

A guide to home equity investments: the untapped real estate asset class

This report covers the investment opportunity in untapped home equity and the growth of HEIs, and outlines why the current macroeconomic environment presents a unique inflection point for credit-oriented investors to invest in HEIs

Regulators’ FRTB estimates based on faulty premise – industry study

US market risk capital requirements could more than double if banks abandon IMA

Cboe’s new options add diversity and liquidity to the credit market

Cboe has recently launched two options on futures products to help investors manage exposure and mitigate risk in corporate bond portfolios: options on iBoxx high-yield corporate bond index futures (IBYO), and options on iBoxx investment-grade corporate…

Optimal allocation to cryptocurrencies in diversified portfolios

Asset allocation methods assign positive weights to cryptos in diversified portfolios

Diversification is even better than a free lunch – study

Data back to 1926 shows that spreading bets brings higher returns as well as lower risk

Podcast: Jan Rosenzweig on fat tails and LDI portfolios

An optimised portfolio can look very different when extreme moves are given more weight

SocGen’s VAR up 33% in Q4

Gap with French rival BNP Paribas shrinks to just €9 million, the least since mid-2020

Keep risk parity simple, stupid

In times of volatility, simpler risk parity strategies may outperform more elaborate counterparts