Investing

Investors, whether banks, asset managers, hedge funds or pension funds, operate a dizzying array of mandates and strategies, but there are many commonalities when it comes to identifying and managing risk in their portfolios. Risk.net keeps investors up to date with the latest approaches and developments in managing portfolio risk – from tackling liquidity risk to measuring exposures, to macro, political and climate risk, as well as showcasing innovative new quant models, strategies and software systems.

This section features predominantly third-party content. Read more about our policy on this content here.

Japan’s yen swaps go global

JSCC isn’t just clearing swaps, it is clearing the way for the next stage of Japan’s financial evolution

How next-generation exchange infrastructure is redefining global market access

Designed to reimagine market connectivity, GAN offers strategic significance for financial institutions, regulators and exchanges

Fixed income ecosystem

Manage risk, uncover opportunity and make informed decisions with ICE’s end-to-end fixed income solutions

Institutional ETF trading: from tactical tool to embedded strategic advantage

Leveraging ETFs for resilience, efficiency and growth in today’s complex market

US Treasury clearing success depends on competition and choice

The origins of the forthcoming clearing mandate for US Treasury securities and details of the ICE clearing platform scheduled to launch by end of year

ICE’s approach to pricing global fixed income assets

Accurate and transparent bond pricing is critical for managing risk, meeting regulatory requirements and making informed investment decisions

A paradigm shift for prepayment risk assessment

For MBS investors, the ability to link data to specific loans and securities offers more precise analysis, alongside other advances in data and analytics

Precision-crafted: the new tools of investing

Key trends, tactics and innovations that are influencing investors’ thinking in the current environment

Fixed income finesse: striking a balance amid shifting rates

An increasingly unpredictable economic environment leads investors to look for a wider range of products to satisfy evolving strategies

Investors find smoother path with smart beta

In the face of evolving volatility, investors are demanding a smarter approach to strategic asset allocation

The future of quantitative investment

Discussion on the increasing appeal of QIS, latest trends and use cases in the Apac region

The future of fixed income

Apac investors’ use of fixed income products, the fast-track evolution of the UBS fixed income proposition and the innovations likely to be seen by 2030

The future of portfolio execution

The changing needs of institutional investors and intermediaries, and why clients are seeking a more tailored approach to portfolio execution

Mitigating risks with derivative ETFs

The evolution of synthetic ETFs, regulatory impacts, and balancing leverage and transparency

Addressing risks and leveraging compliance opportunities amid banking regulation uncertainty

How financial institutions can stay compliant, adapt to shifting policies and seize strategic advantages amid regulatory change

J.P. Morgan Inverse VIX Futures ETN: a more intuitive approach to risk

J.P. Morgan’s new inverse Vix futures ETN, designed for a more stable risk profile

Expert vision, efficient execution

Why more investors are turning to third-party portfolio implementation platforms to maximise efficiency and impact

Yen rise spurs Japanese rates market surge

Traders are moving on an expectation of increased yen volatility in 2025

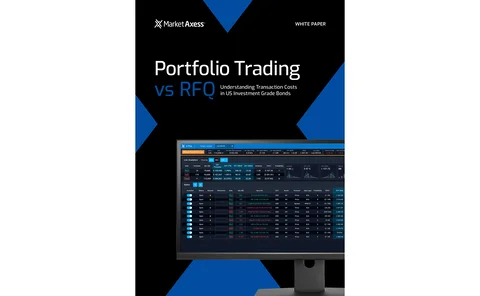

Portfolio trading vs RFQ: understanding transaction costs in US investment-grade bonds

How factors such as order size, liquidity profiles and associated costs determine whether a portfolio trade or RFQ list trade is the optimal choice

To liquidity and beyond: new funding strategies for UK pensions and insurance

Prompted by policy shifts and macro events, pension funds and insurance firms are seeking alternative solutions around funding and liquidity

The evolution of portfolio strategies: Special report 2024

This report explores the dynamic evolution of portfolio management and investment strategies, addressing challenges, technological advancements and ongoing innovations