This article was paid for by a contributing third party.More Information.

FX alternative risk premia as a key diversifier for equity bond portfolios

Many challenges are being presented in the current period of positive US equity bond correlation, including increased portfolio volatility. Siddharth Grover, head of quantitative investment strategy structuring at BBVA, discusses how the BBVA FX Risk Premia Indices can aid investors seeking diversification, and provides insight into potential trends moving forward

US equity bond correlation has shifted from negative and remains positive since 2021, marking a significant departure from the previous two decades of negative correlation dynamics. The negative correlation between bonds and equities has traditionally given rise to the benefits of diversification, which is the only ‘free lunch’ for an investor, allowing them to boost their returns while maintaining a similar level of risk/volatility of portfolio returns. These diversification benefits are challenged during periods of positive correlation, adding to the complexities of traditional strategies reliant on bonds as a hedge against equity market volatility.

According to Ana Munera, head of global markets strategy at BBVA, to contextualise this shift in correlation, one must look back to the 1980s and 1990s, when sustained periods of positive correlations were observed. Assessing the probability of this new pattern enduring requires an examination of the macro-financial features prevalent during previous periods of positive correlation prior to 2001.

Munera points out that periods of positive correlation have historically often coincided with escalating levels of public debt, elevated inflation, uncertainty surrounding policy rates and growth models reliant on supply-side factors. These macroeconomic conditions – reminiscent of the current landscape – could sustain a period with a similar outcome.

Given this precedent, in BBVA’s view, there is a high probability of an extended period of positive equity bond correlation, which would result in a marked increase in portfolio volatility, thus impacting the performance of balanced portfolios. This does not stem from the inherent volatility in stocks or bonds themselves, but rather from the loss of the hedge provided by the bonds in the portfolio. Consequently, traditional 60/40 portfolios are expected to see a wider range of risk-adjusted returns and deeper drawdowns.

In response to this landscape, implementing additional risk management approaches becomes paramount. Diversifying portfolios beyond equities and bonds can be achieved by including low or negatively correlated asset classes, alternative risk premia strategies (ARPs) or a combination of both, thus enhancing portfolio resilience.

ARPs serve four strategic needs for investors:

- They offer diversification

- They are a liquid and transparent investment

- They are cost-efficient

- They provide a toolbox for use in different market and macro regimes.

ARPs deployed in foreign exchange as an asset class also offer advantages:

- Exposure of FX risk premia to underlying macroeconomic factors, such as growth or inflation, differs from the factors provided by equity and bonds due to the nature of the asset. Any FX transaction involves a long and short position in the respective currency, thus providing a relative exposure to the macro linkages associated with international trade, capital flows and overall business and monetary cycles that affect the relevant economies.

- The over-the-counter FX market, with average trading volumes in excess of $7.5 trillion per the Bank for International Settlements’ (BIS’s) 2022 Triennial survey, is the largest and most liquid financial market in the world.

- When deployed jointly with a traditional equity bond portfolio, an investor has the assurance that exposure does not add to the same market risk factor they are already bearing in their portfolios at any given point in time.

The BBVA FX Risk Premia Indices are designed to capture all the desired characteristics listed above and are a powerful tool for investors looking for diversification and sources of uncorrelated returns. They offer direct access to a diversified portfolio of macro-linked and technical FX trading strategies using a risk-balanced, rules-based allocation process, with a focus on the prevailing macroenvironment.

The BBVA FX Risk Premia family of indexes is classified into three buckets:

- Trend risk premia: performance can be understood as a convex payoff, thereby offering a better-than-average performance in trending and uncertain times.

- Carry risk premia: performance tends to be akin to a concave payoff and tends to gain in a stable macroeconomic environment.

- Relative valuation or fair value: performance tends to be a combination of concave and convex payoffs, thus gaining by design in transitory macro-environments.

BBVA’s approach to ARPs aims to combine already known risk premia frameworks with a deep market understanding to offer a differentiated value proposition for its clients. The three main families of indexes present some unique aspects:

- Trend: as macro assets, currencies have different relative performance in different economic and market scenarios. The BBVA framework trades in macro-linked currency pairs to capture the macro trend and measures geographic stress to position effectively.

- Carry: given its nature, this may suffer from sudden risk-off episodes. BBVA’s framework, in addition to being a dynamic portfolio, also utilises indicators of macro stress to decide on the final allocation, with the aim of protecting the portfolio.

- Relative value: one of the usual problems with value strategies is that deviations from expected relative value can be acute for a long period of time. BBVA’s framework introduces mechanisms that aim to protect and potentially benefit during such periods.

Investors could follow different approaches when it comes to ARP; they may look for a particular solution that fits their expected market environment or portfolio need or, alternatively, they can follow a portfolio approach, combining the different risk premia to provide an additional low-correlated overlay to their existing portfolios.

Evaluating the past 23 years, since the BBVA FX Global Risk Premia portfolio was introduced in 2001, shows that relative value and macro trend complement each other, particularly during the turning point in any given economy. However, carry has done well, on average, in capturing the FX forward-implied carry in almost all environments.

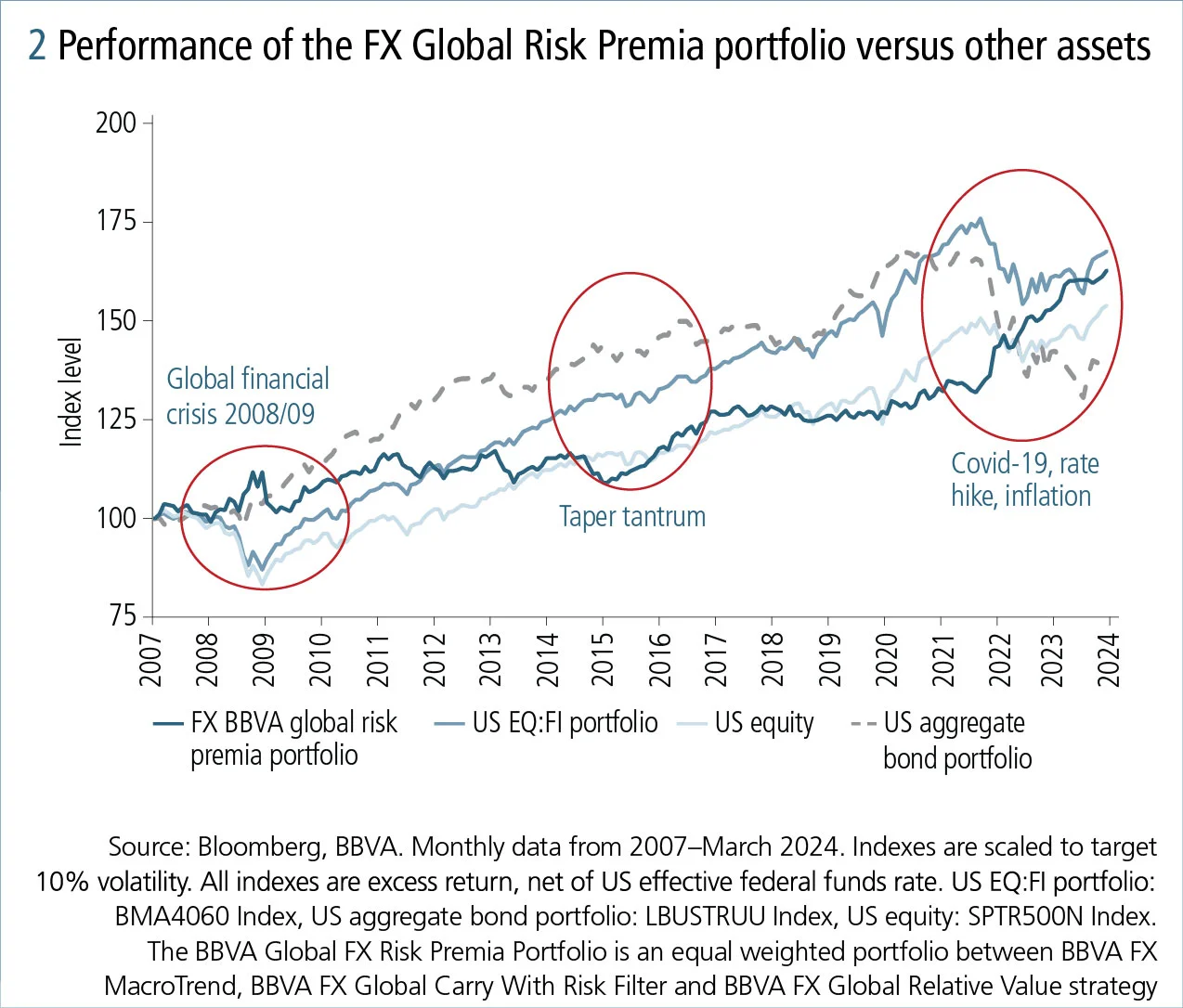

The BBVA FX Global Risk Premia portfolio – combining a trend, carry and relative value approach – has done well, on average, in all periods, offering a low correlation (0.12) with US equity portfolios since 2001. It has exhibited a Sharpe ratio of 0.7, 0.8 and 1.2 since then, and over five and 10 years, respectively.

Given its FX ARP focus in Latin America, BBVA’s strong trading capabilities in the region’s currencies allow the bank to provide very efficient pricing and a liquid source of risk and return in Latin America.

BBVA has also launched a set of risk control variations on the FX ARPs, which allows optionality or 100% capital-guaranteed products through a variety of wrappers, to accommodate more conservative client needs and leverage the growing and strong FX asset investment solutions platform offered by the bank.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net