Corporates

Apac banks put trust in pre‑trade

Amid tougher trading conditions, Apac banks are making greater use of pre‑trade analytics to inform their strategies and reduce risk. But how successful are these tools?

Navigating IFRS 9: strategies for effective implementation and moving beyond

There has been a constant change within the landscape of financial reporting, and IFRS 9 has been proven to be a critical component.

Adapting to economic uncertainty: internal audit’s journey

In this report, internal auditors in different sectors have shared their experiences and strategies, providing valuable insights for others facing similar challenges

Like your CSA dirty? It’ll cost more

Buy-side firms have to pay up if they want to post corporate bonds to their dealers, but prices vary

Asia moves: Senior hires at BNP Paribas, BNY Mellon and more

Latest job news from across the industry

EU Council backs Emir exemption for corporates

Leaked doc shows majority of members want to keep intra-group reporting relief introduced in 2019

GFXC fosters global awareness of T+1 impact on FX

Risk Live: Many non-US firms yet to realise FX implications of the country’s shift to shorter settlement times

The case for modularity and interoperability

This report, produced by WatersTechnology and Broadridge, investigates the extent to which firms have optimized their entire trade lifecycles, the structure, challenges and interoperability of their front-office systems, and what they most value when…

Challenged single-name CDS market takes optimistic turn

Trading has boomed despite recent criticism, but can the market regain its former strength?

Integrating ECL onto a stress-testing platform: portfolio composition

How to grow a portfolio that is internally consistent with a stress scenario

Asia moves: Senior hires at Citi, Nomura and more

Latest job news from across the industry

A dynamic program under Lévy processes for valuing corporate securities

The authors design and solve an extended structural model that accommodates arbitrary Lévy dynamics for the underlying firm’s asset value, realistic debt payment schedules, multiple seniority classes and various intangible assets.

Chinese corporates step up FX hedging after reopening

Exporters eye hedges as RMB strengthens, but negative forward points are a turn-off for some

ESG strategies special report

This Risk.net special report sponsored by SAS features a series of articles that reflect on the latest initiatives for consistent standardised global frameworks for measuring ESG, consider the methodologies investors are using to make measurable progress…

Integrating ECL onto a stress-testing platform: credit risk characteristics

How credit loss in the ECL process can leverage changes in the credit risk profile of a portfolio during a stress scenario

Integrating ECL onto a stress-testing platform: scenarios

Strategies for producing stress-testing ECL values that comply with IFRS 9, as well as CECL standards

Reading between the fines: a deep dive into financial institution penalties in 2022

Fenergo’s latest research report on financial institution penalties in 2022 is available now. Key analysis shows that fine values in Apac were just 0.77% of what they were in 2021

An uphill climb to T+1 settlement

The SEC is pushing an aggressive schedule for faster settlement of equities and corporate bonds

‘Globalisation rewired’: what does it mean for investors?

After half a century of outsourcing production to developing nations, companies are changing tack – with long-term implications for investors

EC stuns corporates by scrapping Emir swaps exemption

Industry confused as to why intragroup reporting obligation needs resurrecting

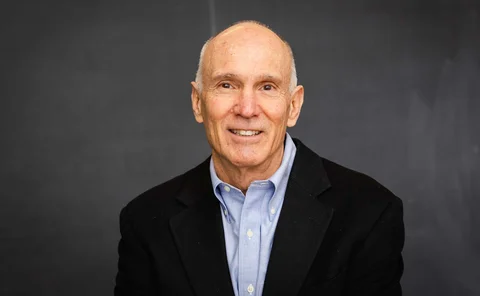

Lifetime achievement award: Stephen Kealhofer

Risk Awards 2023: KMV co-founder helped usher in a new era of credit risk analysis – at banks and investors

IRB risk-weights highest at smallest EU banks – ECB

Lenders with less than €30 billion in assets consistently report lower risk densities than bigger banks across all modelled portfolios

ANZ defies ‘white label’ trend with algo expansion

Instead of relying on large LPs, Australian bank aims to offer six new FX algos of its own by February

PBoC deposit requirement hits FX hedging, again

Reinstated rule hikes forwards costs and dents volumes, but volatility sees corporate demand persist