Collateral management

Brevan Howard is first non-bank caught by margin rules, sources say

Non-cleared exposures thought to exceed $1.5 trillion

Industry seeks smaller ‘big bang’ for margin

New study supports sixfold hike in 2020 compliance threshold to avoid “dormant” margin accounts

Initial margin – Preparing for the buy‑side ‘big bang’

Video Q&A: David White, triResolve

Hong Kong banks fear clashing swaps margin rules

SFC proposal could complicate trades with HKMA-regulated entities and centralised treasuries

Reform fails to solve collateral woes in Korea

Korean swaps users wary of collateral reuse, leaving dealers with LCR burden

Safeguarding liquidity in a changing environment

Nick Gant, head of fixed income prime brokerage for Europe, the Middle East, Africa and Asia-Pacific at Societe Generale Prime Services, discusses banks’ evolving responsibilities for providing liquidity in a post-financial crisis environment in which…

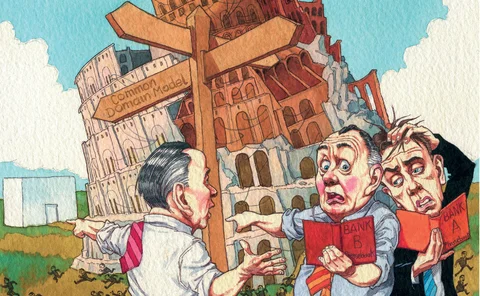

The battle for the back office

Post-trade incumbents at risk as Isda and others search for standards

Breaking the collateral silos – Navigating regulation with a strategic alternative

Emmanuel Denis, head of tri‑party services at BNP Paribas Securities Services, discusses why financial institutions must rethink old practices of collateral management and instead adopt a tri-party approach, with which equities can be managed as…

Isda’s O’Malia: back-office costs are ‘killing’ swap dealers

Banks set to begin testing Isda’s common domain model for trade lifecycle processes

LCH margin changes to ease funding stresses, say FCMs

Clearers welcome move to free up excess cash margin and remedy ‘double-dipping’ complaints

Asian buy side faces non-cleared margin currency penalty

Global banks charge premium for accepting local securities instead of major currencies

Esma backtracks on account segregation

Status quo protected for rehypothecation of collateral in tri-party, securities lending and prime brokerage

BNY Mellon’s Neal on funding, liquidity and collateral

Markets head Michelle Neal says firm has “big responsibility” after JP Morgan’s tri-party repo exit

Effective collateral management strategies

Sponsored webinar: Calypso

Exploring a new frontier: Using cognitive technology to strengthen credit risk management

Content provided by IBM

Risk Chartis Market Report: Buy-side risk management technology

Sponsored by OpenLink and Tradeweb

Non-cleared margin requirements: The top five considerations

Sponsored feature: TriOptima

Derivatives start-up aims to cut costs at margin hub

Ex-Morgan Stanley bankers’ offering aims to reduce daily collateral flows that currently top $200bn

Custody Risk announces shortlist for Global Awards 2016

Shortlist for the Custody Risk Global Awards 2016 is published

An imperfect solution: Derivatives create new challenges for buy side

Sponsored survey analysis: Calypso Technology

Eurex describes its new ISA Direct platform

Sponsored video: Eurex Clearing

Tackling buy-side OTC derivatives challenges: Regulations, risks and collateral management

Sponsored webinar: Calypso

Custody Risk announces shortlist for European Awards 2015

Preliminary shortlist for the Custody Risk European Awards 2015 is published

Collateral option valuation made easy

Vladimir Sankovich and Qinghua Zhu develop a method to value cheapest-to-deliver option embedded in CSAs