CCP

WHAT IS THIS? A central counterparty (CCP) manages default risk by collecting initial and variation margin from both parties to a trade. Spill-over losses are absorbed via a default fund to which all members contribute – introducing a degree of mutualised risk – and by the CCP’s own capital. The concept is an old one that was extended to over-the-counter derivatives in the aftermath of the financial crisis.

European legislators squabble over Emir

The derivatives catch-all

Unlevel playing field for CCP members concerns banks

Under the bar, over the top?

Dealers resigned to CCP competition in Asia

Gaining interest

Polish OTC clearer aims for 2012 launch as Europe fragments

Another central counterparty plans to launch in Europe, starting with zloty-denominated interest rate swaps

CFTC urged to raise bar for CCP stress tests

Market participants say CFTC proposals should be more detailed, more prescriptive

EU Council leans towards special treatment for FX

Industry's concerns starting to be reflected in legislation proposals

Basel Committee may adjust 'blunt' CCP default fund capital

Netting treatment in controversial current exposure method is up for discussion at an April stakeholder meeting, but regulators reject other criticisms

Clearing back-loading provision removed from latest EU Council text

Council removes back-loading provision in Emir proposal

SGX could expand clearing to Australia post ASX merger

SGX could expand its OTC clearing service to the Australian market once a decision has been made on a merger with ASX, but it also plans to add new currencies and asset classes – including forex forwards

CPSS-Iosco proposes risk standards for CCPs

Central counterparties should be ready for failure of one or two largest customers, regulators suggest

Sovereigns wrestle with debt impact of CSAs

Kiss of debt

Voluntary commitments take back seat to Dodd-Frank

Losing commitment

Multi-currency CSA chaos behind push to standardised CSA

The evolution of swap pricing

CLS considers membership category for CCPs

"Allowing CCPs to settle FX trades bilaterally would reintroduce Herstatt risk, so it would certainly be preferable to have CCPs become either direct or third-party members of CLS," says LCH.Clearnet executive

Nasdaq OMX to launch Nordic swap CCP

Stockholm-based service already has Swedish debt office on board. Launch planned for second half of 2011

Fed’s Tarullo outlines OTC derivatives reform agenda

Federal Reserve governor Daniel Tarullo stresses importance of central counterparties, close scrutiny of market participants

CLS committed to settlement risk mitigation under new regulations

68% of respondents to FX Week online poll believe CLS should be central clearer for FX products, but CLS insists it remains focused on mitigating settlement risk

Draft European clearing rules threaten Eurex business model

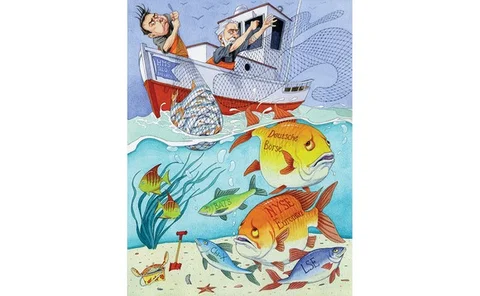

Analysts warn Council of the European Union proposals could hurt trading revenues at Eurex, as its owner, Deutsche Börse, pursues merger talks with NYSE Euronext

Langen report: clearing rules will only apply to new trades

European Parliament calls for existing derivatives trades to be excluded from clearing rules, but proposes wider exemptions for public-sector bodies

Central banks accused of collateral hypocrisy

Despite the funding risk it creates, central banks still refuse to sign two-way collateral agreements

Regulation

Special report

A clash over CCP membership

Caps in hand?