CCP

WHAT IS THIS? A central counterparty (CCP) manages default risk by collecting initial and variation margin from both parties to a trade. Spill-over losses are absorbed via a default fund to which all members contribute – introducing a degree of mutualised risk – and by the CCP’s own capital. The concept is an old one that was extended to over-the-counter derivatives in the aftermath of the financial crisis.

Technology

Systems check

Proliferation of central clearing in Asia causes tech trials

Technology trials

Derivatives users face tough choices on CCPs

A clear path?

Client clearing poses acute liquidity risks

Margin jump risk

Deconstructing Emir

Deconstructing Emir

Peer review needed to prevent regulatory arbitrage, says AMF

Clearing rules 'won't work' unless US and European regulators can agree on detail, says senior French regulator

The complexity of client clearing

Client clearing complexity

US still has no plans to give Asian sovereigns Dodd-Frank exemption, says Hong Kong regulator

Asian countries are concerned about the lack of Dodd-Frank Act CCP exemptions for sovereigns; proliferation of CCPs carries its own risks, say dealers

More guidance needed from regulators on clearing

Clear guidance?

Buy-side firms urged to avoid stampede to CCPs

Panel participants encourage buy-side firms to engage with CCPs early to avoid a last-minute rush

Central bank liquidity would help CCPs in distressed situations, says BIS

BIS weighs in on CCP central bank liquidity access debate

Client clearing services slowly maturing

A clear path?

Risk institutional investor rankings 2011

A guiding light

Esma gears up for Emir challenge

Esma essentials

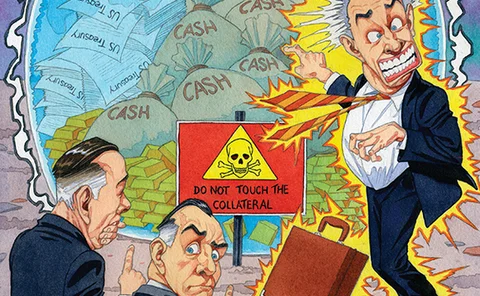

CCPs object to ‘misleading’ Emir collateral clause

CCPs object to Emir collateral clause

Firms face heightened op risk while implementing US CCP rules

Through a glass darkly

Arguments against forex clearing flawed, says Duffie

Foreign exchange forwards and swaps should be cleared under Dodd-Frank despite industry reservations

Exemption clarity allows market participants to prepare for new regime

Banks, market infrastructures and industry associations prepare to move forward with regulatory preparation, now that fx swaps and forwards are set to be exempt

Collateral: look, but don’t touch

Collateral: look, but don’t touch

Inconsistency could lead to arbitrage

Consistency is key

SEC has flexibility on Dodd-Frank implementation, says Schapiro

Collaborating for change

Shift to clearing presents CCP system challenges

A clear challenge