CCP

WHAT IS THIS? A central counterparty (CCP) manages default risk by collecting initial and variation margin from both parties to a trade. Spill-over losses are absorbed via a default fund to which all members contribute – introducing a degree of mutualised risk – and by the CCP’s own capital. The concept is an old one that was extended to over-the-counter derivatives in the aftermath of the financial crisis.

US still has no plans to give Asian sovereigns Dodd-Frank exemption, says Hong Kong regulator

Asian countries are concerned about the lack of Dodd-Frank Act CCP exemptions for sovereigns; proliferation of CCPs carries its own risks, say dealers

More guidance needed from regulators on clearing

Clear guidance?

Buy-side firms urged to avoid stampede to CCPs

Panel participants encourage buy-side firms to engage with CCPs early to avoid a last-minute rush

Central bank liquidity would help CCPs in distressed situations, says BIS

BIS weighs in on CCP central bank liquidity access debate

Client clearing services slowly maturing

A clear path?

Risk institutional investor rankings 2011

A guiding light

Esma gears up for Emir challenge

Esma essentials

CCPs object to ‘misleading’ Emir collateral clause

CCPs object to Emir collateral clause

Firms face heightened op risk while implementing US CCP rules

Through a glass darkly

Arguments against forex clearing flawed, says Duffie

Foreign exchange forwards and swaps should be cleared under Dodd-Frank despite industry reservations

Exemption clarity allows market participants to prepare for new regime

Banks, market infrastructures and industry associations prepare to move forward with regulatory preparation, now that fx swaps and forwards are set to be exempt

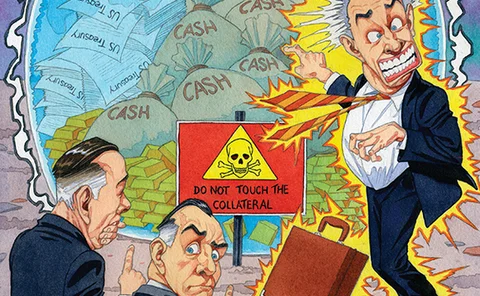

Collateral: look, but don’t touch

Collateral: look, but don’t touch

Inconsistency could lead to arbitrage

Consistency is key

SEC has flexibility on Dodd-Frank implementation, says Schapiro

Collaborating for change

Shift to clearing presents CCP system challenges

A clear challenge

Video: Industry executives consider future of derivatives market

Isda's Conrad Voldstad, along with Credit Suisse's Eraj Shirvani and Stephen O'Connor of Morgan Stanley discuss the near future for the derivatives industry

CFTC and SEC could diverge on rules, says Schapiro

SEC chair says Dodd-Frank Act should be adapted to fit markets

Video: Algorithmics' Michael Zerbs on the ‘unintended consequences’ from Basel III

Algorithmics' president and chief operating officer Michael Zerbs talks about the long-term impact of moving from Basel II to Basel III, including some 'unintended consequences' likely to emerge from the move to central clearing as well as the specific…

Isda AGM: dealers, CCPs debate risks of lowering bar to entry

Weaker clearing members could be overstretched by a crisis, dealers warn - but LCH.Clearnet and CME differ on the risk of wider access

Isda AGM: Esma committed to G-20 clearing deadline, says Maijoor

New authority will conduct cost-benefit analysis to decide which derivatives should be cleared - but G-20 deadline is not negotiable, says Esma chair in first public speech

Isda AGM: clearing regionalisation comes with costs, warn Shirvani and O'Connor

Outgoing and incoming Isda chairs warn multiple CCPs with divergent standards will threaten market liquidity

Isda AGM: regulators must work together to avoid fragmented market, warns Credit Suisse’s Rohner

Institutions will be weaker and markets will be riskier if new rules vary between jurisdictions, Credit Suisse vice-chair warns

Isda AGM: industry getting to grips with nuts and bolts of reform

No-one’s talking about existential threats to the derivatives market any more – but the more practical questions that have now taken centre stage may prove harder to resolve