CCP

WHAT IS THIS? A central counterparty (CCP) manages default risk by collecting initial and variation margin from both parties to a trade. Spill-over losses are absorbed via a default fund to which all members contribute – introducing a degree of mutualised risk – and by the CCP’s own capital. The concept is an old one that was extended to over-the-counter derivatives in the aftermath of the financial crisis.

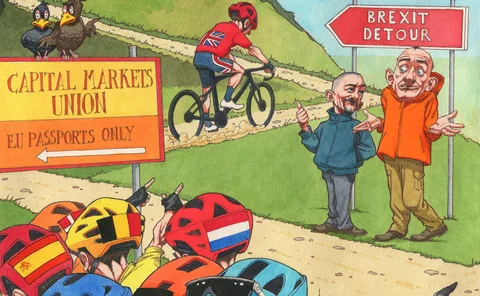

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

ECB mulls wider clearing house access to account facilities

Including CCPs in the Eurosystem may remove the need for them to seek a banking licence

Dealers cast doubt on swaptions compensation plans

Redress scheme for victims of post-Libor valuation change may fail due to “cherry-picking” fears

CME, Eurex rebuff calls to compensate members for losses

BlackRock and BNP want CCPs that recover from a default to reimburse members and clients

Clearing members in cash clash with Apac CCPs

Banks and clearing houses wrangle over who should pay for losses on invested collateral

BNP leads a comeback for Europe’s clearers

Brexit, leverage ratio tweaks and concentration fears could help European banks compete with US FCMs

Interdependencies in the euro area derivatives clearing network: a multilayer network approach

This paper provides insight into how the collected data pursuant to the EMIR can be used to shed light on the complex network of interrelations underlying the financial markets.

Credit data: a sharp turning point in CCP credit risk

The credit risk of CCPs is worsening, even as margin requirements rise, writes David Carruthers

Watch out for Brexit cliff edge 2.0, experts warn

Measures to mitigate a sharp rupture for financial services could be less likely at end-2020

Supervisory stress testing for central counterparties: a macroprudential, two-tier approach

This paper examines the role of supervisory stress testing of central counterparties (CCPs). A key message is that the design of supervisory stress tests (SSTs) should be tailored to CCPs’ roles, risk profiles and financial structures.

OCC updates default auction rules to encourage buy-side bids

Clearer’s proposed changes follow client fears of being locked out

LCH targets hardwired pre-cessation triggers

Proposal aims to align transfer pricing for cleared and bilateral markets in the event of split on ‘zombie Libor’ triggers

EU council dials back on margin haircuts for CCP resolution

Lawmakers close avenues for regulators to dip into non-defaulting members’ initial margin

Signing the Libor fallback protocol: a cautionary tale

As Orwell’s Room 101 beckons for Libor publication, muRisQ Advisory’s Marc Henrard warns of a potential pitfall in the fallback protocol

Inside top CCPs’ default funds

Central banks favoured by CCPs to hold default resources

Podcast: Andrew Dickinson on CCPs’ defence mechanisms

Trades’ size limits, membership rules and more transparency key to avoid another CCP default

CCP risks, Sonia shift and CVA carve-out

The week on Risk.net, January 4–10, 2020

European CCPs home to 241 non-bank clearing members

Majority of non-financial counterparties are energy and power firms

Small, speculative clearing members – are they worth the risk?

CCPs need new tools to scrutinise their members, for everyone’s good health

Volume pop leads to higher IM at Ice Clear Europe CDS

Open interest in CDX contracts increased 78% in first nine months of 2019

One bad apple: default risk at CCPs

One clearing member's disproportionately large position increases the credit risk for all CCP members

JSCC caps member cash calls, revamps futures margin model

Clearing house set to end unlimited default fund top-ups for futures clearing

IM calls rocket at LCH’s repo service in Q3

Peak aggregate initial margin call of €462 million in third quarter

SwapClear model update causes IM hike

Maximum aggregate IM call for Q3 was £3.7 billion