Central banks

Fed fractures post-SVB consensus on emergency liquidity

New supervisory principles support FHLB funding over discount window preparedness

Hawkish RBA comments wrong-foot Aussie dollar rates traders

Governor Bullock’s unexpected rate hike talk led to stop-outs and losses

12 angry members: why dissent is growing on the FOMC

Hardening views on wisdom of further cuts mean committee’s next meeting is unlikely to be harmonious

Hedge funds cut BoJ bets after torrid year in yen rates

Dealers see lighter positioning after shock October election saw more than $300m of losses, compounding April’s pain

Deep water waves: accelerating, broadening, consequential

Factors that will impact investment returns over the next decades, the interplay between them and their likely impact on investment outcomes

Talking Heads 2025: Who will buy Trump’s big, beautiful bonds?

Treasury issuance and hedge fund risks vex macro heavyweights

BoE plans system-wide test on private credit risks

Bank aims to probe market after First Brands and Tricolor collapses raise alarms about subprime lending

Fed official dismisses de-dollarisation talk

Speakers at IIF conference believe dollar selloff is cyclical rather than a structural decline

US banks’ cash holdings jump $79 billion in Q2

Cash reserves up 4%, in biggest rise since 2023

Low-vol gold rush points to further upside

Options markets see no scramble to chase metal higher despite 43% year-to-date rally

The ‘get-out-of-debt’ card that may worry bond investors

A new paper analyses the controversial tool that governments may be forced to deploy to control borrowing costs

Why flows now rival fundamentals

Geography and market sentiment are having profound impacts on price action, says LMAX’s head of FX data

Sharper economic picture sets scene for dollar swaps rebound

Razor-thin bid/offer spreads and slim post-April trading volumes give way to an uptick in August

How much do investors really care about Fed independence?

The answer for some is more nuanced than you might think

BoE’s Benjamin on non-bank liquidity and market resilience

Why the UK central bank’s financial stability head is considering further reforms to the gilt market

Elizabeth McCaul on supervision, new macrodynamics and investing in suptech

Former ECB Supervisory Board member speaks about the Covid-19 and Credit Suisse shocks, regulation debates, the rise of non-banks and what makes tech projects succeed

Judy Shelton on gold, tariffs and where the Fed went wrong

Potential successor to Jerome Powell makes the case for cutting rates and tamping down dollar volatility

Central bank watch: Biased to ease, for now

A mid-year review of the monetary policy outlook for G10 central banks, India, China and South Korea

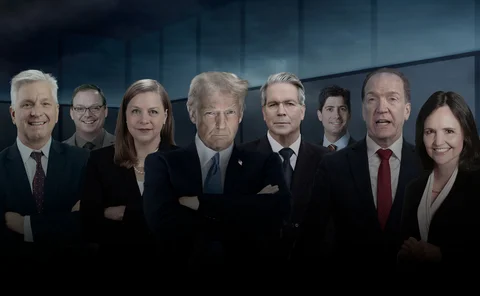

Fed succession planning: will Trump stick to the script?

The race to succeed Jerome Powell as head of the world’s most powerful central bank has already begun

Let’s speak the same language: a formally defined model to describe and compare payment system architectures

The authors propose a means with which to represent and compare three key functions of payment system architectures: issuance/withdrawal, holding and transfer of funds.

BoE analysis sparks debate over reuse of repo collateral

Central bank policy analyst contends reuse of collateral may amplify volatility in repo rates