Bonds

One man’s trash is another man’s Treasury

With yields at record lows, investors are asking how much protection bonds will offer in a future crisis

Bailed-out basis traders face regulatory backlash

The cash/futures basis trade could be a test case for regulating systemically risky activities

Cross-border bank loans fizzled in Q2 as bonds soared – BIS

Outstanding dollar-denominated bonds climbed 4% over Q2

First Ameribor bond bolsters SOFR alternative

Signature Bank sets sub debt milestone for aspiring Libor replacement; swaps expected to follow

Citi turns to fintech to boost FCM interest income

Clearing giant is optimising its treasury function to combat low rates and CCP fee hikes

Euribor fallback consultation set for November

ECB’s Holthausen raises concerns over inclusion of non-existent term €STR as safety net for euro contracts

FX swap volumes set to rise on China bond index inclusion

Traders expect greater use of FX derivatives if FTSE Russell adds bonds to WGBI this week

Bonds go back to the future as electronic volumes grow

Surge in bond ETFs and portfolio trades accompanies investor return to platforms

Friary deal clears path for Sonia switch revival

Consent solicitation for Libor-linked pass-through notes is first transition test for variable-duration instruments

Hong Kong plots Honia-linked floater debut

Central bank hopes floating rate note sale will kick-start new debt market linked to risk-free rate

France, Germany lead EU on MREL debt sales

French banks account for 27% of total bail-in bond issuances

Dealers vie with Markit to electronify bond issuance

Competing platforms could split the market for new issuance in Europe and the US

Covid recession makes US insurers’ junk bond piles riskier

About $227.5 billion of firms’ debt holdings are BB+ rated or lower

Eurozone funds charged into overseas debt in Q2

Net purchases almost reversed the first quarter’s fire sale

Covid liquidity, block trades and Fed op risk

The week on Risk.net, August 1-7, 2020

Why Asia needs to talk about SOFR

Focus on local benchmark reform is “distracting” Asia’s preparations for the end of USD Libor

Asia debt market suffers SOFR inertia

Issuers of floating rate notes stick with Libor in absence of term version of risk-free rate

Term SOFR rate still possible this year, benchmark firms say

Administrators target year-end benchmark trials despite low swaps liquidity

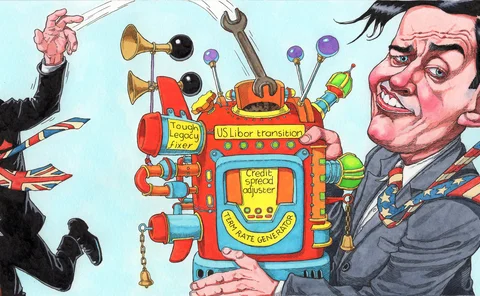

UK’s tough legacy fix spells trouble for US Libor transition

FCA will have little control over how synthetic Libor rates are used in other jurisdictions

Altman: mega-bankruptcy wave coming

Credit conditions were worsening before Covid, research finds

‘Improving’ Mifid post-trade transparency splits markets

Mooted changes to Europe’s transparency regime are dividing markets – largely along functional lines

SocGen’s digitised bond passes settlement test

Banque de France-backed deal pips private consortiums in dummy run for digital currency trades

Volatility scaling flops in credit alt risk premia

Strategies miss recovery from March plunge, prompting rethink on speed of mean reversion

Covid-19 and the credit cycle

The Covid-19 health crisis has dramatically affected just about every aspect of the economy, including the transition from a record long benign credit cycle to a stressed one, with still uncertain dimensions. This paper seeks to assess the credit climate…