Benchmark

Hedge funds boost new Tona futures market

Arbitrageurs said to be behind early trading as contracts tipped to prove useful for US buy-siders

Banks mull structured notes as term SOFR basis hedge

ARRC signals opposition to passing term SOFR-SOFR basis risk to investors via structured payoffs

Long-end euro swap pricing anomaly remains largely untapped

Deviation in swap curve attracts limited interest because of regulatory and pension reform barriers

Regional banks face soaring term SOFR spreads

Bid/offers hit 10bp as dealers price counterparty risk into non-cleared Libor transition trades

Easing of trading curbs is no quick fix for term SOFR swaps

ARRC’s new guidelines will do little to improve liquidity, but may keep a lid on spiralling basis

Fed’s Bowman confirms interdealer term SOFR ban

Isda AGM: Further softening ruled out after April reprieve lifts curbs on term SOFR basis swaps

FRA-OIS demise leaves hole in bank treasury risk management

Banks now face ‘greater downside’ to widening credit spreads

Tradeweb lodges MAT application for SOFR and Sonia swaps

If accepted by the CFTC, trades referencing the benchmarks must be traded on-Sef from June 1

Emmi seeks to ditch ‘expert judgement’ in Euribor overhaul

Q3 consultation would centralise Level 3 submissions with administrator in bid to expand panel

Is Euribor on borrowed time, or here for the duration?

As €STR gains traction, traders are still hedging their bets on a euro benchmark transition

Strict term SOFR trading rules ‘permanent’, says Fed’s Bowman

Official says restrictions on use of term SOFR swaps “should not be expected to change”

Refinitiv’s FXall launches automated forward fixing tool

New service offers asset managers automatic competitive pricing for a benchmark trade’s forward points

Term SOFR trading ban remains as easing talks collapse

Fed working group resolute on interdealer trading restrictions despite looming capacity crunch

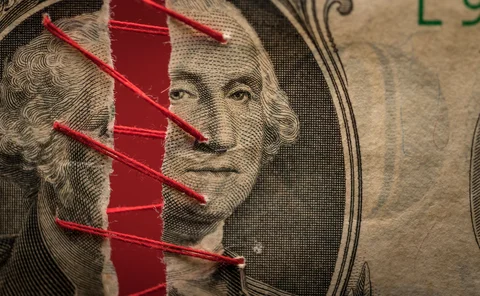

Swaps market braces for $60 trillion Libor conversion

Staggered timeline should smooth transition, but scale of the switch still presents challenges

Foreign banks set to boost onshore Korean won trading

Plans for longer trading hours and more open interbank FX market will stoke KRW hedging demand

NY Fed paper warns of systemic risks from SOFR credit lines

Stress tests need to account for credit facilities being “drawn to the limit”, says Stanford’s Duffie

CMS pricing: overdue annuities

An RFR-based pricing and risk management model for CMS and its derivatives is presented

Data shines light on Tibor fragility

Lack of actual transactions in D-Tibor should be considered in fallback discussions

ECB group sounds alarm on ‘sluggish’ Euribor

Money market participants question robustness of key eurozone rate after methodology changes

Canada approves term Corra rate

CARR restricts use cases but mulls allowing interdealer hedging of derivatives on new benchmark

Libor Act leaves door open for synthetic rate in US contracts

Absence of proposed limit protects borrowers from sky-high prime rate but may irk some investors

S&P Indices versus Active (SPIVA): institutional scorecard

How well do actively managed equity funds stack up against their index benchmarks over short- and long-term periods?

ARRC’s trivial fight over term SOFR use

Toyota’s ABS deal should not derail effort to expand use of term rate in derivatives

SOFR remains elusive in US dollar collateral agreements

Derivatives users slow to amend CSAs amid market volatility and looming Libor deadline