Benchmark

Libor/SOFR basis like ‘free money’ for early movers – GS trader

Sharp narrowing of basis swaps below fallback spreads has failed to open transition floodgates

EC official signals ‘preference’ for synthetic US Libor fix

UK regulator has resisted calls for a synthetic fallback for legacy dollar contracts

Calls grow to ease restrictions on term SOFR derivatives

Ban on interdealer trading is raising costs for end-users transitioning from Libor, banks say

JSCC swap surge triggers plea to rethink US client ban

With over two-thirds of yen RFR swaps volumes going to JSCC, calls grow for CFTC to ease clearing restrictions

ORX to launch controls benchmarking service

App will be delivered via start-up tech platform led by former HSBC op risk chief

Cross-currency’s €STR switch may hasten Euribor demise

Rising cost of issuer cross-currency hedges could spur greater adoption of euro risk-free rate

Benchmark challenges inhibit crypto adoption

Without authoritative reference pricing, users may struggle to value assets and assess execution, traders say

CME to reinforce term SOFR with swap inputs

Inclusion would leapfrog a 25% OTC liquidity threshold embedded in methodology

A second term SOFR: help or hindrance?

Ice launches CME rival as fallback for loans but market ambivalence may put endorsement out of reach

Regional banks lead charge into term SOFR

Forward rate is favoured by smaller lenders and is increasingly used in caps and floors

Avoid the rush: don’t let UMR implementation for phase six catch you off–guard

With firms soon to be subjected to phase six of the uncleared margin rules (UMR), the implementation of phase five has taught a series of valuable lessons. Firms must grasp the complexity of the processes and ensure they are prepared in time for…

High rates offer an opportunity for Singapore’s benchmark transition

Rising interest rates should speed the transitioning of legacy SOR loans – but there is little time to spare

How Russian stocks still meet EU rules for ‘good governance’

Loose SFDR definitions leave room for Russian state-owned firms to remain in article 8 funds

Barclays, HSBC held $12trn of Libor swaps on eve of cessation

Both banks made significant progress over 2021, but more remains to be done

For corporates, Sora seems to be the hardest word

Singapore is facing challenges adapting to new overnight lending rate, but progress is being made

Fillip for credit-sensitive rates as Axi, Critr advance

IHS Markit makes benchmarks available for live products; Invesco appointed as Axi administrator

Technology vendor of the year: Bloomberg

Risk Awards 2022: Data giant delivered risk analytics, while playing key role in Libor transition

Exchange of the year: Intercontinental Exchange

Risk Awards 2022: Amid Brexit and benchmark transition, Ice fulfils Abu Dhabi exchange ambition

Innovation in technology: International Swaps and Derivatives Association

Risk Awards 2022: Isda takes a fintech turn with quant analysis tool Perun, leveraging data standards legacy

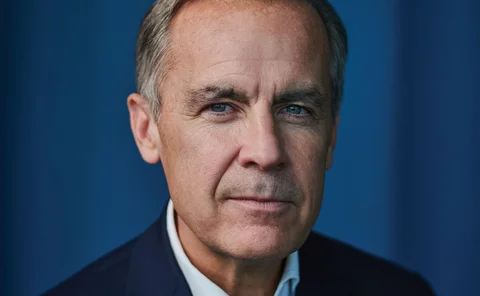

Lifetime achievement award: Mark Carney

Risk Awards 2022: The calm at the eye of the storm of post-crisis regulation and climate risk management

Banks rely on clients to police US Libor ban

Dealers say it’s “impossible” to verify end-user compliance with narrow Libor exceptions trade by trade

Canada looks beyond bankers’ acceptance market in rate reform

Banks “moving away” from antiquated lending practice that is a key input for CDOR benchmark

Regulatory straitjacket adds $7bn to Danske’s credit RWAs

Remedials to improve internal models push total RWAs up 5%

Investors shun Chinese bonds favoured by biggest benchmarks

Indexes are increasing their allocation to China, but European investors want climate action first