Algorithmic trading

Club rules? How German retail trading venues shut out PTFs

Murky rule books prevent non-bank market-makers from competing for Europe’s growing online customer demand

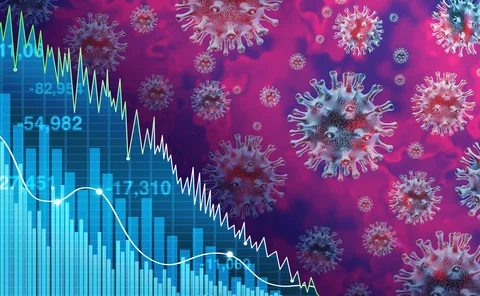

Reading between the fines: a deep dive into financial institution penalties in 2022

Fenergo’s latest research report on financial institution penalties in 2022 is available now. Key analysis shows that fine values in Apac were just 0.77% of what they were in 2021

P2P platforms look to bring banks into the fold

The USP of peer-to-peer FX matching venues is that they cut out the middleman. So why are they now inviting them in?

Treasury traders remain wary about adopting algos

Yet proponents insist US government bond market is ‘ready for disruption’

New buy-side tools seek to break grip of bank FX algos

Proprietary algorithms come of age to provide alternatives for the buy side

ANZ defies ‘white label’ trend with algo expansion

Instead of relying on large LPs, Australian bank aims to offer six new FX algos of its own by February

Can algos collude? Quants are finding out

Oxford-Man Institute is among those asking: could algorithms gang up and squeeze customers?

Complying with climate risk framework standards for streamlined processes

Conscious that climate change affects all sectors of the economy, financial institutions are realising the significant impact this will have on their customers and, ultimately, their own profit margins.

Deutsche Bank set to expand Pro algo into FX swaps

German bank’s principal resting order algorithm should support swap clients in 2023

Podcast: Leveraging real‑time data feeds for faster business decisions

The markets have been on a very volatile ride in 2022, which makes low-latency data more crucial to the business

Enhanced expected impact cost model under abnormally high volatility

The authors extend their impact cost model beyond the typical factors to address the larger transaction costs brought on by stock market crowding effects in times of market turbulence.

Alternatives to deep neural networks in finance

Two methods to approximate complex functions in an explainable way are presented

Talking Heads 2022: Rates market ruckus

Inaugural interview series looks at how sell-side traders are adapting to a world of surging inflation and rates

A child of inflation: BNPP’s new macro trading unit

Talking Heads 2022: Currency and rates traders join forces at French bank as it plans to bring FX algos to US Treasury bonds

Barclays confronts ‘implausible’ macro risks

Talking Heads 2022: Bank is reaping rewards of sticking with its trading businesses, says macro head Lublinsky

Goldman’s rates traders have been crowd-watching

Talking Heads 2022: Steepener unwinds in sterling were “canary in the coalmine”, says rates trading co-head

Linking performance of vanilla options to the volatility premium

A framework to account for vanilla options' performance in trading strategies is presented

Banks prepare to unleash FX swap bots

BNP Paribas, JP Morgan build execution algos to plug into platforms – but swaps liquidity needs to catch up first

Systematic hedge funds eye outsourcing to bank algos

Cost pressures encourage new stream of clients to pass FX algo trading to banks

Case study: Rabobank achieving strategic transformation with Murex MX.3

Crises throughout the last decades have led financial institutions to seek, devise and implement solutions to lower the cost of their operations, focus on their core businesses and speed up their go-to-market innovation

The landscape ahead for FX options desks: a Murex expert series

FX options desks face an increasingly complex and demanding context. The challenges they confront necessitate automation, digitisation, proper risk and lifecycle management and sophisticated, leading analytics

‘Corrective’ algo tells quant firm when it’s wrong

QTS has built a machine to show whether a strategy is likely to succeed or flop

Flow Traders to offer prices on first bond market run on DLT

The first bond market run on a private blockchain gives non-banks an opportunity to take market share

Banks turn to analytics playbook to take on FX platforms

Dealers aim to lure clients from high-fee multi-dealer platforms with improved investment analytics