Risk magazine

The swaps carve-out conundrum

Section 716 of the Dodd-Frank Act will force swap dealers to hive off certain derivatives businesses into separate affiliates. But the legislation is fiendishly complicated, riddled with oversights and requires daring interpretative leaps, which has left…

The end for one-way CSAs

Sovereign derivatives users have been able to avoid posting collateral to their dealer counterparties in the past, but pending reforms to bank capital and funding rules are changing the equation. If sovereigns refuse to budge, they will have to accept…

Basel CVA changes criticised

The Basel Committee on Banking Supervision has adapted its proposals for a capital charge on counterparty risk following industry feedback, but banks were hoping supervisors would go further. By Mark Pengelly

Surviving the liquidity squeeze

Excess liquidity in the euro funding markets halved at the beginning of July, causing Eonia to leap higher. The extent of the move surprised traders and caused problems for some participants. Christopher Whittall reports

Saying no to algos

A number of banks have launched algorithmic trading systems for foreign exchange, intended to provide more efficient execution for clients. But some question whether algorithmic models are actually needed in the highly liquid foreign exchange market. By…

Playing on forex correlation

The eurozone crisis sent market participants scrambling to put on macro hedges. A popular trade was to short the euro, but with the cost of this strategy escalating, some turned to correlation products. By Christopher Whittall

Lufthansa wary of OTC regulations

Corporates across the globe have lobbied to ensure end-users are not subjected to new clearing requirements for derivatives. For Lufthansa’s treasury department in Frankfurt, ensuring it is able to continue to hedge its foreign exchange and interest rate…

Bespoke solutions for an Islamic CSA

Islamic derivatives users are still getting to grips with a new sharia-compliant master agreement, but some argue the market will be stunted without an accompanying collateral document. Lawyers say that is some way off, so they’re cooking up bespoke…

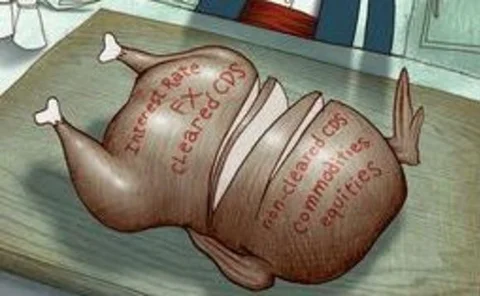

Clearing dilemma for CCPs

Dealers have made progress towards clearing swaths of the over-the-counter derivatives market. But market participants are likely to have to clear more awkward products to satisfy regulators’ demands. Mark Pengelly investigates

Equity volatility backlash

Taking a long equity volatility position is a favourite macro hedge for risk managers and traders across asset classes, but the trade doesn’t always work as expected. How has the volatility experienced in May and June affected macro hedging? Joel Clark…

A focus on gone-concern contingent capital

Regulators have found it easier to reach consensus on a standard for contingent capital that converts at the point of a bank’s insolvency, but continue to struggle with the definitions for going-concern conversion. How will supervisors proceed? Joel…

Liquidity takes centre stage for banks and regulators

Regulators and banks have increased their focus on liquidity risk management significantly since the crisis. William Perraudin discusses some of the possible implications

Organisational aspects of risk management

In the last of this four-part series, David Rowe looks at organisational issues and argues the chief executive and board must accept responsibility for strategic risk management decisions

Scor looks to Solvency II

Philippe Trainar, chief risk officer at Scor, talks to Alexander Campbell

State Street advises institutional investors to move away from modern portfolio theory

New report suggests investors should move away from using normal return distributions under modern portfolio theory

Citi hires Margolis from Goldman Sachs

Latest hire in a series of senior appointments to the firm's FX business

Morgan Stanley is mystery buyer of Natixis CDS portfolio

Morgan Stanley is said to have acquired the bulk of an €8.6 billion portfolio of complex credit derivatives from Natixis last month.

Bear bailout vehicle turns first paper profit

Federal Reserve balance sheet data shows Bear Stearns’ assets held in Maiden Lane vehicle made a paper profit for first time since its inception

Global Custody Survey 2010

2010's Global Custody Survey paints a positive picture for market participants as assets under custody rise for the majority of respondents. Sophia Morrell reports.

First FSAP for US flags commercial real estate woes

The US banking system at risk from commercial real estate woes, the IMF’s first Financial Sector Assessment Programme says

Robeco: Bond ETFs hampered by low liquidity

Illiquidity in corporate bond markets make it hard for firms to generate index-like returns

Cesr reveals European financial markets risks, including double-dip recession worry

The Committee of European Securities Regulators (Cesr) has made public for the first time its analysis of trends, risks and vulnerabilities in financial markets