Operational risk

Sigor consults on new AMA supervisory guidelines

AMA range of practices tackled in new Sigor paper.

Industry doubts disclosure will drive remuneration reform

Think tank CSFI unsure of merits of transparency as focus on remuneration grows

SocGen studies hedge fund fraud to reduce risk

French bank completes statistical study on statistical properties of fraudulent funds

UK government responds to industry criticism of regulatory restructure

HM Treasury issues consultation summary on proposed changes to financial oversight in UK

FSA forced to admit 96 staff exits in Q3

UK regulator admits it lost staff in the third quarter of 2010.

Inefficiency in reporting costing institutions more than 700 days a year

Consultancy says duplication of reporting and poor compliance oversight is costing banks massively

Types of operational risk loss by event, October 2008 to October 2010

As in August, most losses in October fell into the ‘Clients, products and business practices’ category

A comprehensive risk and control self-assessment methodology

How to take control

Marco Moscadelli: The Bank of Italy man

After 20 years at Italy’s central bank, Marco Moscadelli knows his country’s banking industry well. But this hasn’t narrowed his focus, and pivotal roles on European supervisory bodies have also given him a say on how the operational risk is approached…

Shining a light on the flash crash

Flash cordons

The top 10 operational risks to watch in 2011

Batten down the hatches

Sponsored feature: The fight against financial crime – a post-crisis response

The fight against financial crime – a post-crisis response

Dodd-Frank slows down full implementation of Basel II

Contradictions in the US regulations slowing down exit from Basel II parallel run

Sponsored feature: The ultimate risk – flawed liquidity risk management

The ultimate risk – flawed liquidity risk management

Compensation: A political problem

Rulemakers are falling over themselves to introduce measures to link remuneration more closely with risk, in an effort to appease an irate public. But will their new rules work in practice, and will they have the desired effect of making compensation…

Basel provides guidance on the use of insurance as a mitigant

Insurance covered

Ghost brokers busted by UK Fraud Bureau

UK trio charged with insurance and tax fraud as well as money laundering

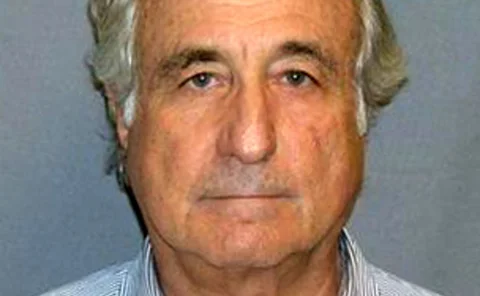

Two former Madoff employees arrested and charged with fraud

Madoff employees charged with creating false documents and trades, and misleading investors

IRS drops lawsuit against UBS on US tax evasion

UBS evades prosecution for tax evasion as US IRS drops charges

Hong Kong's SFC hands lifetime ban to jailed asset manager

Hong Kong managing director of Crown Asset Management banned from industry for life

Former Société Générale trader found guilty of HFT code theft

Samarth Agrawal on trial in Manhattan for theft of proprietary computer code from French bank

South Korea regulator to investigate potential 'unfair selling' by Deutsche

Deutsche Bank under scrutiny by the Financial Supervisory Service for alleged unfair selling

Buckingham settles with SEC over charges of information misuse

Capital management firms settle with SEC over failing to prevent misuse of non-public information