Credit risk

The T. ROWE method

profile

Crisis of correlation

Cover Story

RiskNews

RiskNews

At long last...

Risk Analysis

Coping with copulas

Book review

Financial alchemy

Relative value

Modelling counterparty credit exposure for credit default swaps

Modelling counterparty credit exposure for credit derivatives is more complicated than for non-credit products, since the reference credit and counterparty can exhibit positive default correlation. Here, Christian Hille, John Ring and Hideki Shimamoto…

Plugging the gaps

Italian banks have overhauled the risk management of their loan portfolios. But weaknesses still remain, particularly in the area of risk-adjusted pricing and credit risk transfer. Rachel Wolcott looks at what steps Italy’s banks are taking to fill the…

Taking the option of profit by default

derivatives

Modelling counterparty credit exposure for credit default swaps

Modelling counterparty credit exposure for credit derivatives is more complicated than for non-credit products, since the reference credit and counterparty can exhibit positive default correlation. Here, Christian Hille, John Ring and Hideki Shimamoto…

A Markovian approach to modelling correlated defaults

Vladyslav Putyatin, David Prieul and Svetlana Maslova unveil a simple dynamic binomial credit model with a Poissonian mixing distribution to satisfy the constraints faced by financial institutions assessing their credit exposure in a consistent manner…

Optional extras

credit options

How shock-proof is the market?

event risk

Spitzer probe threatens MBIA bond guarantees

insurance sector

Benefiting from credit

Credit

Is the market equipped for the next LTCM?

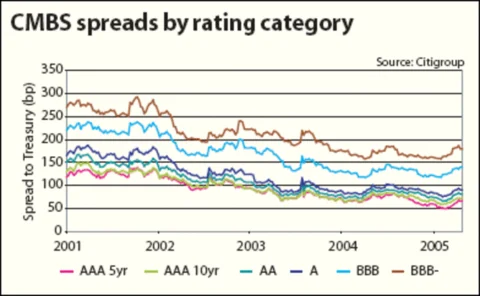

trends in credit

New demand stokes red-hot loan market

loan market

The all-Asian CDO

Asian credits

Tailor-made CDOs for all

Commoditising CDOs

Domestic bliss...at a price

Home currency CDOs

A new hemisphere

Profile

Plugging the gaps

Portfolio management