Credit risk

The keys to CDS success

Electronic trading

Time for multi-period capital models

Several financial institutions use single-period models to determine their credit portfolio loss distribution, calculate their loss volatility and assign economic capital. Here, Kevin Thompson, Alistair McLeod, Panayiotis Teklos and Shobhit Gupta…

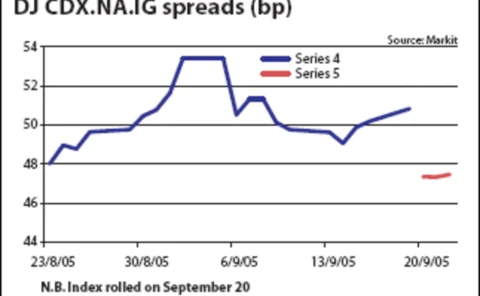

Tranche value on a yo-yo

Correlation trading

RiskNews

RiskNews

Recovery swaps trading on the rise

New angles

Weapons for mass construction

Supranationals

New auction to solve settlement woes

New angles

Risk's CreditRisk Summit 2005: Bottom-of-the-cycle LGD criticised

Speaking yesterday at Risk 's CreditRisk Summit USA, Bogie Ozdemir, a New York-based senior director in the risk solutions group at Standard and Poor’s, argued that Basel II’s suggested approach to defining loss-given-default (LGD) can lead to an overly…

Thomson launches online CDS market-place

US market operator Thomson TradeWeb has opened its TradeWeb CDS online credit default swap market-place for business, with eight dealers already members.

Sponsor's Event> Algo Capital and Credit Forum 2005

Basel II and today’s market landscape make it essential for financial institutions to manage risk and capital in a systematic and transparent manner across the enterprise.

Under Scrutiny - Regulators focus on credit

Well-publicised risk issues and a recent growth spurt have brought credit markets firmly under the scrutiny of global regulators. Nikki Marmery investigates whether the attention will prove to be a boon for attracting more investment - or a barrier to…

Filling the ratings void

Unlike bond investors, structured products investors lack the benefit of industry-standard risk ratings. But with investors, IFAs and distributors all demanding change, Germany's investment banking industry, analytic firms and ratings agencies across…

Major dealers issue joint letter to Fed on credit derivatives

The New York Federal Reserve meeting with 14 major dealers on September 15 appears to have succeeded in coercing the industry into taking more concerted action to tackle the mounting problems in credit derivatives confirmation backlogs. Following the…

Europe's managers find joy in their own distress

distressed debt

The keys to CDS success

Electronic trading

Outsourcing alternatives

Collateral management

A fresh look at credit default swaps

Corporates

Credit default swaps

Back to basics

Under Scrutiny - Regulators focus on credit

Regulation

Cashflow CDOs contain more CDS, says Fitch

The rating agency reckons around 30% of the collateral in recent CDOs is synthetic

Asia comes of age

Regional focus